CRYPTOCURRENCIES – December 5, 2021

/0 Comments/in Premium/by Aksel KibarThe sharp correction in cryptocurrencies put more pressure on BTC than many other pairs. After a sell-off like this our attention should be on the price charts that managed to remain strong and close to their resistance levels. Usually those that hold well will be the ones to recover to new highs when momentum returns.

GLOBAL EQUITY MARKETS – December 4, 2021

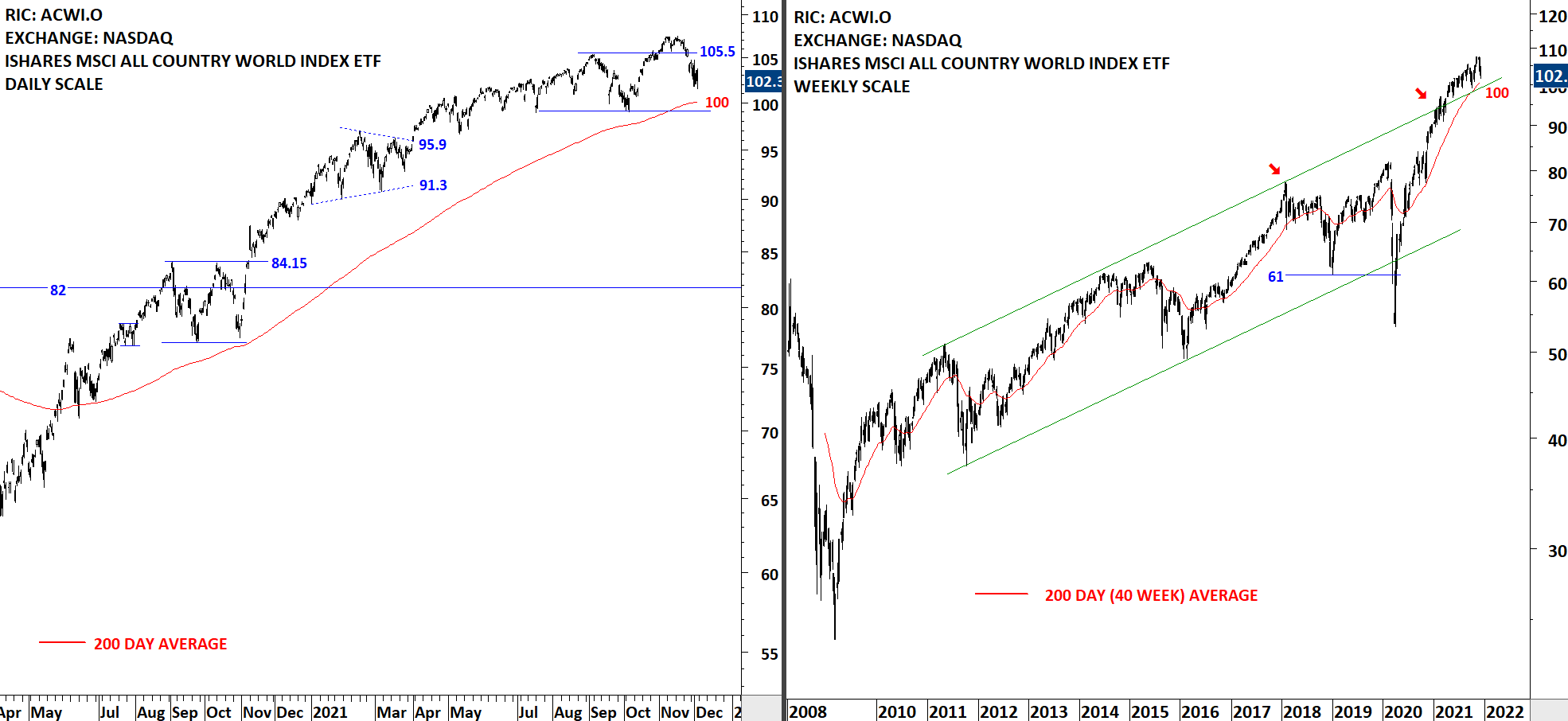

/0 Comments/in Premium/by Aksel KibarREVIEW

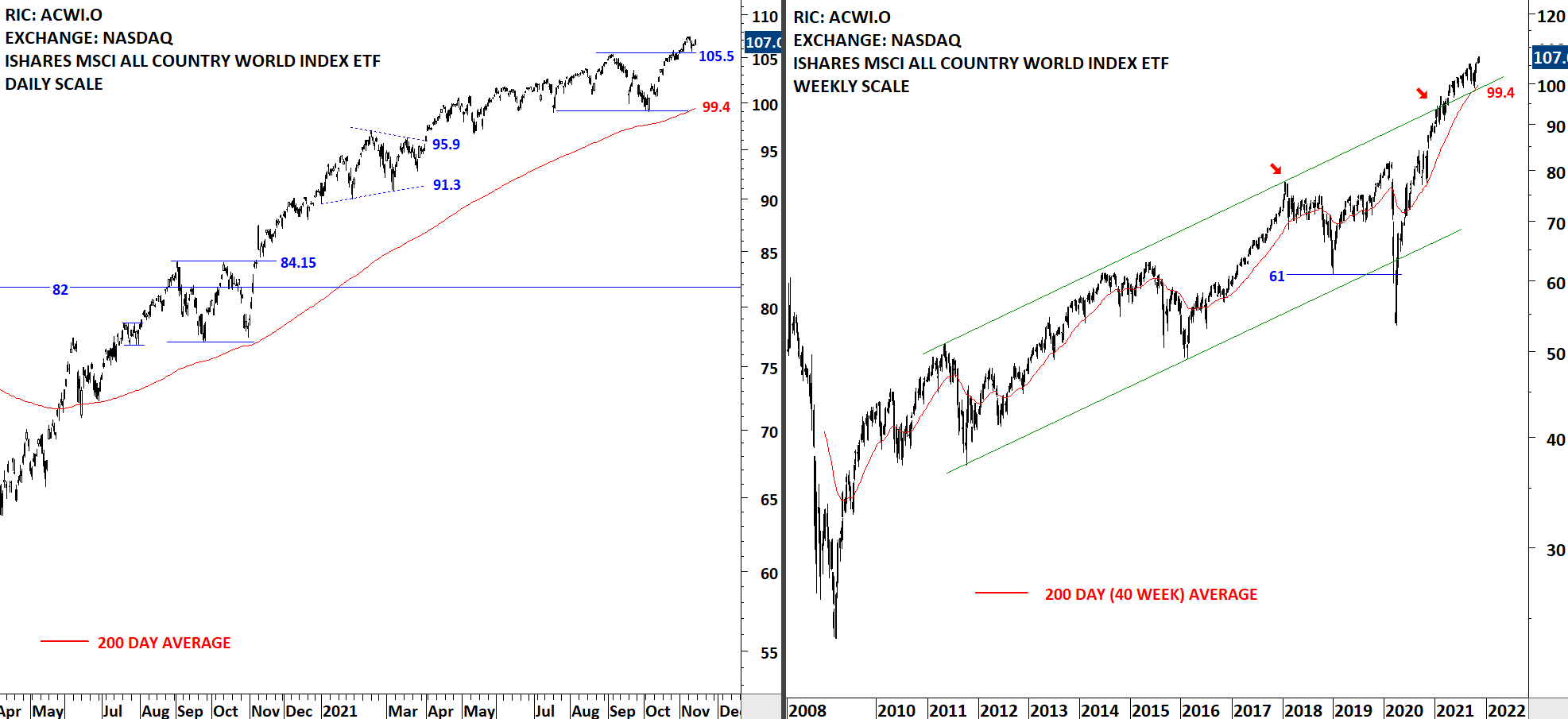

