INTERIM UPDATE – April 11, 2019

A short-term bullish opportunity might be developing in Energy sector equities in Global markets. Last week's Global Equity Markets report featured SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP). This interim update adds few more well-defined horizontal chart pattern setups that can resolve on the upside. Breakouts from these consolidations can add momentum to Energy related equities.

Read MoreGLOBAL EQUITY MARKETS – April 6, 2019

REVIEW

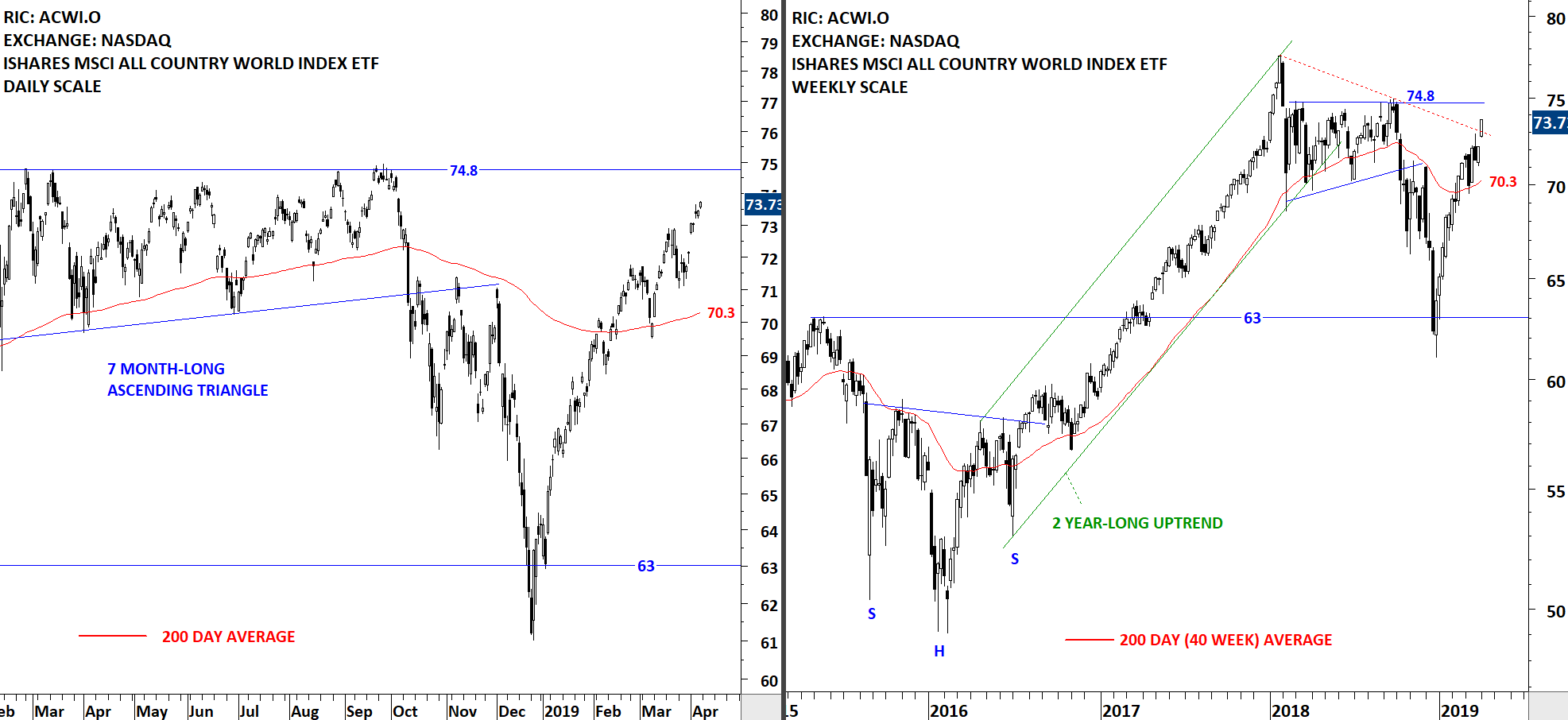

The benchmark for Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continues to remain strong. The ETF had a strong rebound from support at 63 levels and since then the uptrend resumed without any significant setback. In February the ETF cleared its 200-day moving average and continues to trend above its long-term average. In the short-term horizontal resistance at 74.8 levels can act as an overhead supply. Strong support is the 200-day average at 70.3 levels.

Read More

Read More