GLOBAL EQUITY MARKETS – August 3, 2019

REVIEW

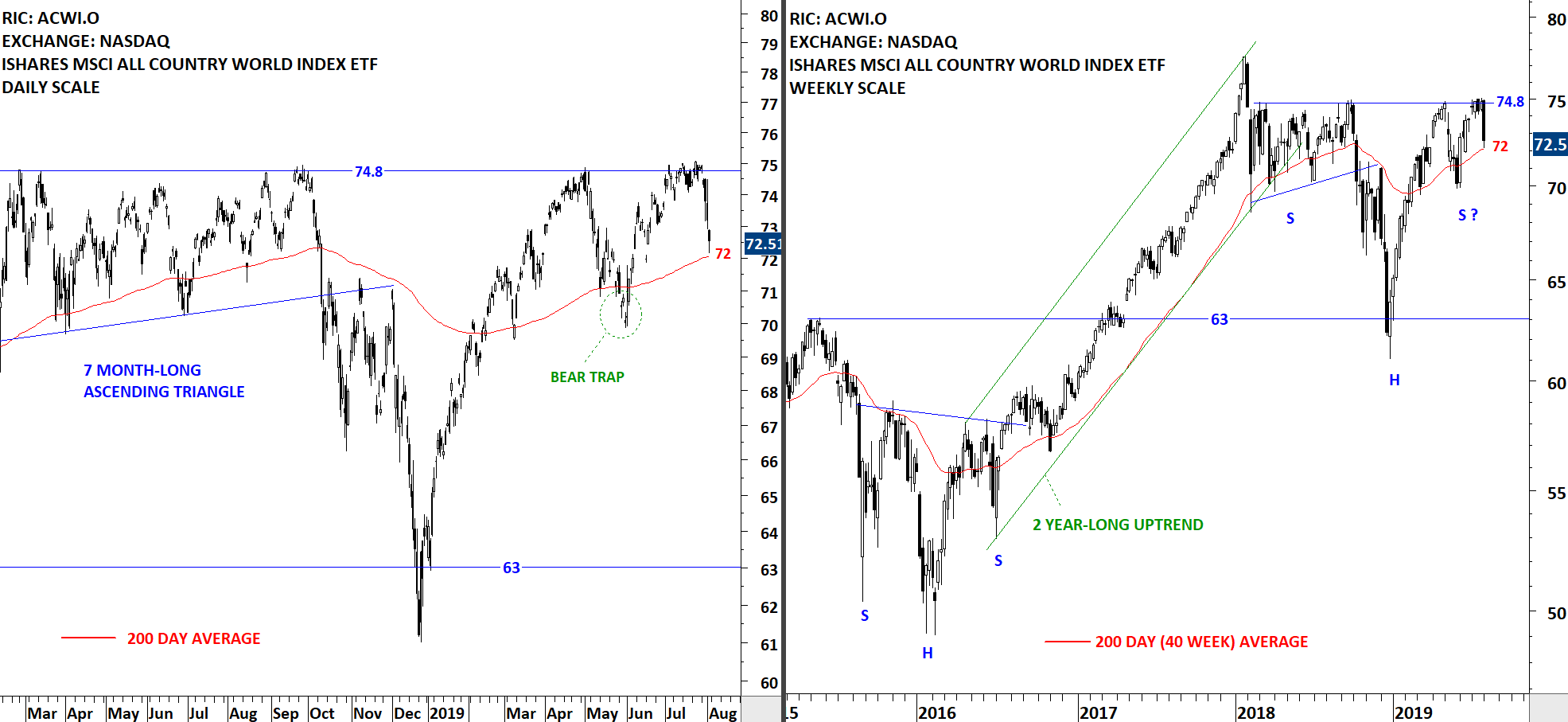

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) failed to break above the strong horizontal resistance once again. Failure to break above the strong resistance resulted in a pullback towards the long-term average at 72 levels. On Friday the ETF tested the 200-day and closed the day off its lows. If we see the price stabilizing above the support at 72, the new trading range can become 72 and 74.8. Failure to hold above the 200-day can result in a larger scale correction. Next support is at 70 levels.

