Reminder:

We are continuing our Member webinar series with a review of the most reliable chart patterns Tech Charts Global Equity Markets report featured over the past two years. We will go through numbers on chart pattern reliability. Since May 2017, Global Equity Markets report featured classical chart pattern breakouts. Out of those, most reliable were H&S bottom, rectangle, and descending triangle. We will review under which conditions these chart patterns reached their price objectives.

Given the current market conditions, the webinar will review some of the important charts that are at inflection points. Global equities can start new medium-term trends and it is important to review some of the charts that could signal the beginning of strength.

Scheduled for: Thursday, September 19th at 8:30 am mountain (register here)

REVIEW

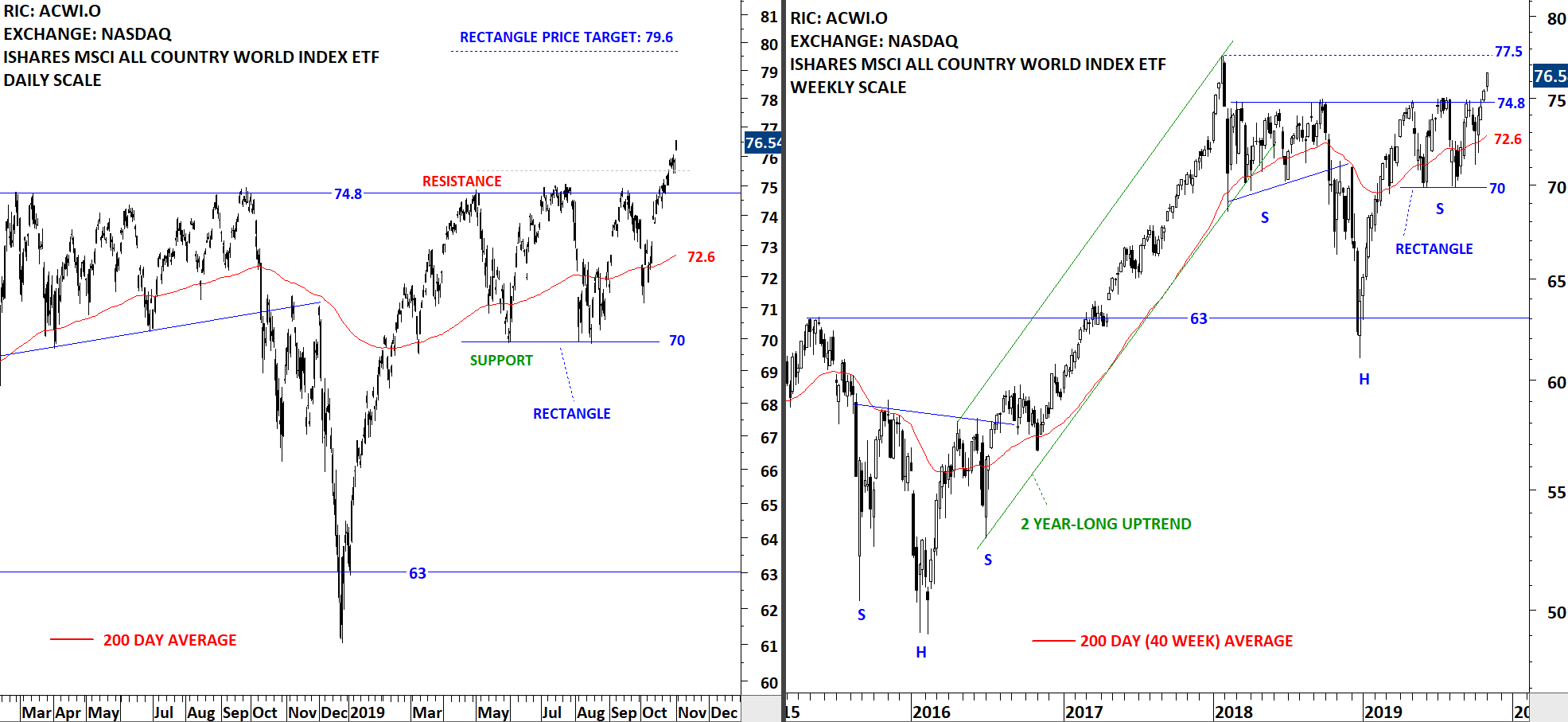

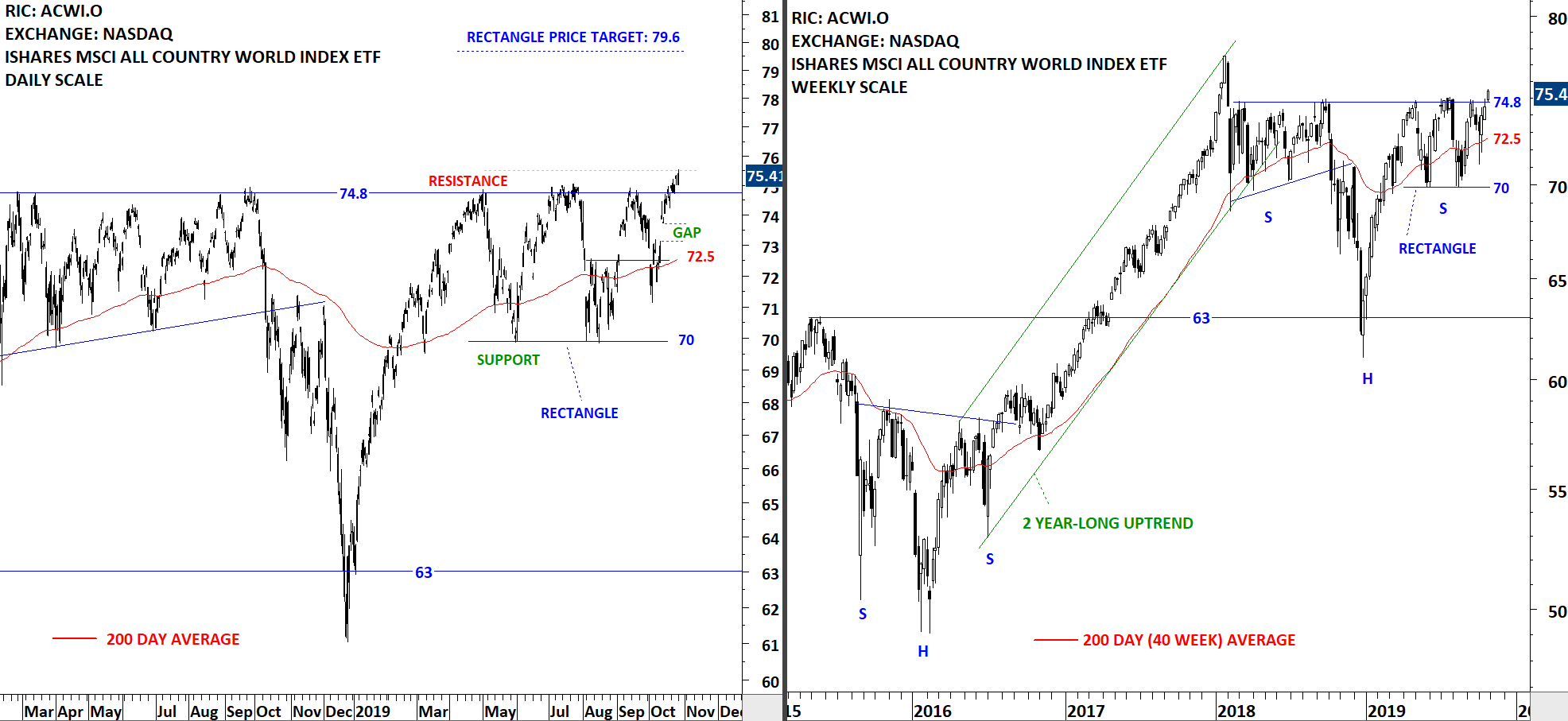

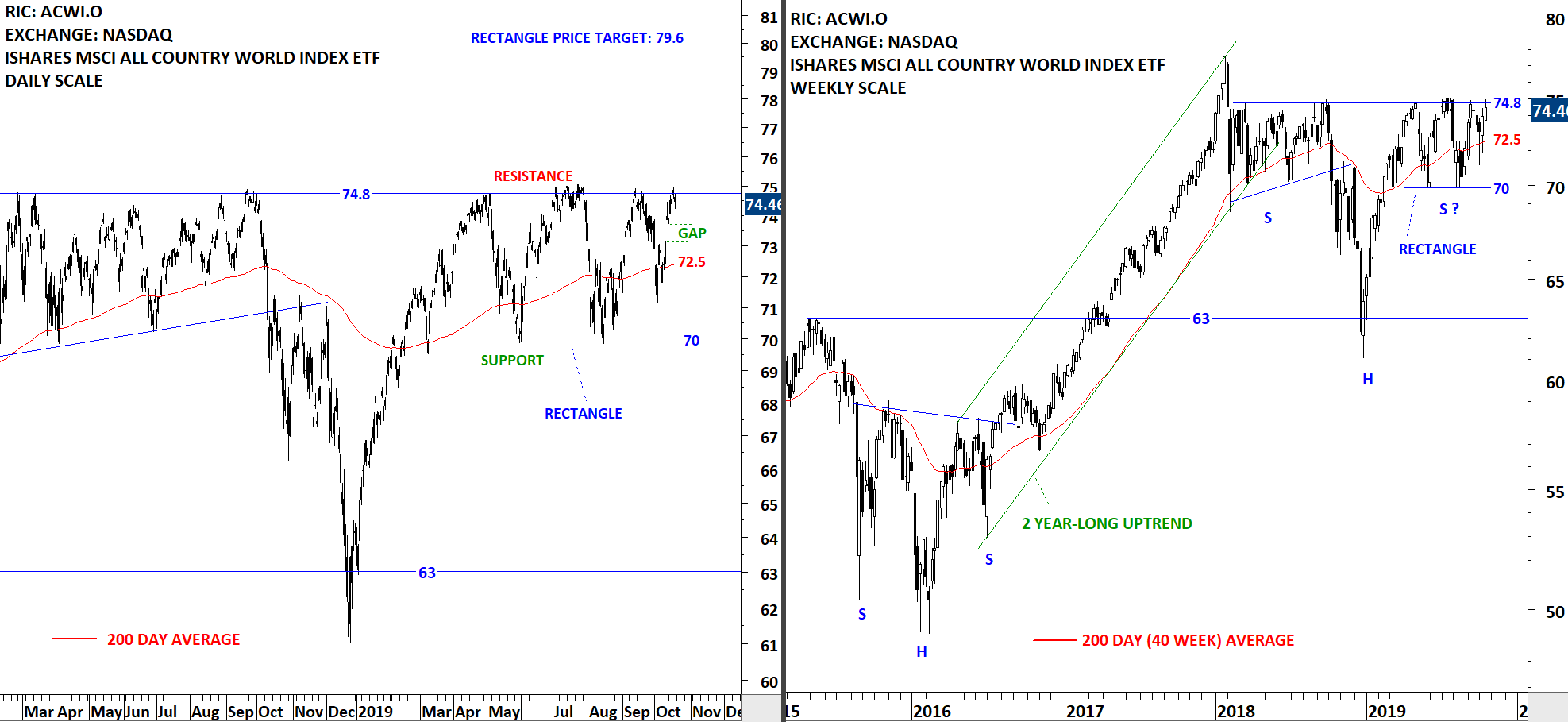

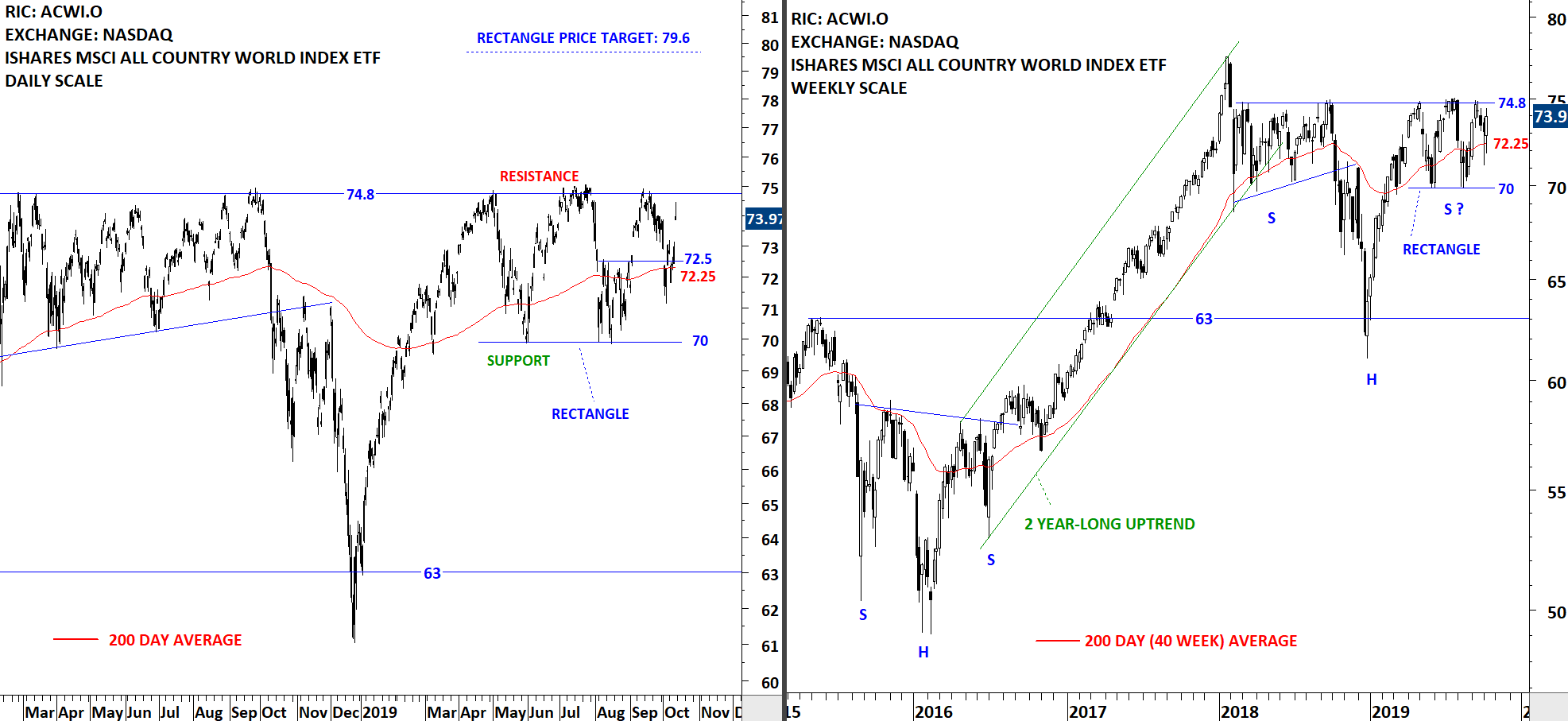

