4 Types of Breakouts - March 2020 Tech Charts Webinar

We are continuing our Member webinar series with a review of 4 types of breakouts.

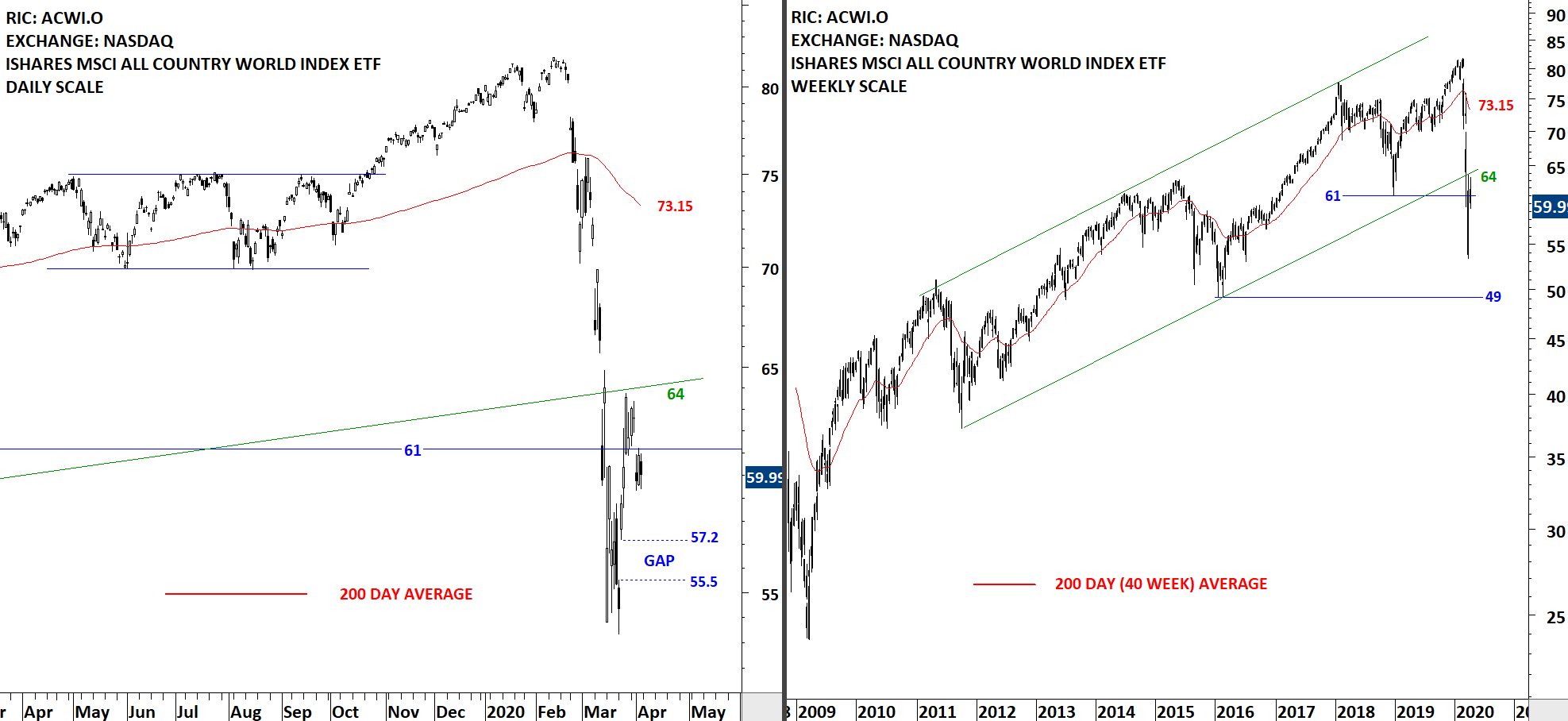

Type 1 are breakouts that immediately rally to price target. Type 2 are breakouts that pullback to chart pattern boundary after the breakout but do not challenge the previously broken support/resistance. These two breakouts are relatively easier to manage when compared with the breakouts that experience a hard re-test (penetrating the chart pattern boundary after a breakout) and those that fail (Type 3 & Type 4).

We will review all 4 types of breakouts with recent examples and discuss strategies to manage each condition.

Webinar Outline

- We will review some of those chart pattern breakouts that rally to their price objective without any pullback

- We will review some of the breakouts that complete an orderly pullback to chart pattern boundary

- We will look at some of the breakouts that experience hard re-test and challenge chart pattern boundaries

- We will review some of the breakouts that failed off of the starting gate.

- We will have a member Q&A at the end of the webinar.

Live questions from Members

- I know you're a classical market technician, but with such a severe one-sided breakdown, are you ever tempted to trade something for a pullback even though you don't have a classical pattern? 36:21

- Does the speed with which a pattern breakout achieves the target price indicate that you should let the trade run? 37:24

- Can you find signs in the chart that could indicate what type of breakout is going to occur? 38:02

- Do you reduce your position sizing (i.e., instead of 1% risk per trade, 0.50% risk) during extended volatility like we're seeing? 39:42

- Can you explain how to calculate the trailing stop loss again? 40:10

- Additional links ATR Trailing Stop-Loss – H&S Top & ATR plug-in

- How do you incorporate sentiment measures (COT DSI etc.) into your decision making? 40:48

- Do you think that in market conditions such as these, the probability of a failed chart occurring is higher? 41:02

- Do you ever circumvent your ATR trailing stop and place it below a newly formed chart pattern negation level that's above the initial entry position? 42:32

- I noticed that on one trade, you placed an SL at the bottom of a gap, but on another, you placed it at the top of a GAP. Do you have rules for deciding this? 43:50

- Is it possible to use this method for long term investing? If yes, would you use the same trailing method? 45:13

- Can the ATR stop rule be implemented in a trading platform? 46:19

- How do you determine your ATR length and multiplier number? Is it historical chart based and specific to a specific chart? Are commodities different than stock charts? 47:13

- As volatility during the day can be larger, have you used one ATR multiple for intra-bar & a lesser ATR multiple near the close, whereby one cancels the other OCO? 49:20

- Over the years, the ratio between reversal patterns vs. continuation patterns? Do you cap that ratio, or you let the patterns dictate what you have currently? 50:08

- Do you always trade long? Never short? 51:13

Recorded live 03.26.2020

Read More Read More

Read More