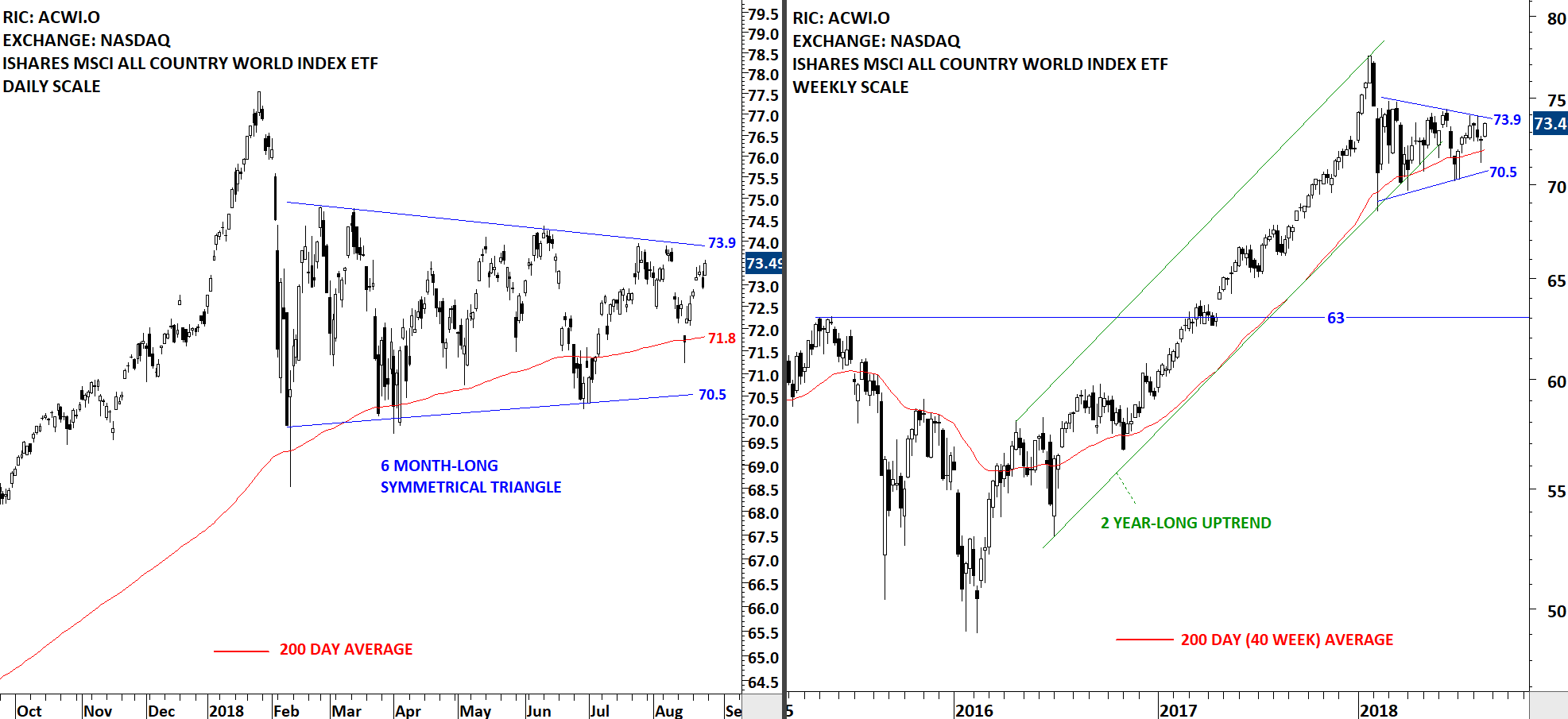

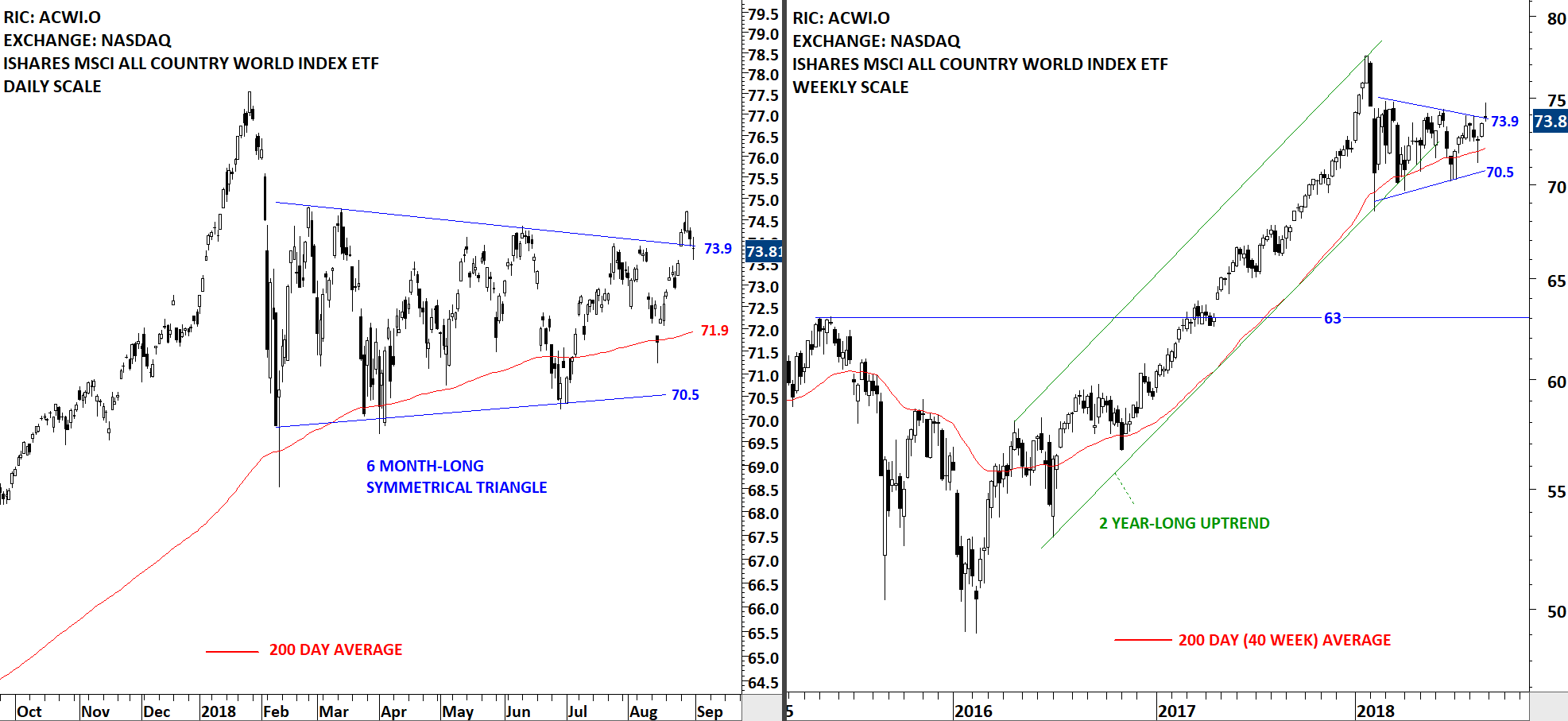

GLOBAL EQUITY MARKETS – September 1, 2018

REVIEW

The iShares MSCI All Country World Index ETF (ACWI.O) breached the upper boundary of its 6 month-long symmetrical triangle. The upper boundary is acting as resistance at 73.9 levels. The jury is still out. We need to see a follow through in the following week to call for a breakout from the lengthy sideways consolidation. This week's price action can be a premature breakout that can be followed by a secondary completion. More on: Premature & False breakouts

Read More

Read More