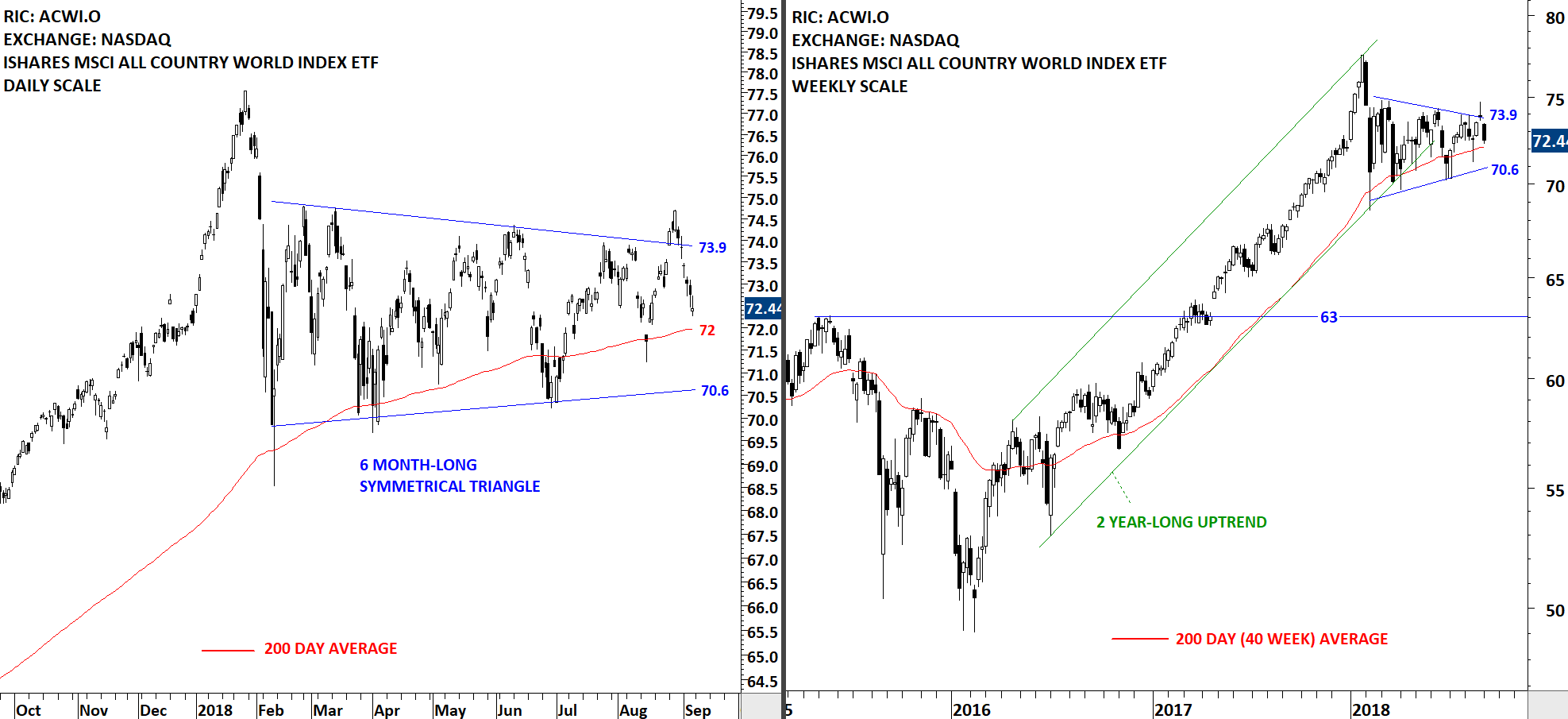

GLOBAL EQUITY MARKETS – September 8, 2018

REVIEW

Strength in U.S. equities alone was not enough to push the iShares MSCI All Country World Index ETF (ACWI.O) out of its 6 month-long consolidation range. Few days of price action above the chart pattern boundary at 73.9 levels failed to materialize into a strong directional movement. The ETF continues to remain in a range between 70.6 and 73.9 levels. Strong support stands at 70.6 levels.