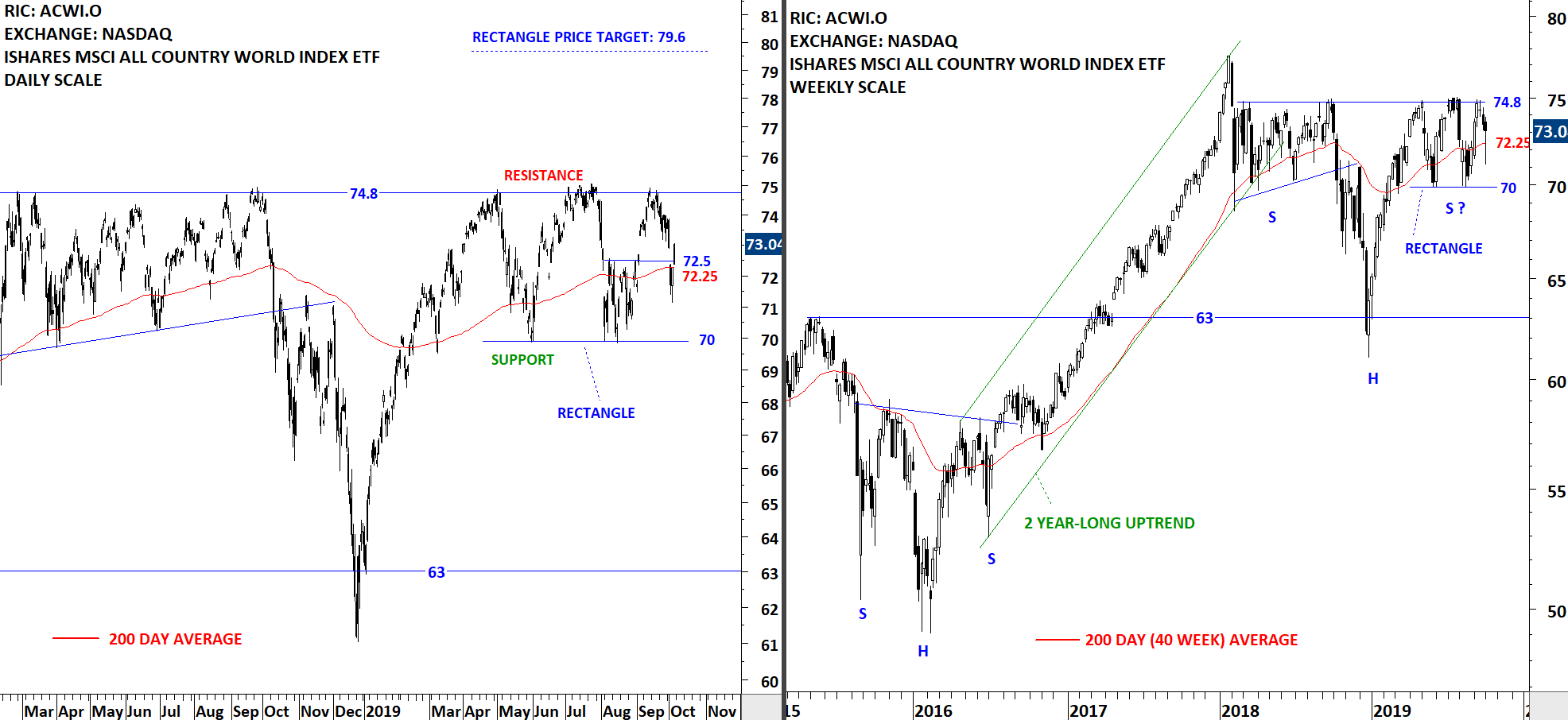

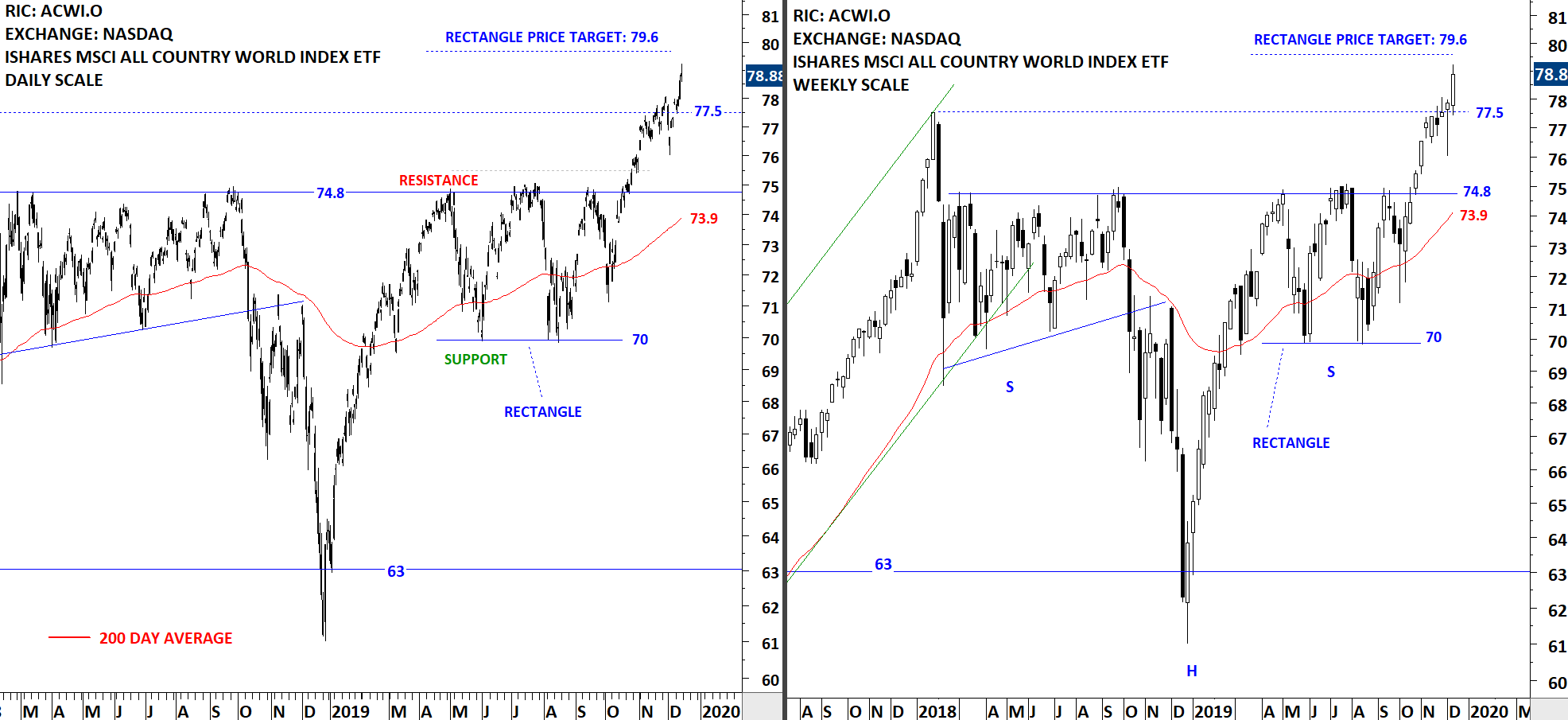

After the minor consolidation between 70 and 72.5 completed on the upside the benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached the upper boundary of the larger scale consolidation at 74.8 levels. A long-term breakout will take place only if the ETF clears the horizontal resistance at 74.8 levels. Larger scale chart pattern can be identified as a H&S continuation. Since April 2019, the ETF is trading between 70 and 74.8 levels. It is important to note that 74.8 acted as a strong resistance since the first quarter of 2018.

Read More Read More

Read More