“Demystifying the world of Classical Charting”

– AKSEL KIBAR

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features one of several great chart analysis that were highlighted in the review section from the latest Global Equity Markets report.

Equity indices of the South East Asia Emerging Markets are showing strength. The Philippines Stock Exchange index cleared its 2 year-long horizontal resistance at 8,125 levels and reached all-time highs. Since then, the index pulled back to the broken resistance which is now acting as a strong support. As long as 8,125 level holds, we can expect the Philippine equity market to remain strong and trend higher.

Read MoreDuring established up trends pullback to the long-term averages are considered to be low risk entry points. A widely followed trend indicator is the 200 day moving average. Price action above the 200 day moving average is recognized as an uptrend, while price trading below the 200 day (40 week) average is considered to be a downtrend. In the last quarter of 2016, the Euro Stoxx Banking index breached its long-term average on the upside what was considered to be the beginning of a possible uptrend. Since then, each pullback found support at the long-term moving average, confirming the steady uptrend. Over the past 6 months, the Euro Stoxx Banking index formed a sideways consolidation that can be identified as a symmetrical triangle. Read More

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features one of several great chart analysis from the latest Global Equity Markets report.

The XAU is a capitalization-weighted index of thirty precious metal mining companies that has been traded on the Philadelphia Stock Exchange since 1983. As its name suggests it includes both gold and silver mining companies. In order to track gold and silver mining companies performance in an index there are several options available for investors, but the two most watched indices are: the NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (called the HUI Index) and Philadelphia Gold and Silver Index (called the XAU Index). Below charts feature the Philadelphia Gold and Silver Index and the NYSE Arca Gold BUGS Index.

The MSCI Domestic U.S. Real Estate Index and related REIT ETFs are going through a lengthy consolidation. Breakouts from tight and lengthy consolidations are usually followed by strong directional movement. Price index respected the boundaries of the 9 month-long symmetrical triangle. Both boundaries were tested several times over the past months. The upper boundary of the possible symmetrical triangle is acting as resistance at 1,180 levels and the lower boundary as support at 1,140 levels. A decisive breakout above 1,180 levels will confirm the symmetrical triangle as a bullish continuation with a possible chart pattern price target of 1,255 levels.

Read More

Read MoreEmerging Markets equities continue to remain strong. A widely followed benchmark for the Emerging Markets equity performance, MSCI Emerging Markets index resumes its multi-month uptrend in a steady parallel trend channel. Last one month's short-term consolidation can be identified as a possible flag; a bullish continuation chart pattern. The lower boundary of the flag at 1,100 level will act as a short-term support. Earlier in July 2017, the MSCI Emerging Markets index cleared a decade-long trend line resistance at 1,015 levels as shown on the monthly scale price chart.

Read More

Read MoreConsumer Discretionary Select Sector SPDR (XLY) Fund (the Fund) seeks to provide investment results that correspond to the price and yield performance of the Consumer Discretionary Select Sector of the S&P 500 Index (the Index). The Index includes companies from industries, such as automobiles and components, consumer durables, apparel, hotels, restaurants, leisure, media and retailing. The ETF is listed on the New York Stock Exchange. Price chart formed a 5 month-long rectangle with the boundaries acting as resistance at 92.35 and support at 88.15 levels. Both the upper and lower boundary of the rectangle was tested several times. A daily close above 93.25 levels will confirm the breakout from the sideways consolidation with the possible chart pattern price target of 96.6 levels. You can check out the sample video below on bullish rectangle continuation.

Here are some of the sample educational videos you might find valuable. This sample video explains how to identify rectangles and to calculate possible chart pattern price targets. Tech Charts Educational Videos cover major reversal and continuation chart patterns.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features one of several great chart analysis from the latest Global Equity Markets report as a case study discussing the breakaway gaps.