Read More

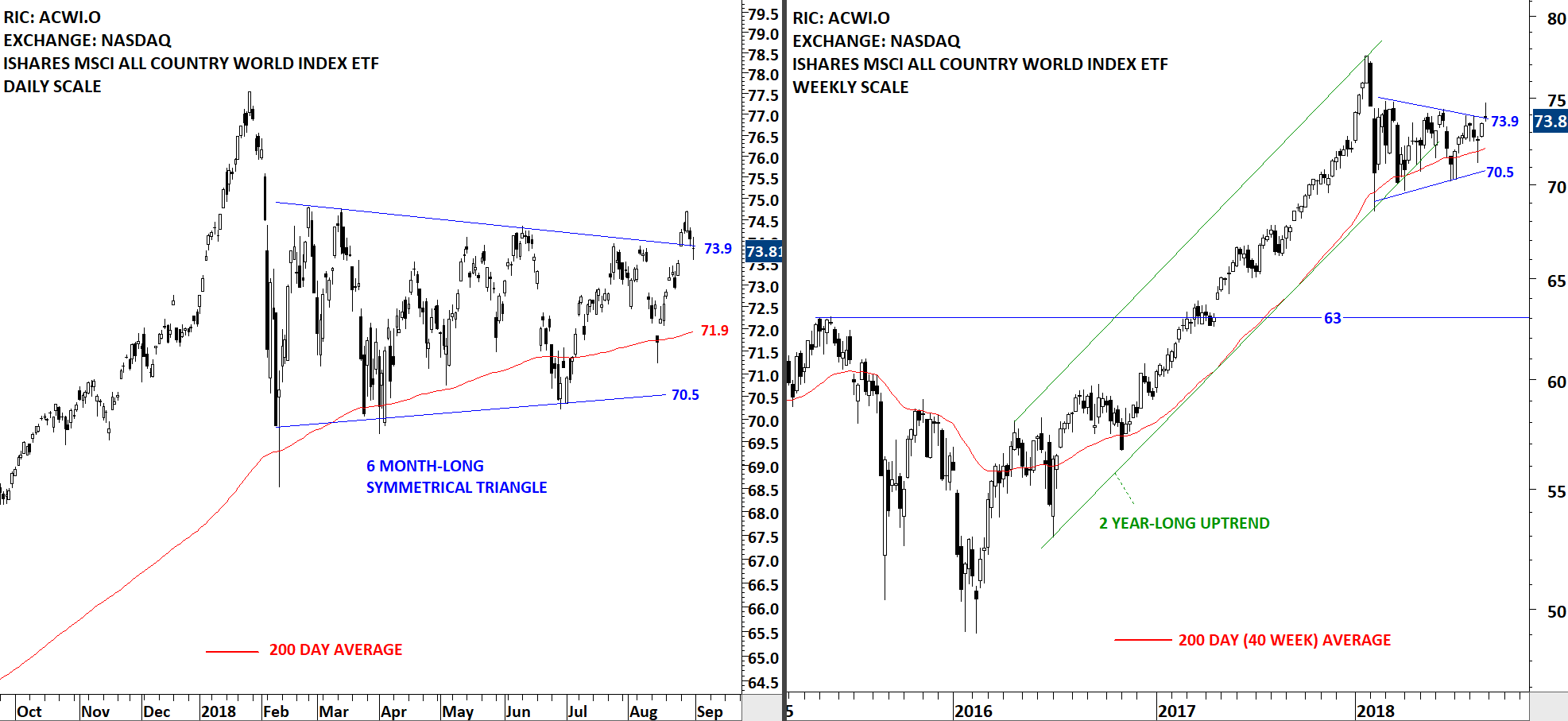

Read MoreGLOBAL EQUITY MARKETS – September 1, 2018

REVIEW

The iShares MSCI All Country World Index ETF (ACWI.O) breached the upper boundary of its 6 month-long symmetrical triangle. The upper boundary is acting as resistance at 73.9 levels. The jury is still out. We need to see a follow through in the following week to call for a breakout from the lengthy sideways consolidation. This week's price action can be a premature breakout that can be followed by a secondary completion. More on: Premature & False breakouts