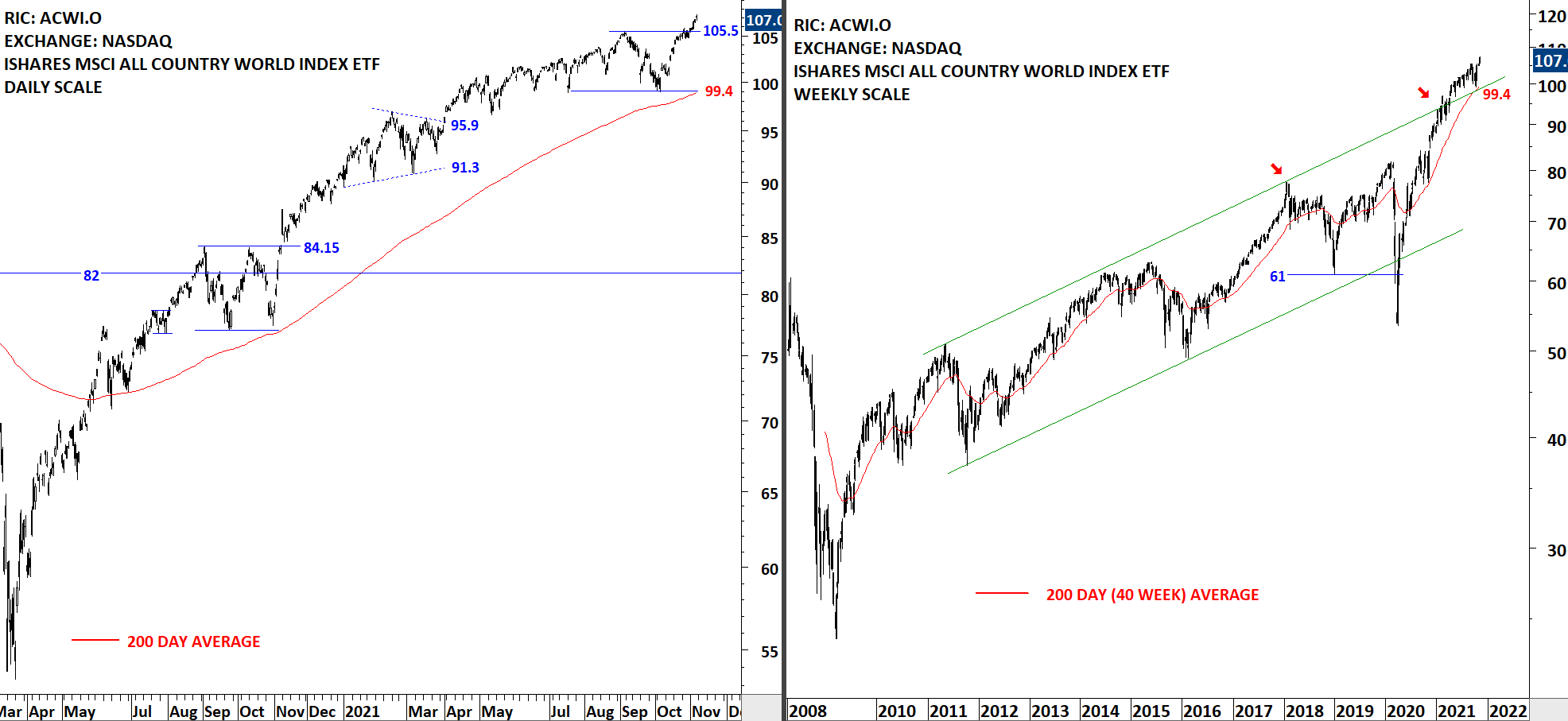

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above 105.5 levels resulted in a failed breakout and is now pulling the price towards the long-term average at 100 levels. Another horizontal support is standing at 99 levels, making the range 99-100; the next possible strong support area. 105.5 becomes resistance again. So far, price action looks like a reversion to the mean.

Read More

Read MoreGLOBAL EQUITY MARKETS – November 27, 2021

/5 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above 105.5 levels resulted in a failed breakout and is now pull the price towards the long-term average at 100 levels. Another horizontal support is standing at 99 levels, making the range 99-100 the next possible strong support area. 105.5 becomes resistance again.

Read More

Read MoreCRYPTOCURRENCIES – November 21, 2021

/3 Comments/in Premium/by Aksel KibarSome of the exciting chart patterns that have completed are cup & handle continuation on ETHUSD, H&S continuation on EGLDUSD and CHRUSD. I've added more exciting setups and also pairs that can outperform BTC in the following months.

