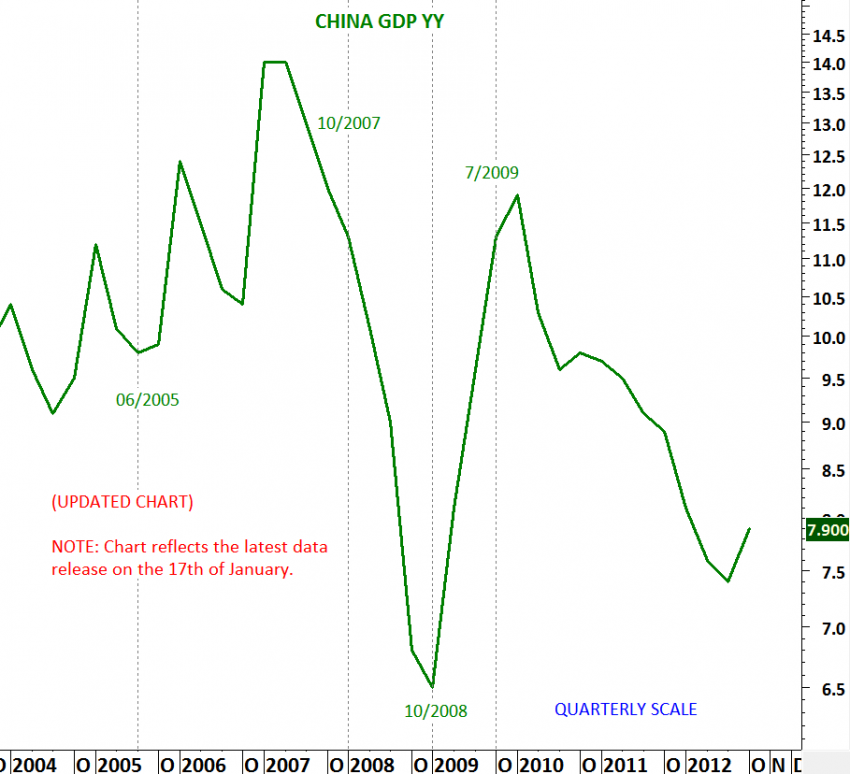

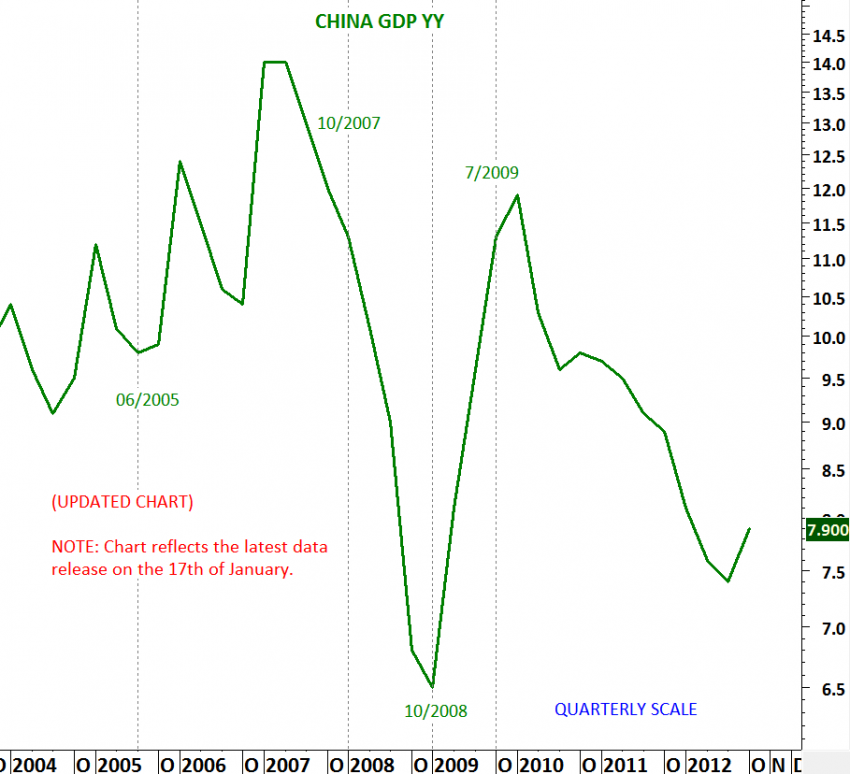

In April 2012 I analyzed the downtrend on the Chinese GDP and the SSE 50 Index (April 13, 2012 – SSE50 Index & China GDP). Chinese equities were trending lower since the mid-2009 and the GDP growth since the beginning of 2010. Equity markets acted as a perfect leading indicator. I’ve concluded that until we see a change in trend on the equity market performance, which was a clear downward trend at that time, we should expect lower GDP growth for the Chinese economy. At the time of the analysis quarterly GDP figure stood at 8.1 % and the SSE 50 Index was around 1,700 levels. In the 2nd and 3rd quarter of 2012, equity indices resumed their downtrend and the GDP dipped to 7.4%.

4th quarter GDP for the Chinese economy is expected on the 17th of January. Overall growth is anticipated to rise by 7.8% annually in the fourth quarter. This will be an improvement from the third quarter, when the economy expanded by 7.4%, and would be the first uptick in growth since the beginning of 2010. By looking at stock market performance over the past few months we can say that equities are signaling a turnaround in the economy and the growth rates and possibly putting a medium term bottom at these levels. Breakout above the 2 year-long downtrend on the SSE 50 Index is bullish for the chinese equities and should be backed by strong economic data.