BRENT CRUDE OIL

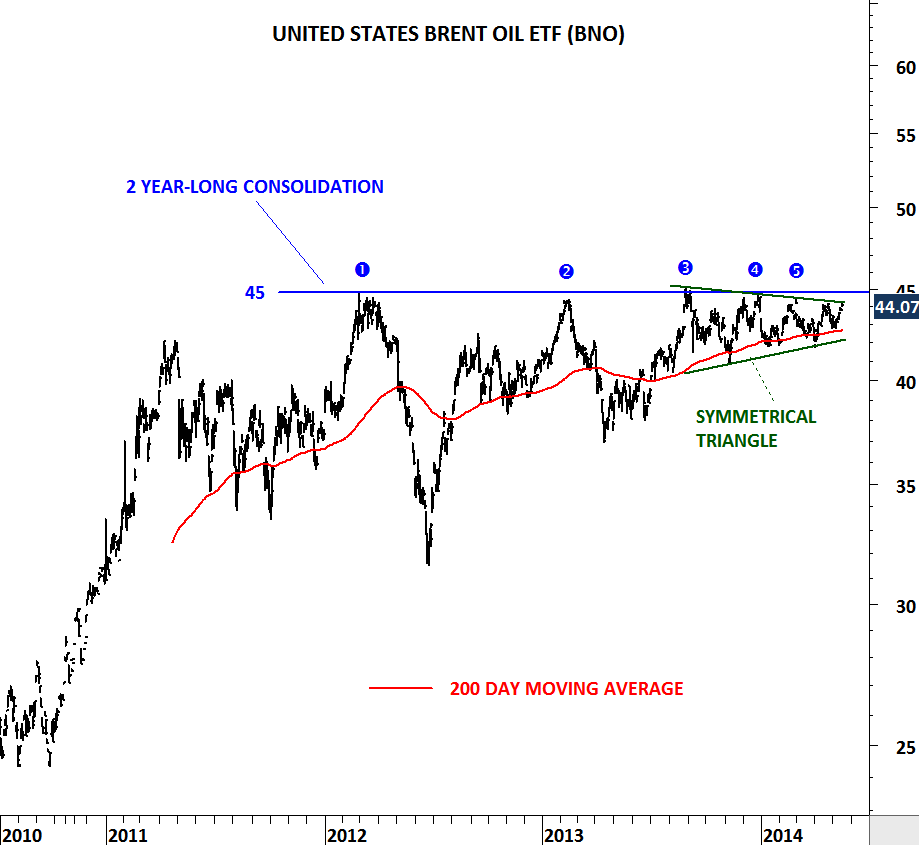

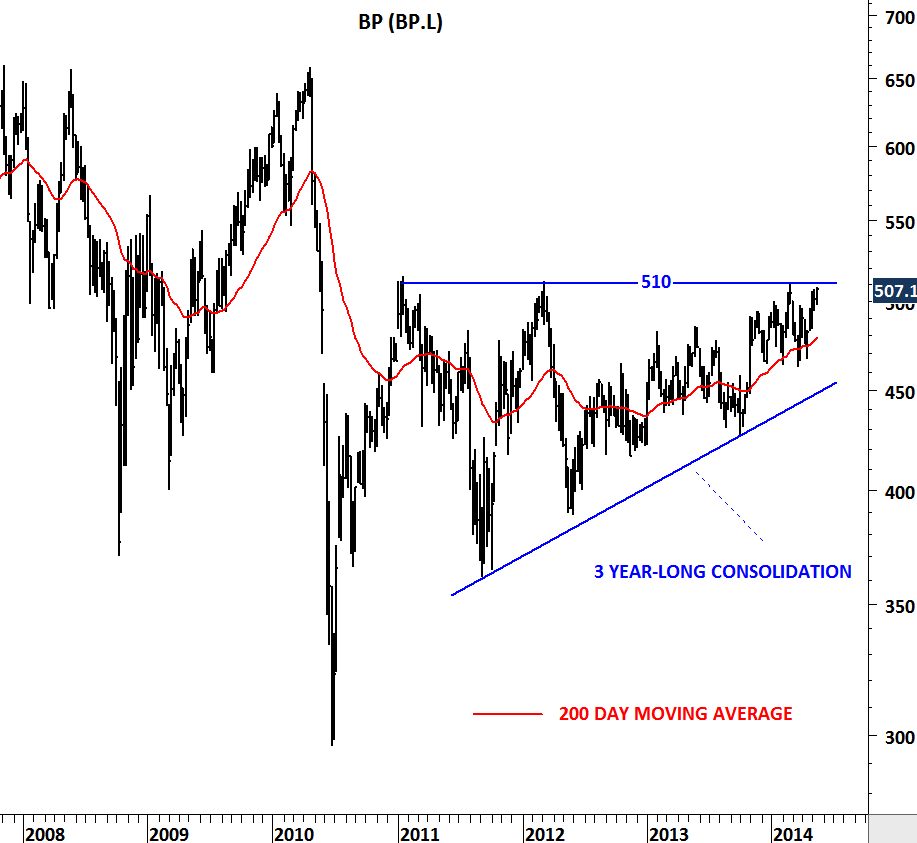

Over the past few months I wrote several updates on Brent Crude Oil . I think energy sector will be the “hot” topic in the second half of the year. The likelihood of a strong breakout is increasing as the consolidation resumes in this tight trading range. Breakouts from low volatility periods are usually very powerful. United States Brent Oil ETF (BNO) trades in NYSE (New York Stock Exchange) and ETFS Brent (OILB.L) trades in LSE (London Stock Exchange). Both charts are due for a strong breakout. Breakout above 45 levels on (BNO) and above 73 levels on (OILB.L) will be very bullish for the energy sector. Another chart that is likely to follow the same trend in the energy sector is BP (BP.L). BP trades in LSE. Breakout above the strong horizontal resistance at 510 levels will be bullish for the stock. These are the charts and levels that I’m watching closely to understand what is next for the energy sector.

What is your view on this? Are there any other supporting factors/developments that suggests a strong directional move any time soon? You can share your views with other followers.