GLOBAL EQUITY MARKETS – May 18, 2019

REVIEW

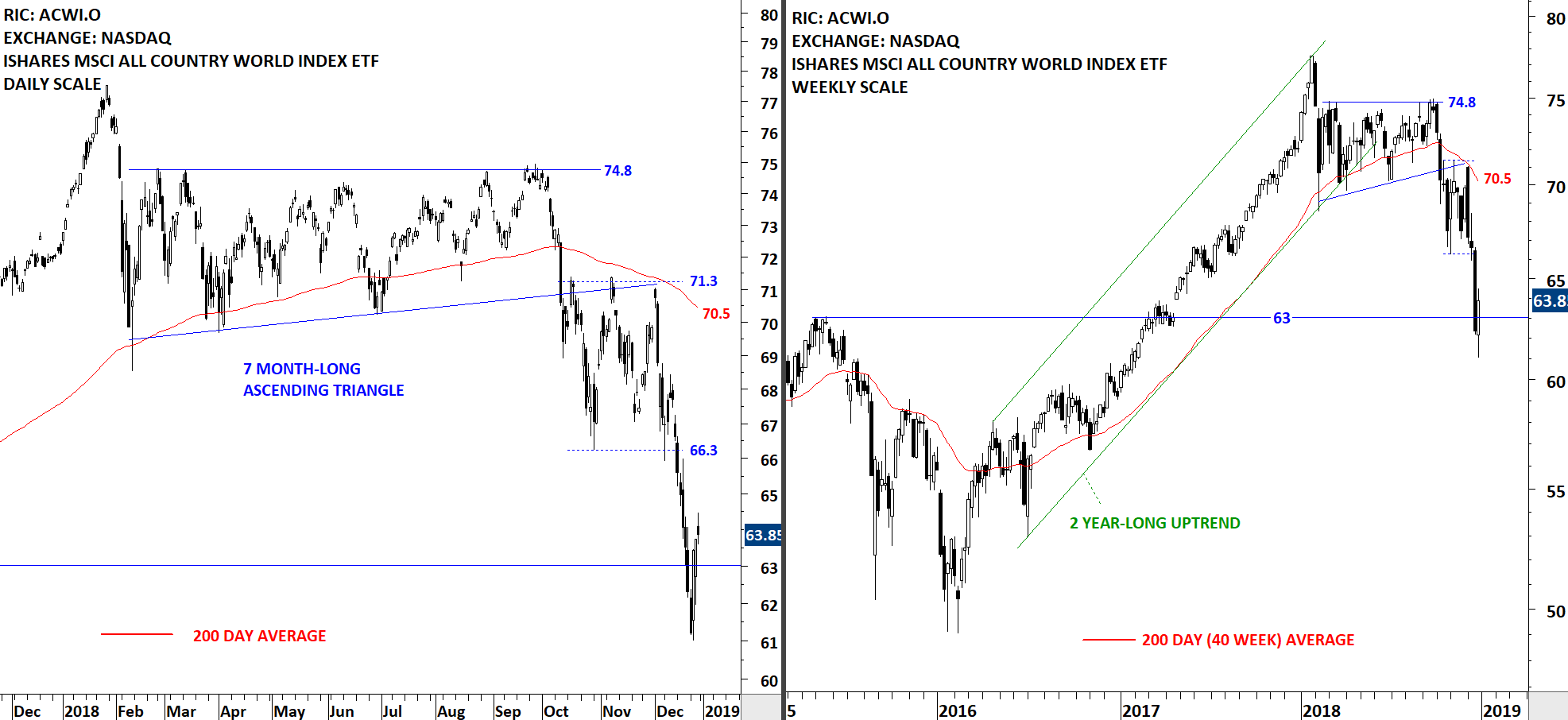

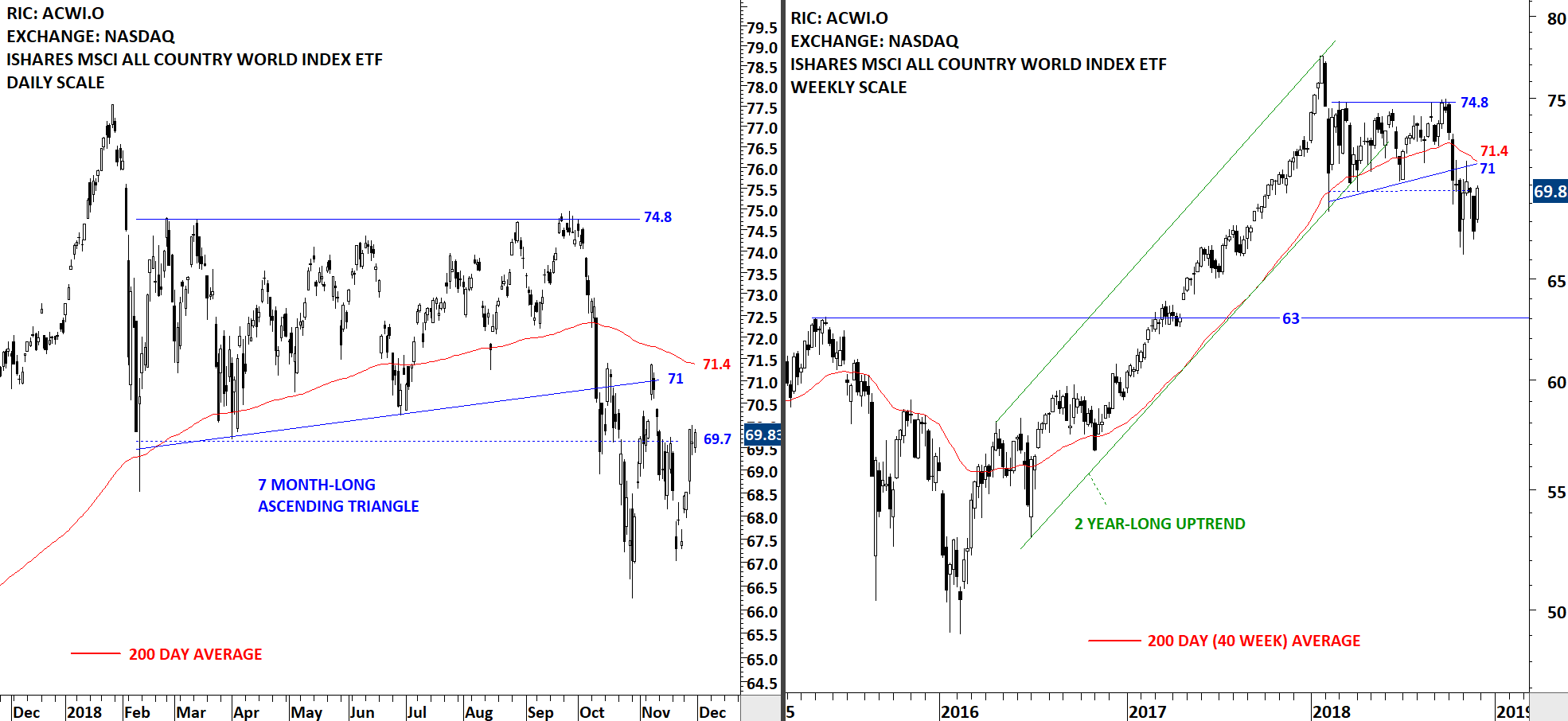

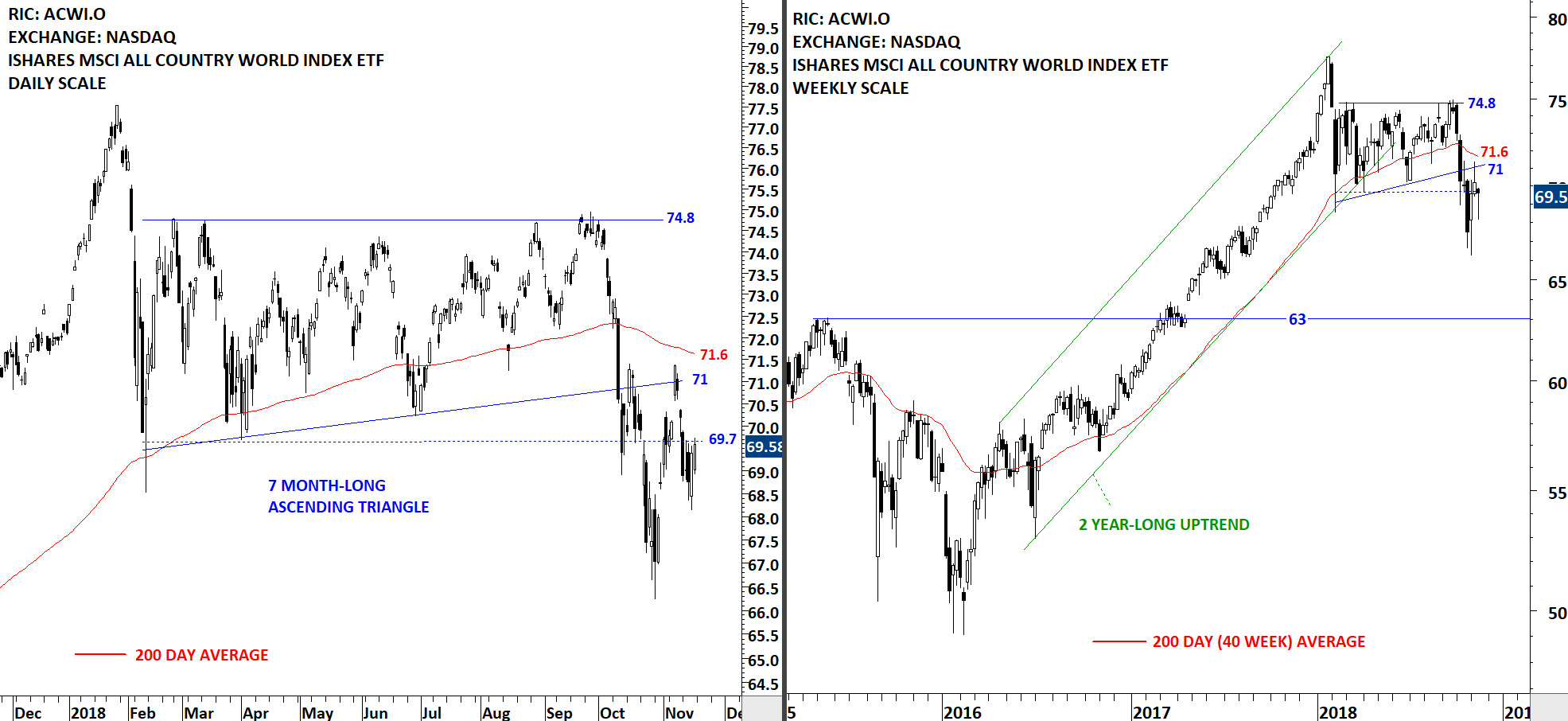

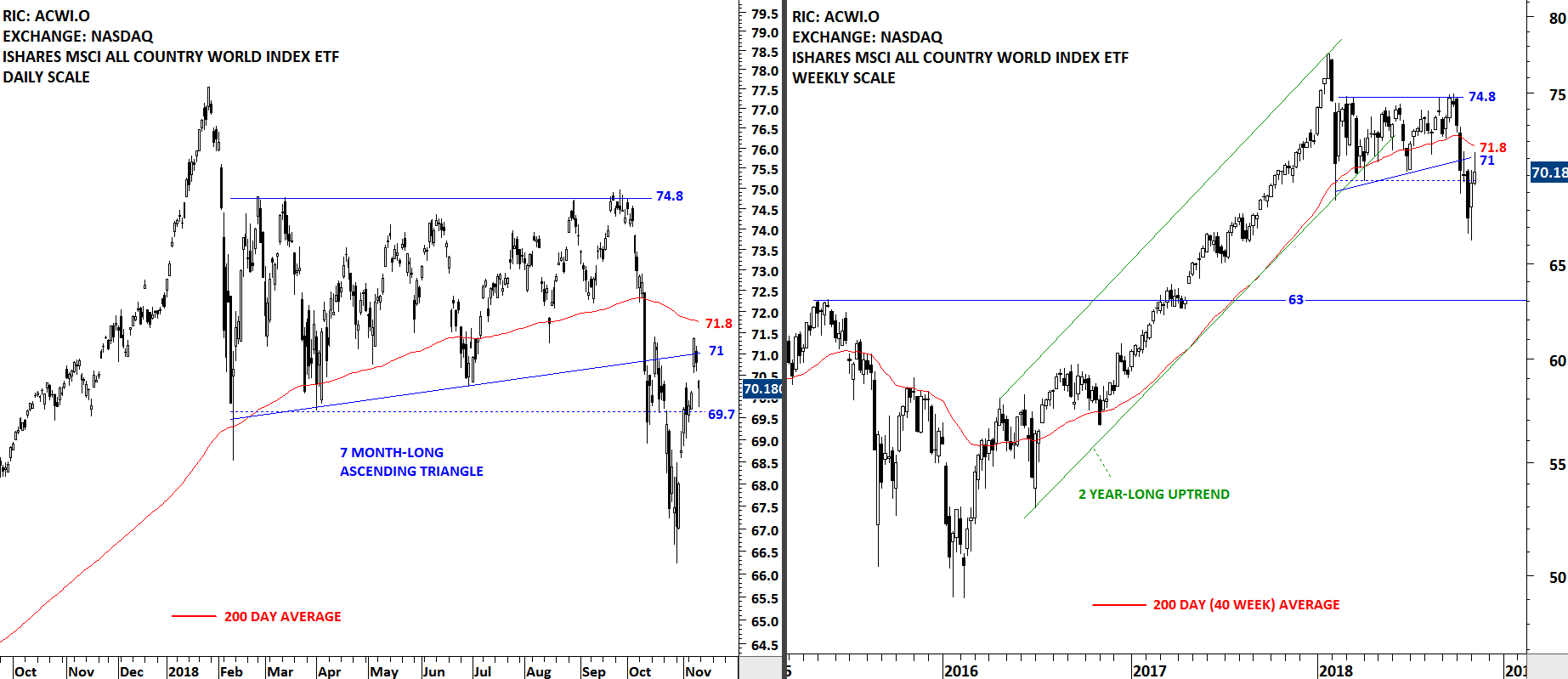

