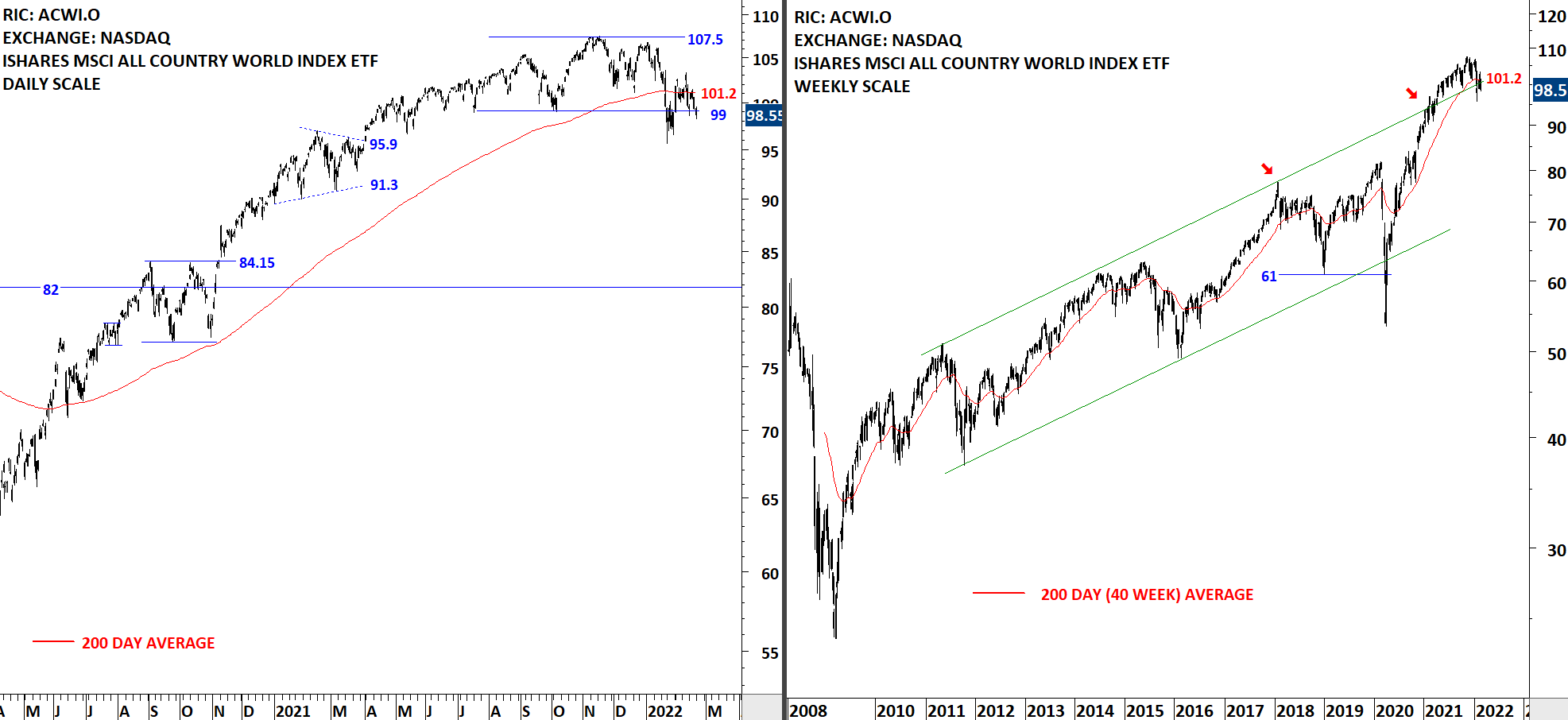

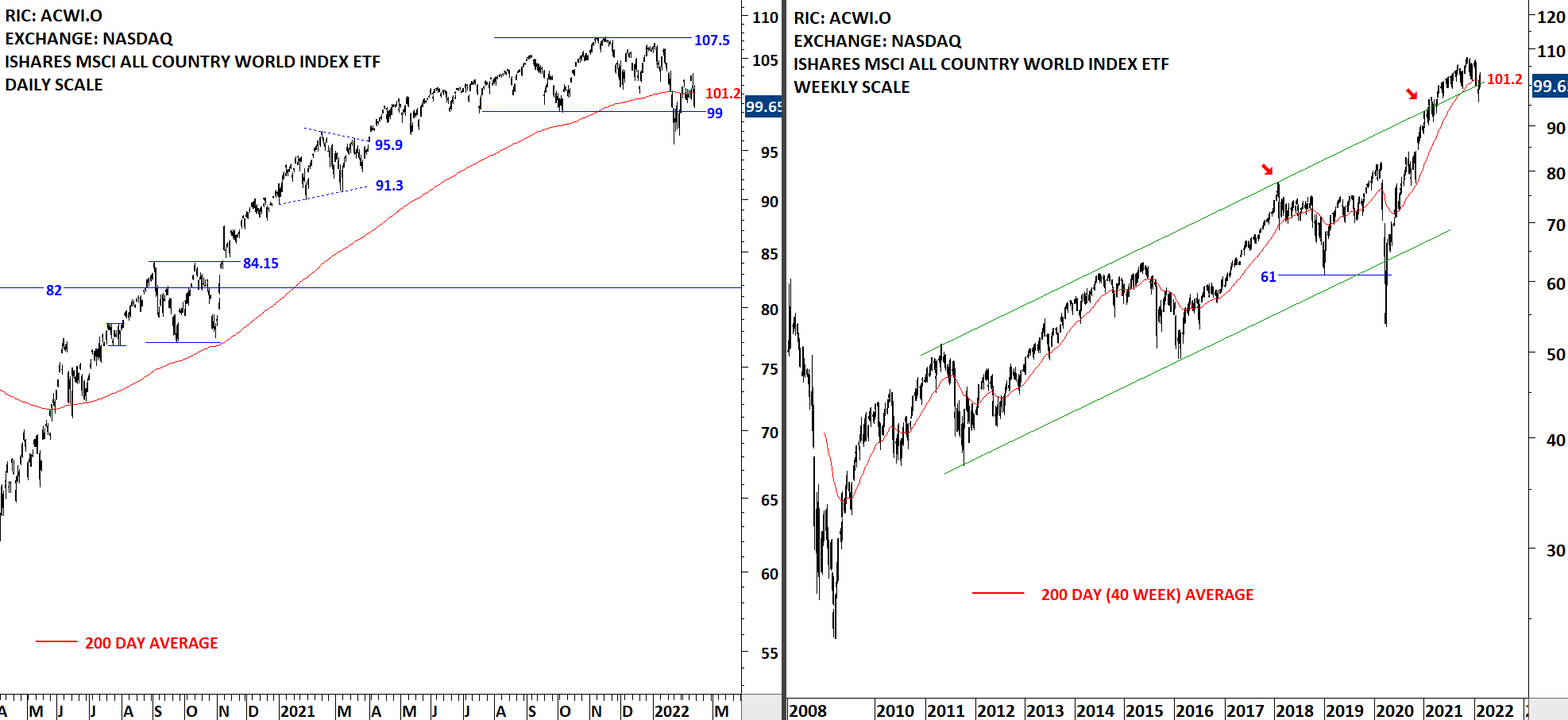

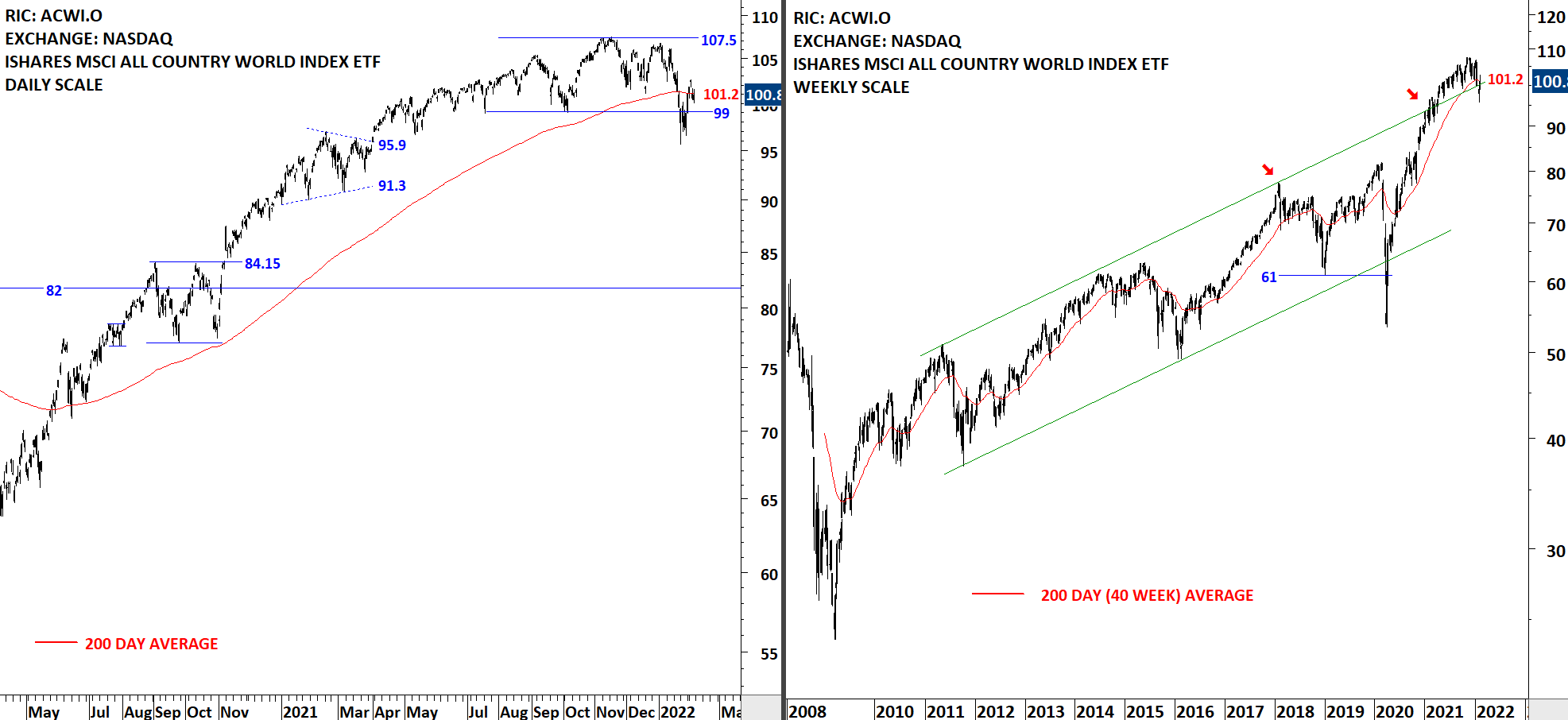

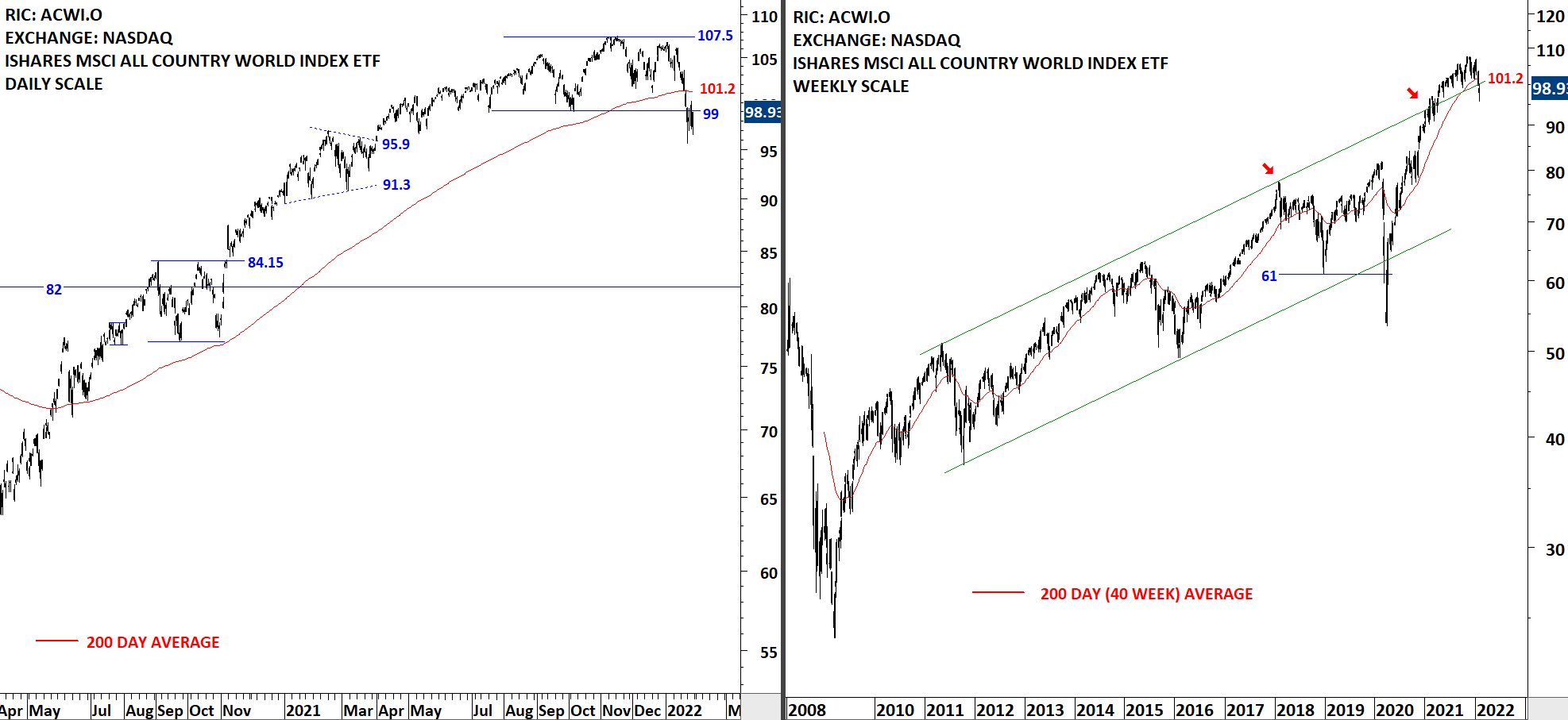