GLOBAL EQUITY MARKETS – November 20, 2021

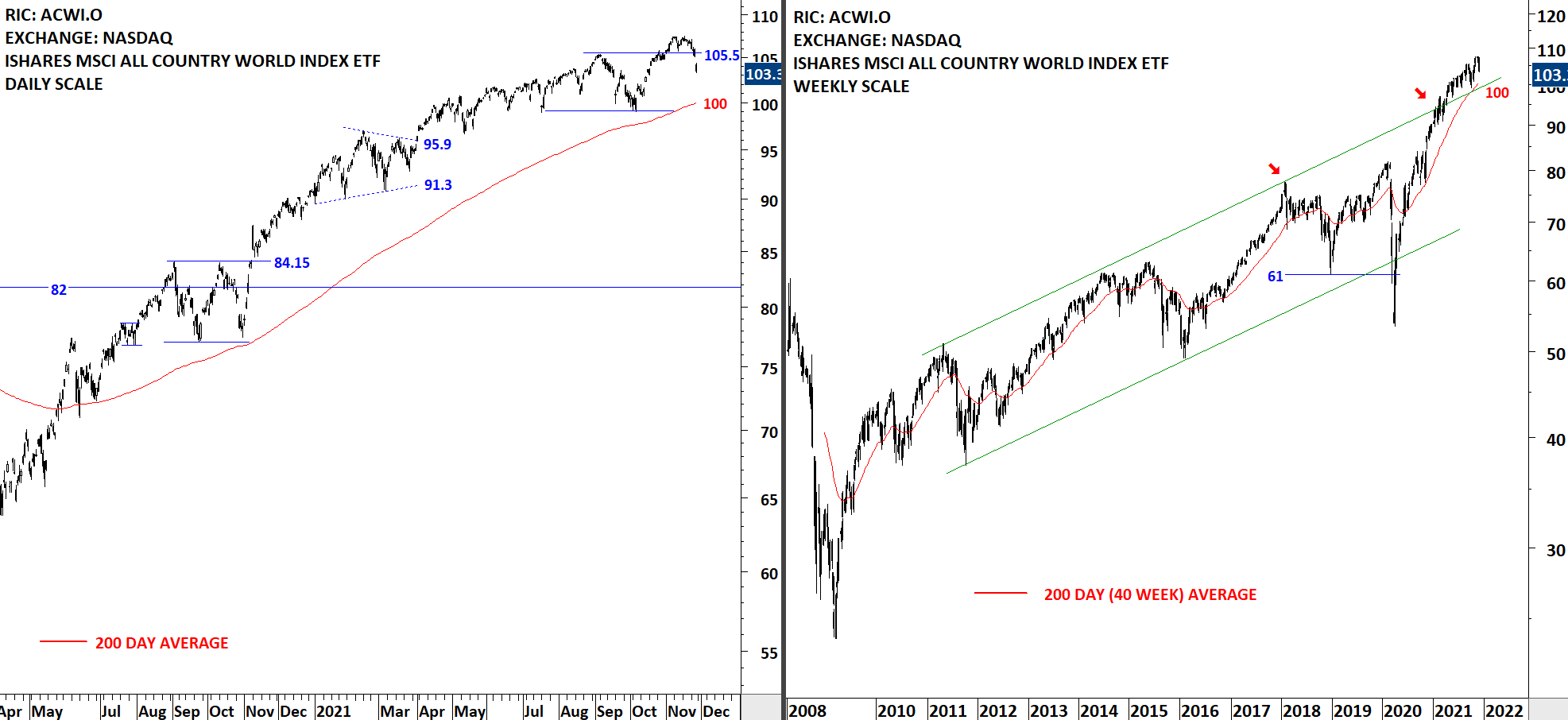

/1 Comment/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. There is no reversal chart pattern on the daily scale price chart. This week's price consolidated and remained above the short-term support level at 105.5. Breakout above 105.5 levels resumed the existing uptrend. Previous resistance becomes the new support at 105.5 levels. Long-term average is also acting as support at 99.7 levels. Failure to hold above 105.5 levels can result in a failed breakout and pull the price towards the long-term average.

Read More

Read MoreRectangle – Trading Range-Bound Price Action

/1 Comment/in Premium, RECTANGLE PATTERN, Video Series/by Aksel KibarGLOBAL EQUITY MARKETS – November 13, 2021

/5 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. There is no reversal chart pattern on the daily scale price chart. This week's price action pulled back and rebounded from the short-term support level at 105.5. Breakout above 105.5 levels resumed the existing uptrend. Previous resistance becomes the new support at 105.5 levels. Long-term average is also acting as support at 99.4 levels.

Read More

Read MoreCRYPTOCURRENCIES – November 8, 2021

/1 Comment/in Premium/by Aksel KibarETHUSD completed its multi-month long cup & handle continuation. BTCUSD might be next to breakout (confirmed) to all-time highs. There are several pairs in alt space in this report that either completed their breakouts or preparing for completion. I will keep our members posted on each breakout setup.