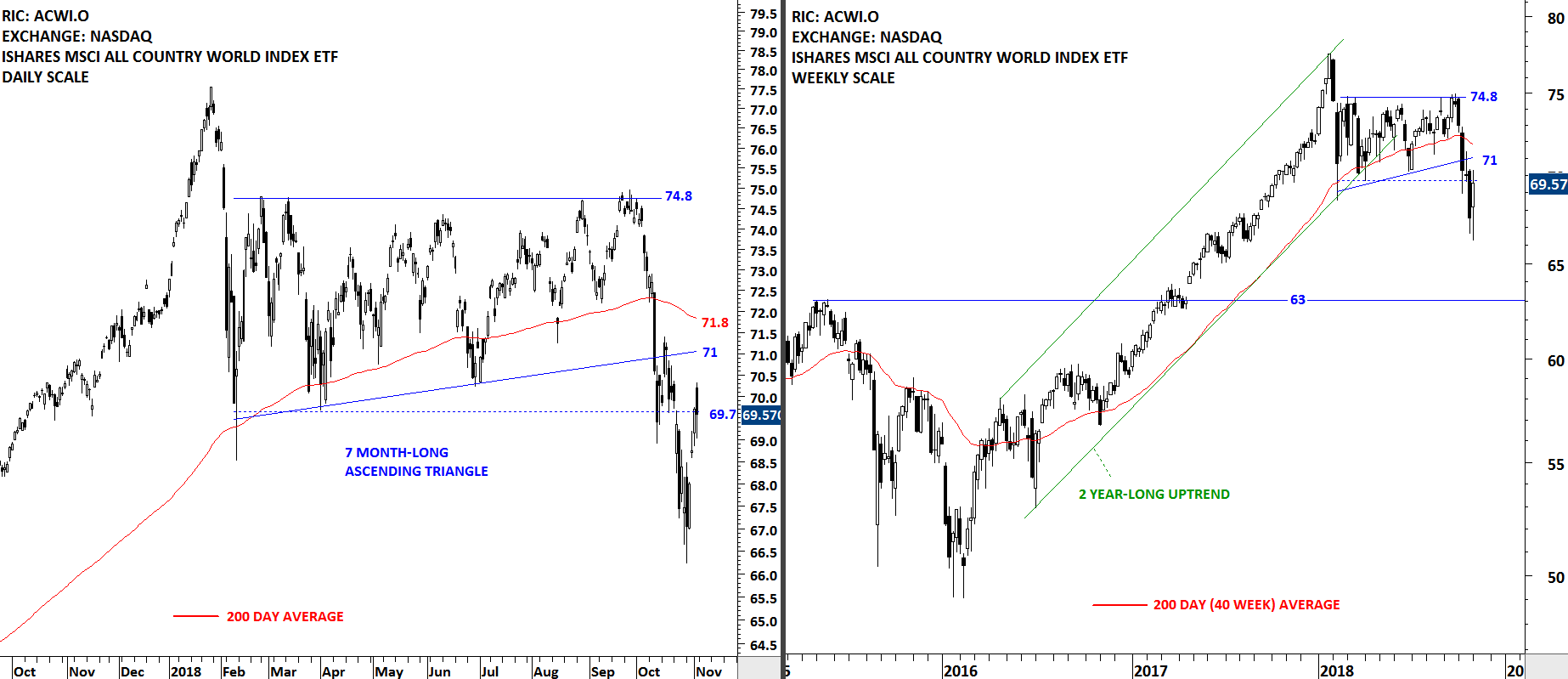

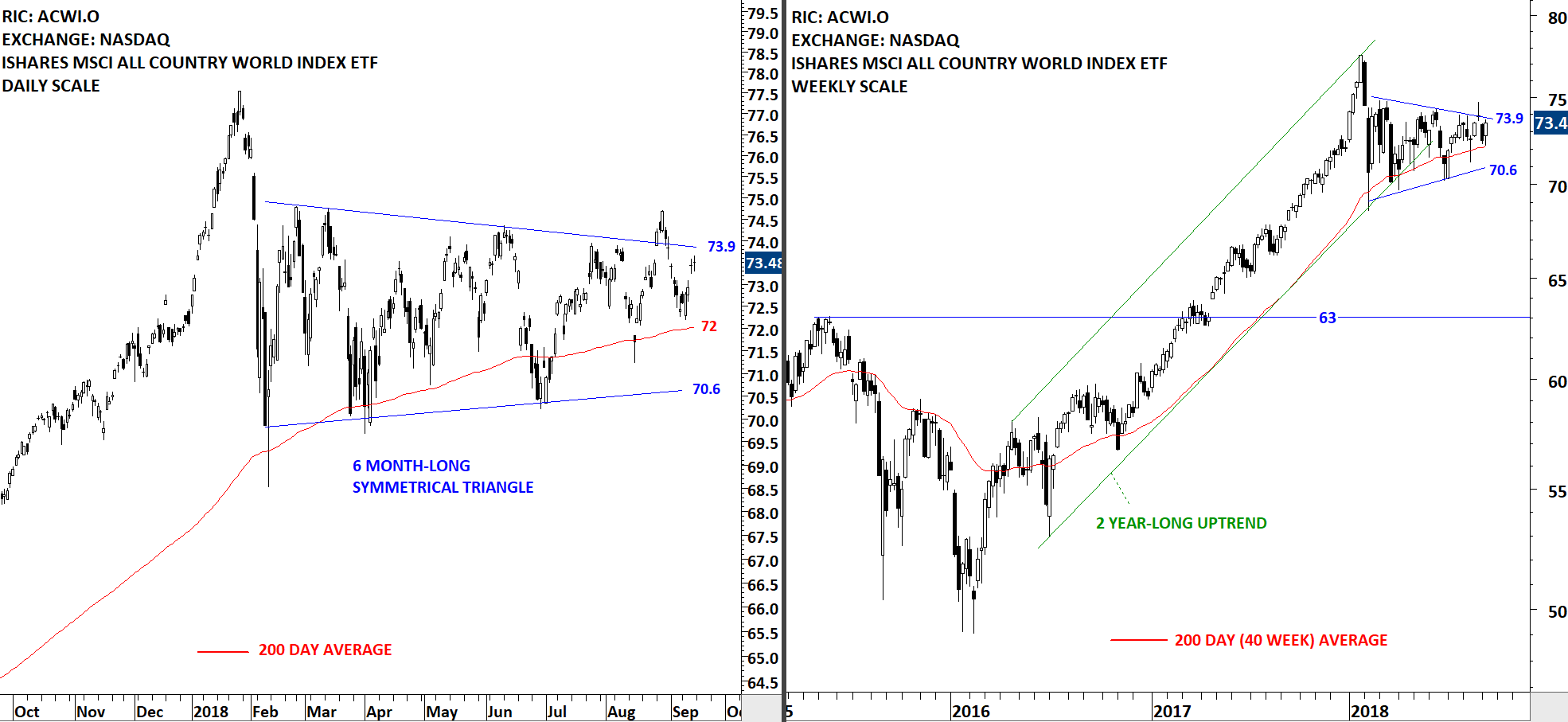

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O), pulled back from the strong resistance at 74.8 levels. During the week price tested the long-term 200-day average at 71 levels and rebounded. For now we can conclude that the 200-day average acted as support. In the following weeks I will monitor the price action around the average. Failure to hold above 71 levels can result in a larger scale correction. The daily scale price chart can form a short-term H&S top. Both the neckline of the possible H&S top and the 200-day moving average are overlapping at the same level (71). In the short-term, as long as the price remains above 71 support, ACWI ETF is expected to trade between 71 and 74.8 levels.

Read More