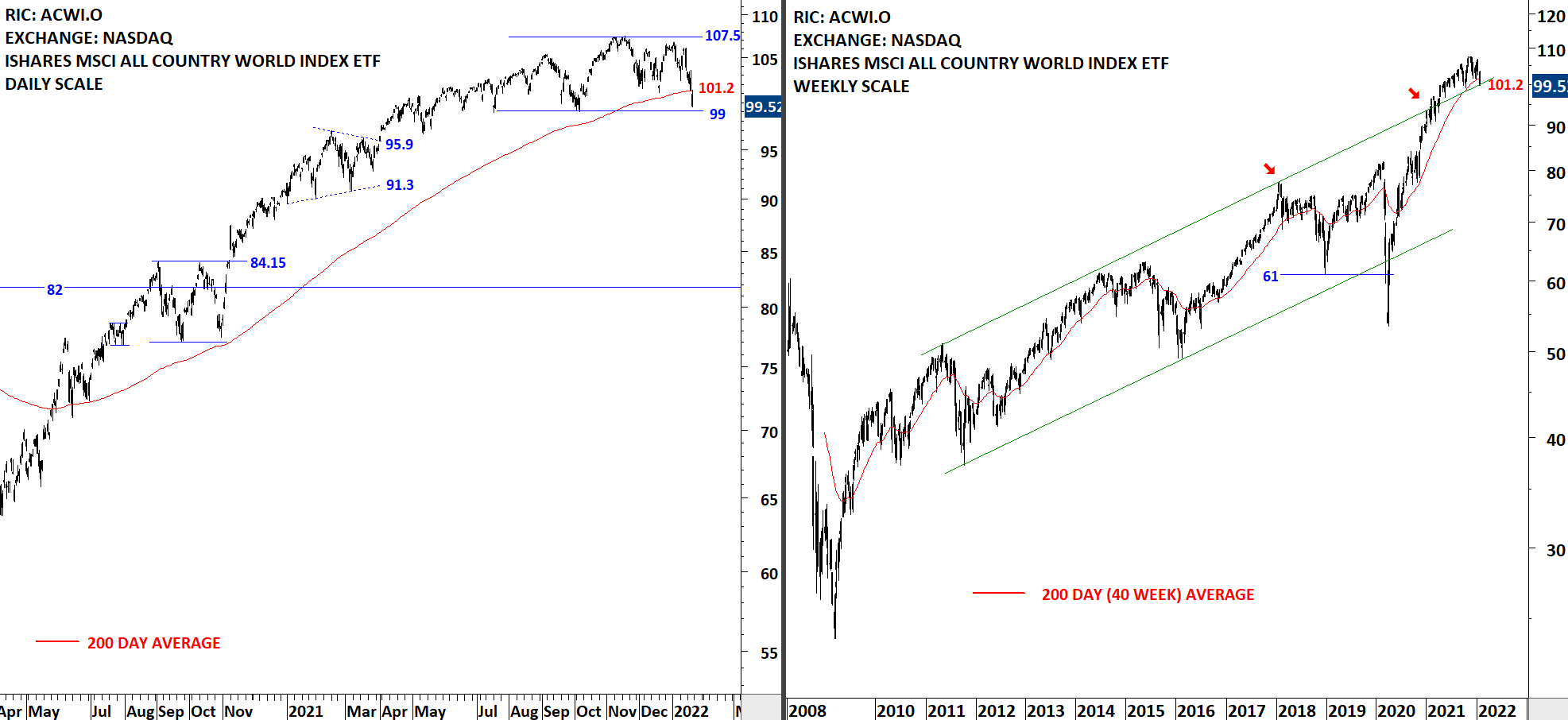

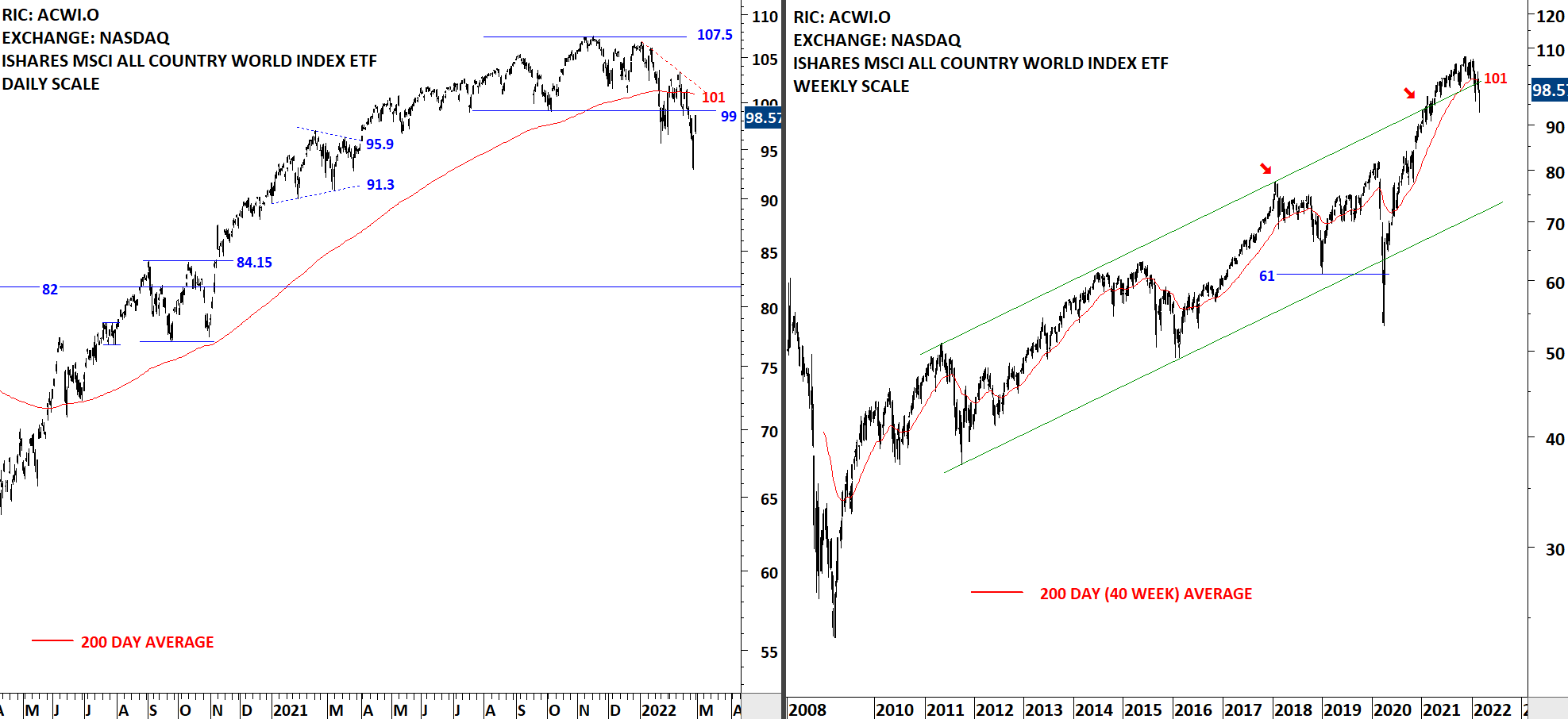

GLOBAL EQUITY MARKETS – February 26, 2022

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) experienced another sell-off below the 200-day average. Previous rebound got rejected at the 200-day average. 99-101 area is the new resistance. The ETF started forming lower lows and lower highs. If rebounds can't push prices above the 99-101 area, downtrend can accelerate. On the long-term chart price is trying to hold above the upper boundary of the rising trend channel. Failure to do so can result in a sell-off towards the next support around 82 levels.

Read More

Read More