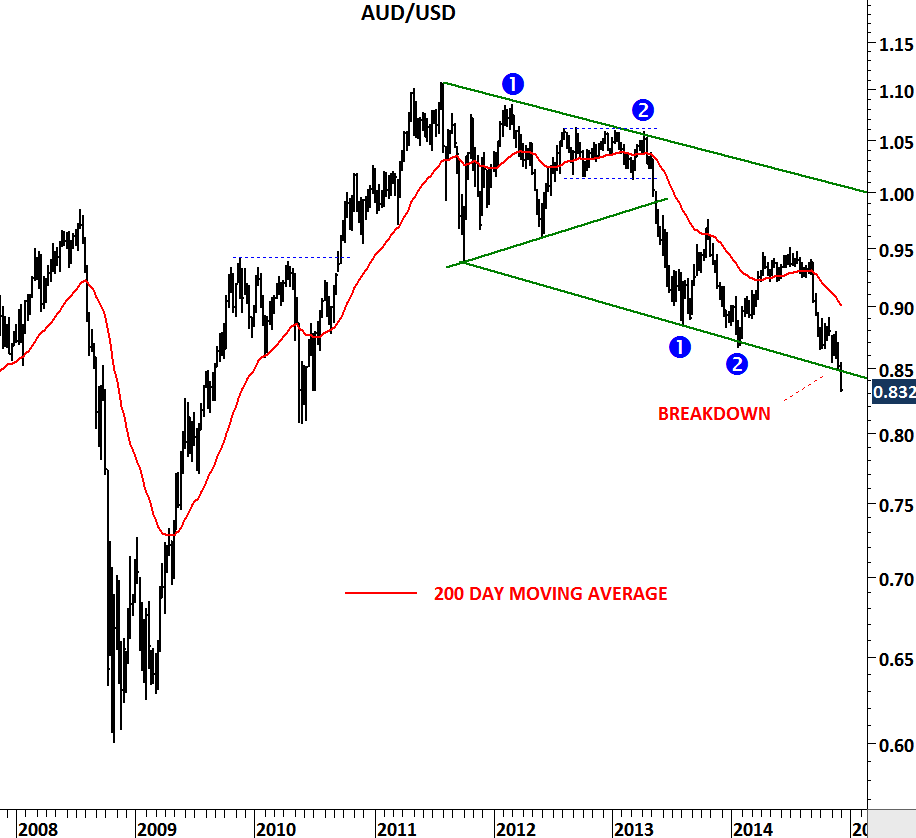

AUD/USD

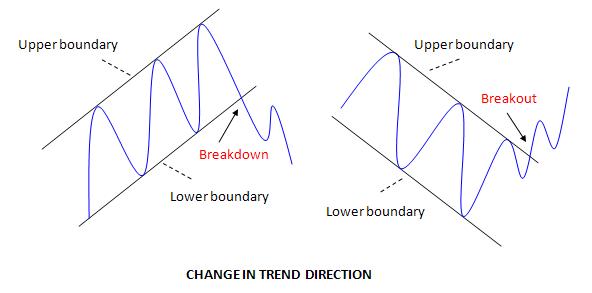

In a downtrend the lower boundary of a trend channel represents the “negative” extreme and the upper boundary the “positive” extreme. Price is expected to rebound from the positive and negative extremes. A downtrend is likely to reverse when the upper boundary is broken on the upside. Likewise an uptrend is likely to reverse when the lower boundary is broken on the downside.

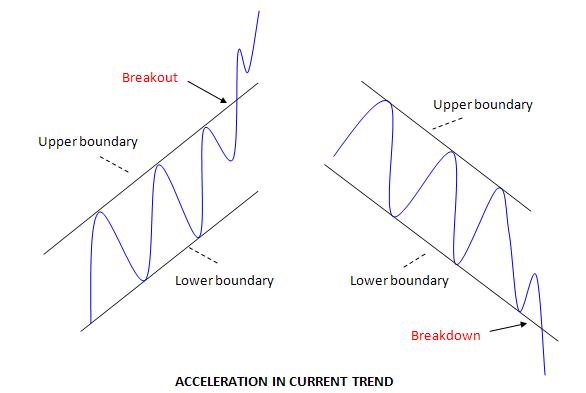

But what happens when the price doesn’t rebound from the lower or the upper boundary of the trend channel? Breaking down a negative extreme is usually a sign of an accelerated move in the direction of the breakdown.

This is the case with AUD/USD. Since 2011, Australian Dollar vs. U.S. Dollar has been in a downtrend. Cross rate rebounded from the lower boundary twice in 2013. With the latest sell-off AUD/USD breached the lower boundary, failing to rebound. Unless the cross rate recovers above 0.85 levels in the following weeks, latest breakdown will be the beginning of an accelerated move on the downside. In the short/medium-term and Australian dollar is weak against the U.S. dollar.