U.S. Initial Jobless Claims, Housing Starts and Unemployment

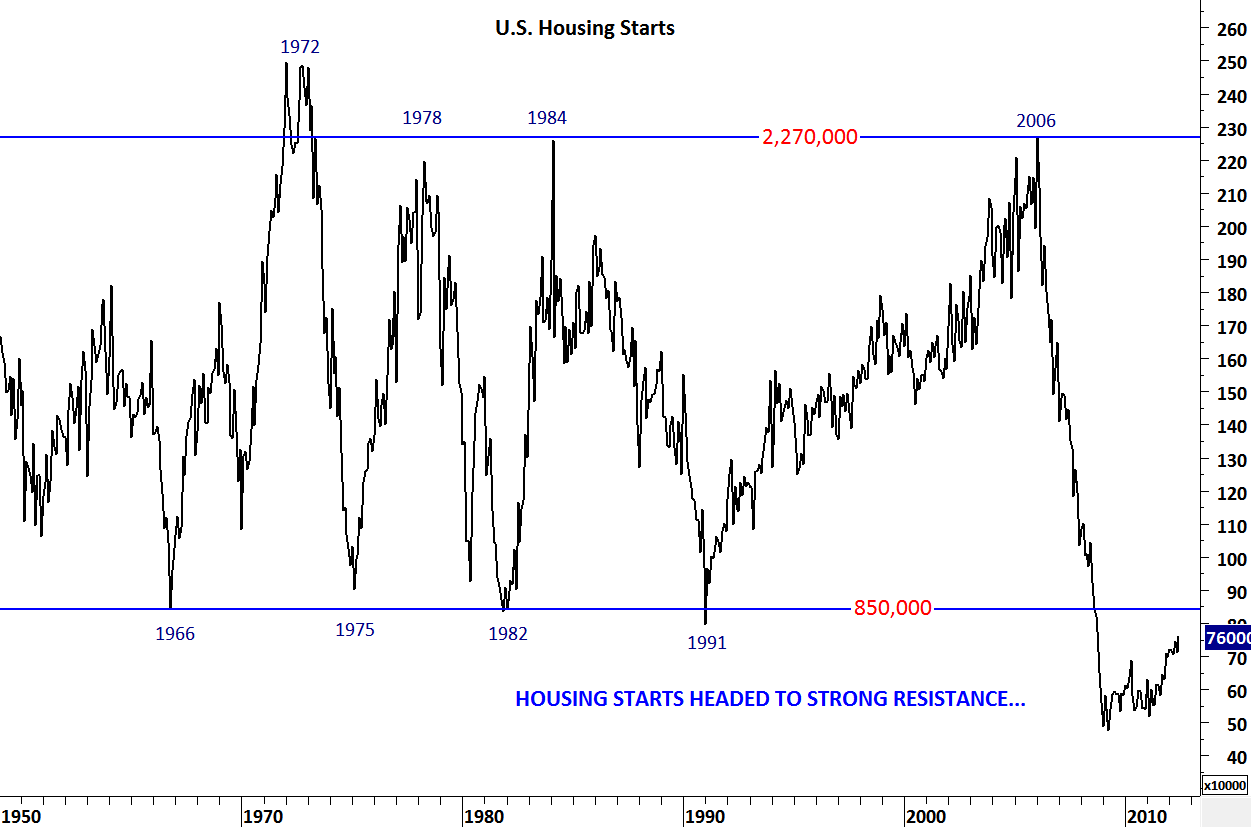

After a long break let me start with updating the latest economic data on housing and unemployment. I think these are the two most important economic data that we should be watching closely over the next few months. Housing because it is the latest bubble that burst and it was the cause of the global financial turmoil. Unemployment because it is the result of the economic slowdown. Recovery in housing will no doubt help the markets and a pick up in employment will restore confidence and help economic recovery.