Read More

Read MoreRectangle – Bullish Reversal

GLOBAL EQUITY MARKETS – July 27, 2019

REVIEW

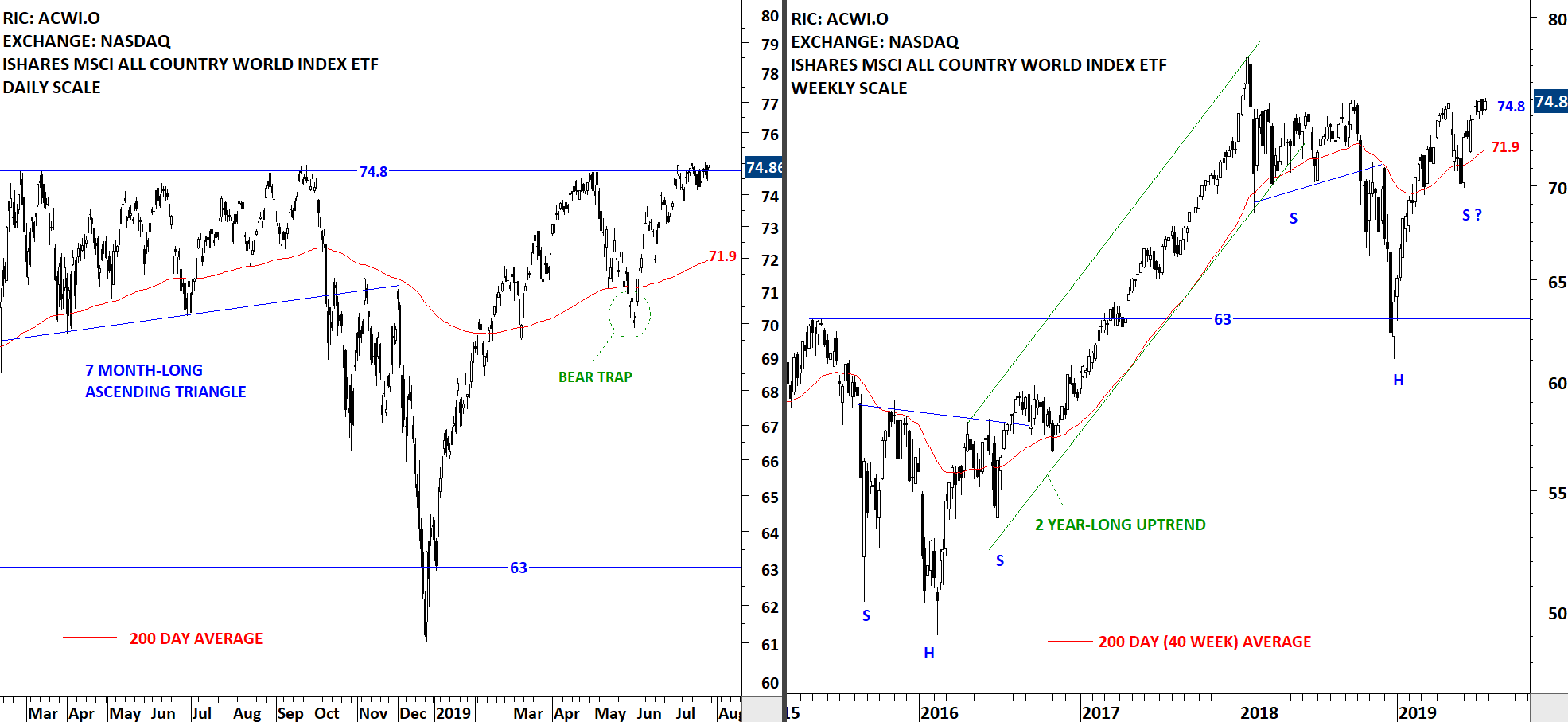

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continues to challenge the strong horizontal resistance at 74.8 levels. A breakout can be very positive for Global equities. Failure at the strong resistance can result in a pullback towards the long-term average at 71.9 levels.

Read More

Read More