In his book Technical Analysis and Stock Market Profits, Richard W. Schabacker discusses different kinds of price gaps. Below are some of the important points he mentions about Breakaway Gaps.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features one of several great chart analysis that were highlighted in the watchlist section from the latest Global Equity Markets report.

Anadolu Efes Biracilik ve Malt Sanayii AS is a Turkey-based company, which is engaged in the production, bottling, selling and distribution of beer under a number of trademarks and also in the production, bottling, selling and distribution of sparkling and still beverages with The Coca-Cola Company trademark. The stock is listed on the Istanbul Stock Exchange. Price chart formed an 18 month-long ascending triangle with the strong horizontal boundary acting as resistance at 22.05 levels. The horizontal boundary was tested several times over the course of the chart pattern. The ascending triangle can act as a reversal chart pattern. A daily close above 22.70 levels will confirm the breakout from the bullish reversal chart pattern with the possible price target of 27.6 levels.

Read More

Read MoreRight angle triangles, with the hypotenuse slanting upwards from the origin of the pattern, are ascending triangles and they are bullish.

The below educational video describes how to identify a bullish ascending triangle, along with some of the characteristics of this pattern that could help you identify and take advantage of such patterns within your own personal trading.

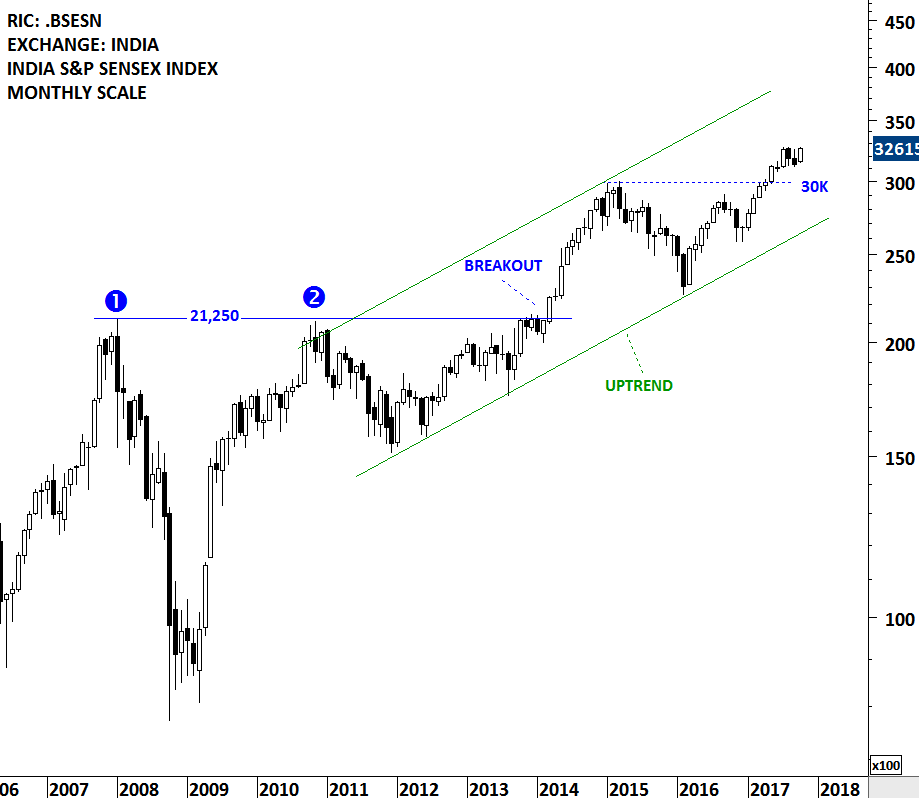

India equity benchmarks have been in a steady uptrend. For the past few months the BSE Sensex index and other equity benchmarks has been in a sideways consolidation. These short-term consolidations can prove to be bullish continuation chart patterns if resolved on the upside. On the long-term chart of BSE Sensex Index, 30K levels continue to form strong support. Long-term uptrend remains intact.

Read More

Read More