Yes, there has been a recovery in the housing market with increasing housing starts when compared with the low in 2009 but housing starts are far from 2008 levels and still below major resistance at 850,000. We should expect this major support at 850,000 level to become resistance over the next few months. Before we see housing starts above 850,000 level it will be early to call for a strong recovery in the housing market.

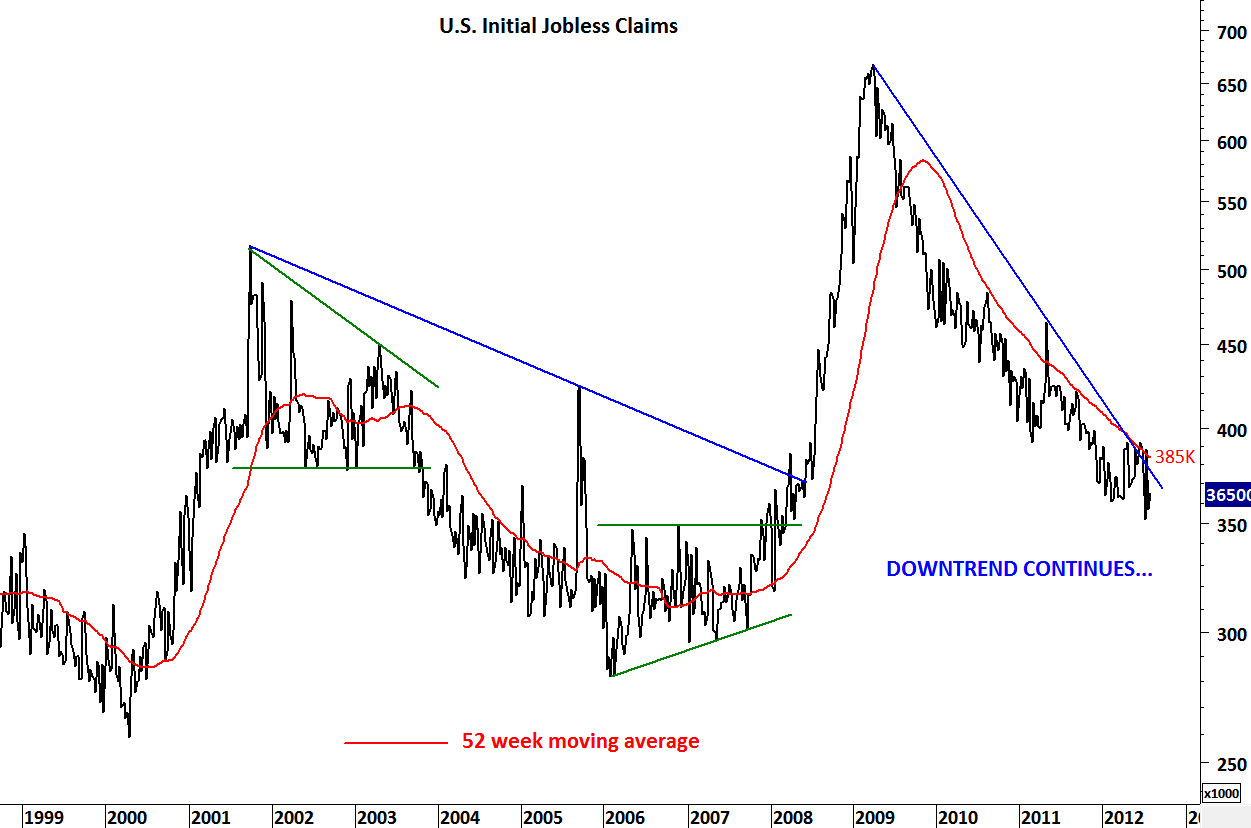

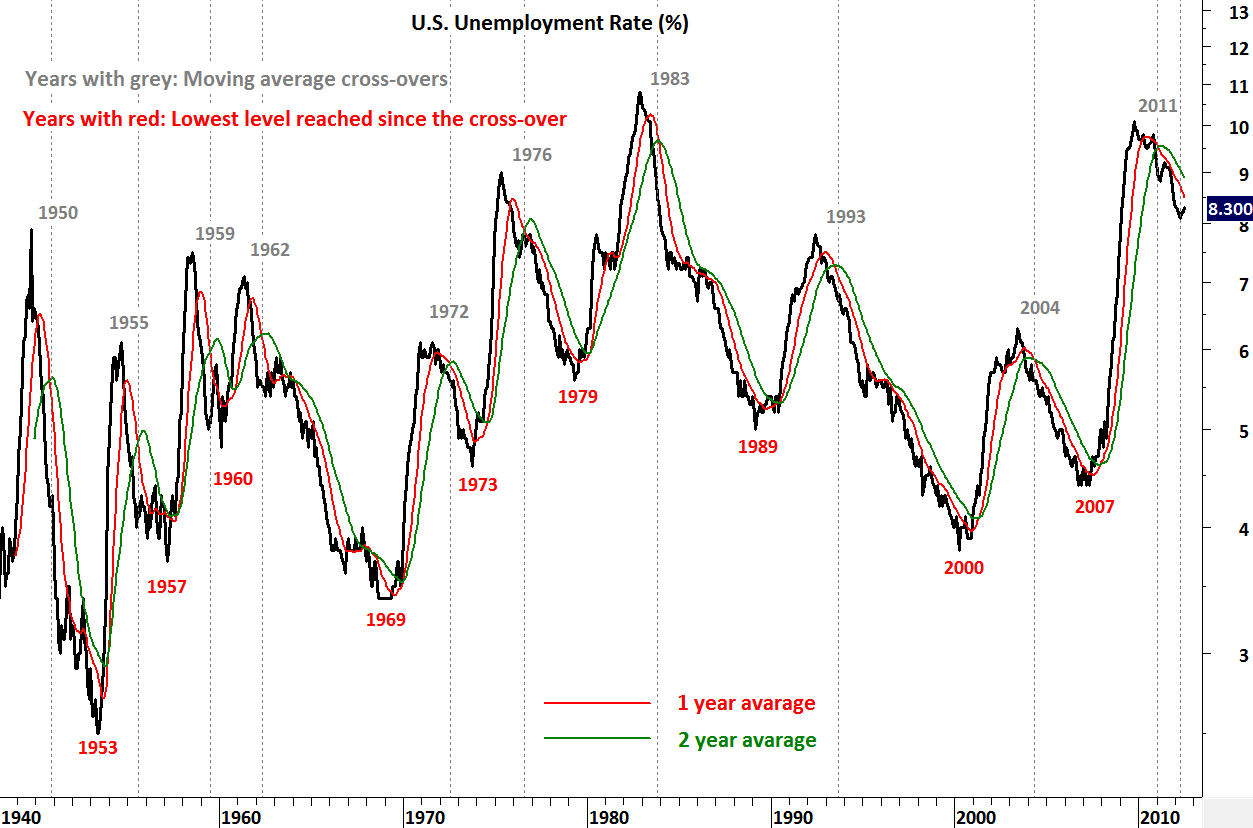

Downtrend continues in jobless claims but unemployment rate rebounded from 8.1% to 8.3% over the past few months. Since the last cross-over on the 1 & 2 year moving averages it has been 1 year and historical data warns us to pay attention to the critical time cycle. In 1960 and 1973 recovery in the job market and downtrend on the unemployment rate reversed in the year following the moving average cross-over . Recoveries were shortlived. Longest recoveries (downtrend) last 7 years between 1962 & 1969 and 1993 & 2000. It is important for the downtrend in unemployment rate to continue past the 1 year threshold to extend the recovery into 3-7 year time cycle.

Earlier analysis on U.S. Unemployment Rate:

http://techcharts.wordpress.com/2012/06/01/u-s-unemployment-rate-chicago-pmi/