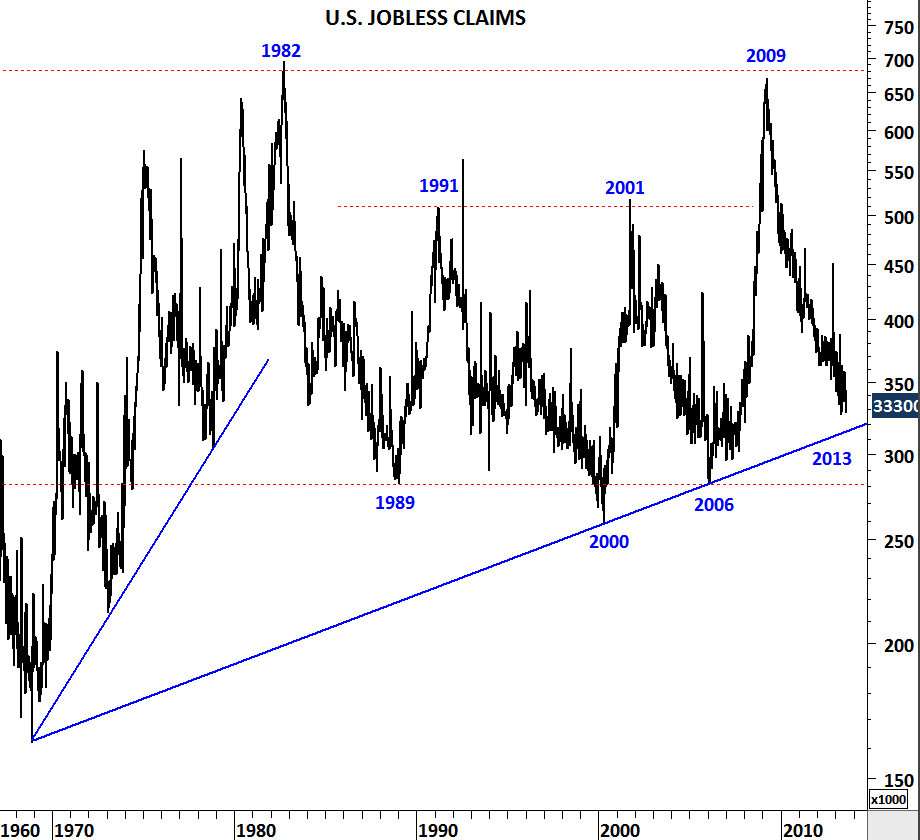

U.S. JOBLESS CLAIMS

Year 2013 could mark the medium/long-term low for the U.S. weekly jobless claims. Over the past 4 years, jobless claims trended lower from 680K levels to 330K levels. This is a significant improvement given the magnitude of the historical swings on this economic time series data. U.S. weekly jobless claims reached an important trend support and if this trend line acts as support as it did in 2000 and 2006, we should expect higher levels in the last quarter of the year. Breakdown below this trend line at 320K levels could help the jobless claims ease towards the horizontal support at 280K.