Read More

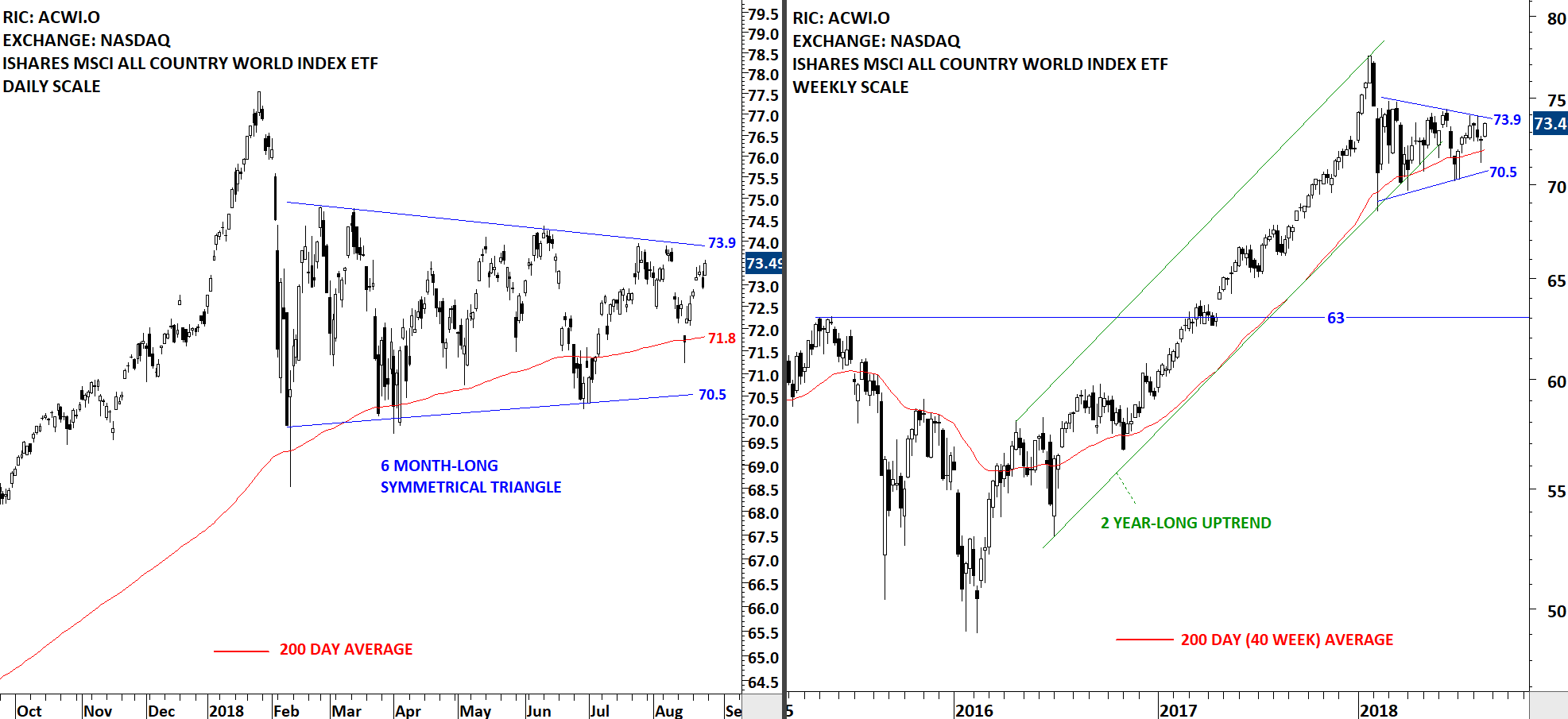

Read MoreGLOBAL EQUITY MARKETS – August 25, 2018

REVIEW

Once again the benchmark for Global Equity Markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is challenging the upper boundary of its 6 month-long sideways consolidation. The upper boundary was tested several times over the past few months. Resistance stands at 73.9. The lower boundary of the possible symmetrical triangle is acting as support at 70.5 levels. The ACWI ETF is trading above its long-term (200-day) average. Breakout above the upper boundary can complete the multi-month sideways consolidation and result in a directional move. The ACWI ETF still remains in a trading range.

Read More

Read More