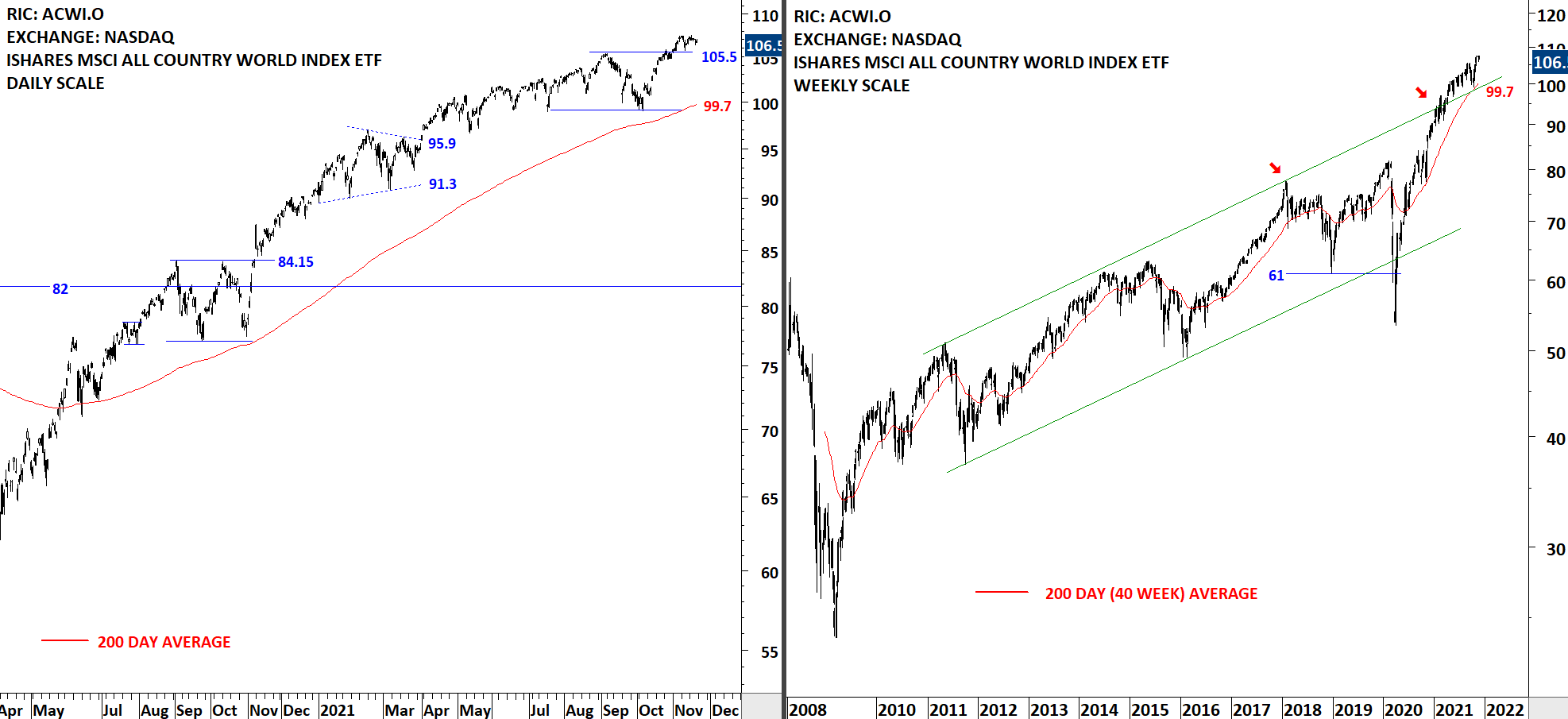

GLOBAL EQUITY MARKETS – November 6, 2021

/3 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. There is no reversal chart pattern on the daily scale price chart. This week's price action cleared the resistance at 105.5. Breakout above 105.5 levels resumed the existing uptrend. Previous resistance becomes the new support at 105.5 levels. Long-term average is also acting as support at 99.4 levels.

Read More

Read MoreIn Association with:

Latest Posts

GLOBAL EQUITY MARKETS – February 28, 2026February 28, 2026 - 11:31 am

GLOBAL EQUITY MARKETS – February 28, 2026February 28, 2026 - 11:31 am CRYPTOCURRENCIES – February 23, 2026February 23, 2026 - 6:54 pm

CRYPTOCURRENCIES – February 23, 2026February 23, 2026 - 6:54 pm GLOBAL EQUITY MARKETS – February 21, 2026February 21, 2026 - 11:28 am

GLOBAL EQUITY MARKETS – February 21, 2026February 21, 2026 - 11:28 am GLOBAL EQUITY MARKETS – February 14, 2026February 14, 2026 - 11:45 am

GLOBAL EQUITY MARKETS – February 14, 2026February 14, 2026 - 11:45 am

Search

As Seen On: