Dear Tech Charts Members,

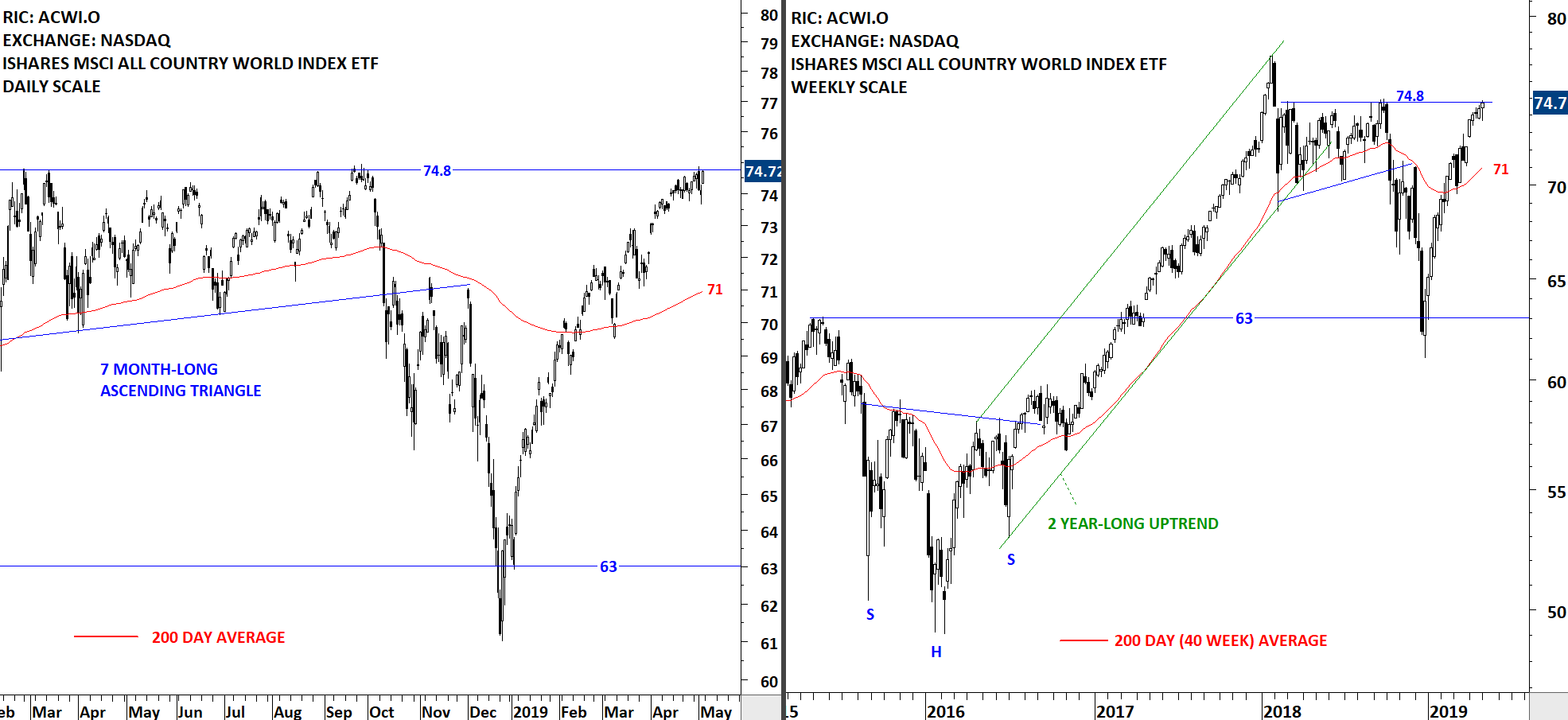

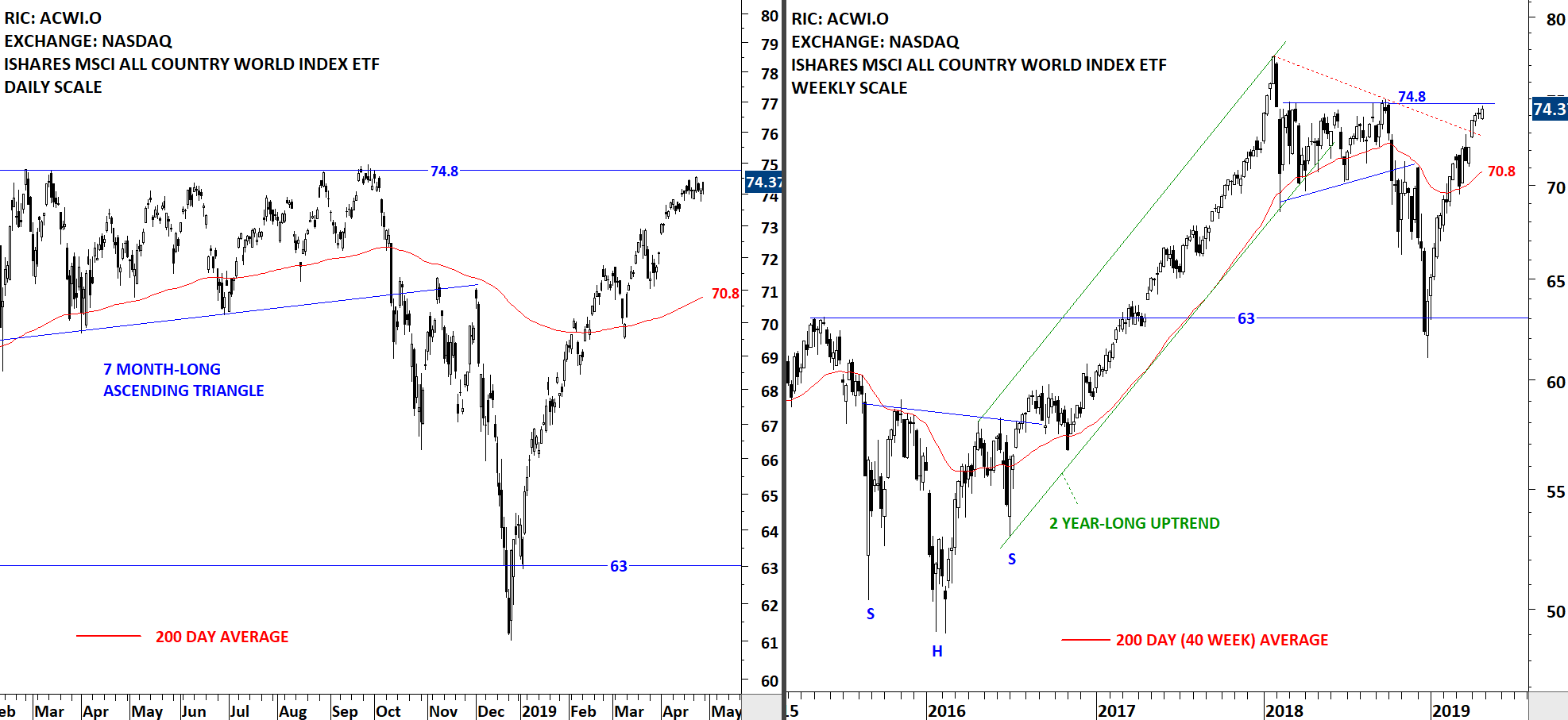

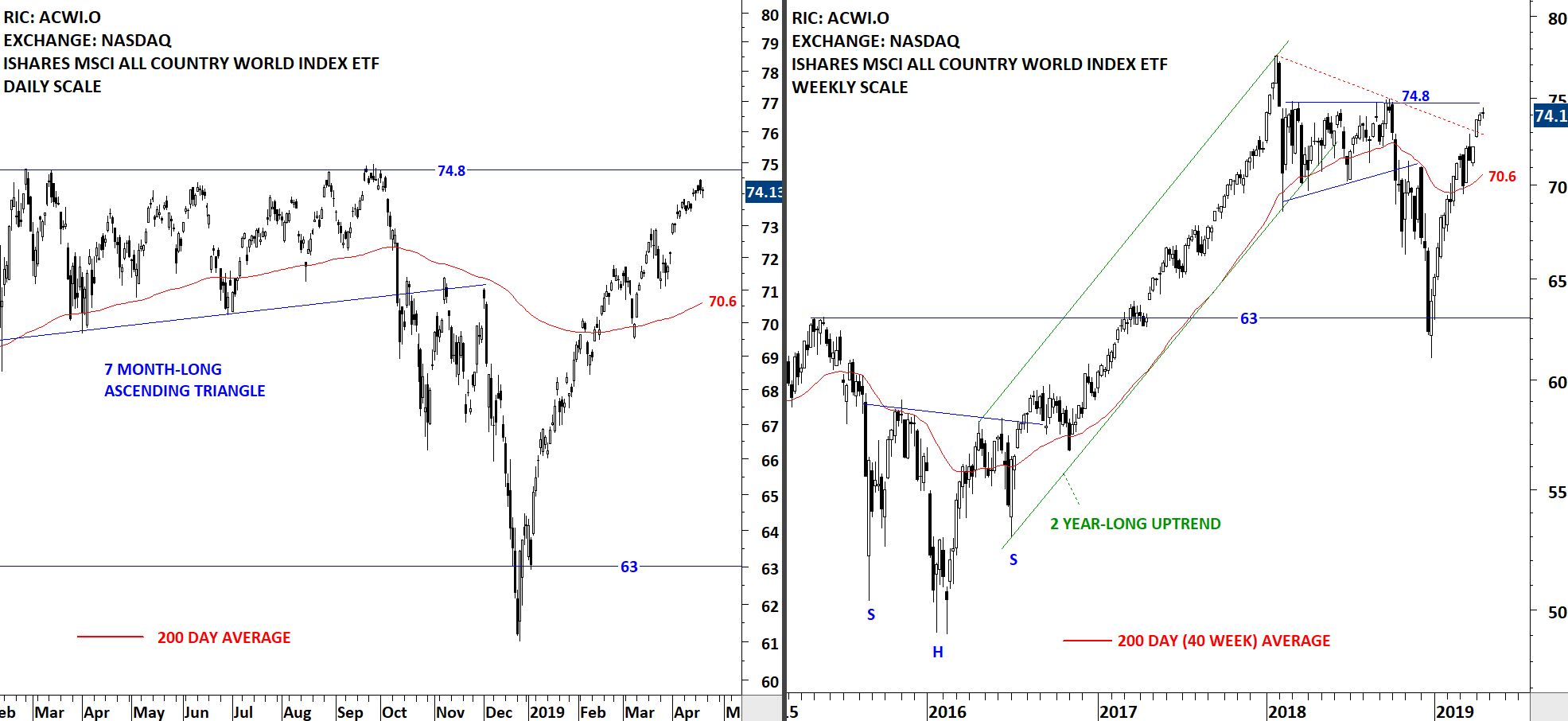

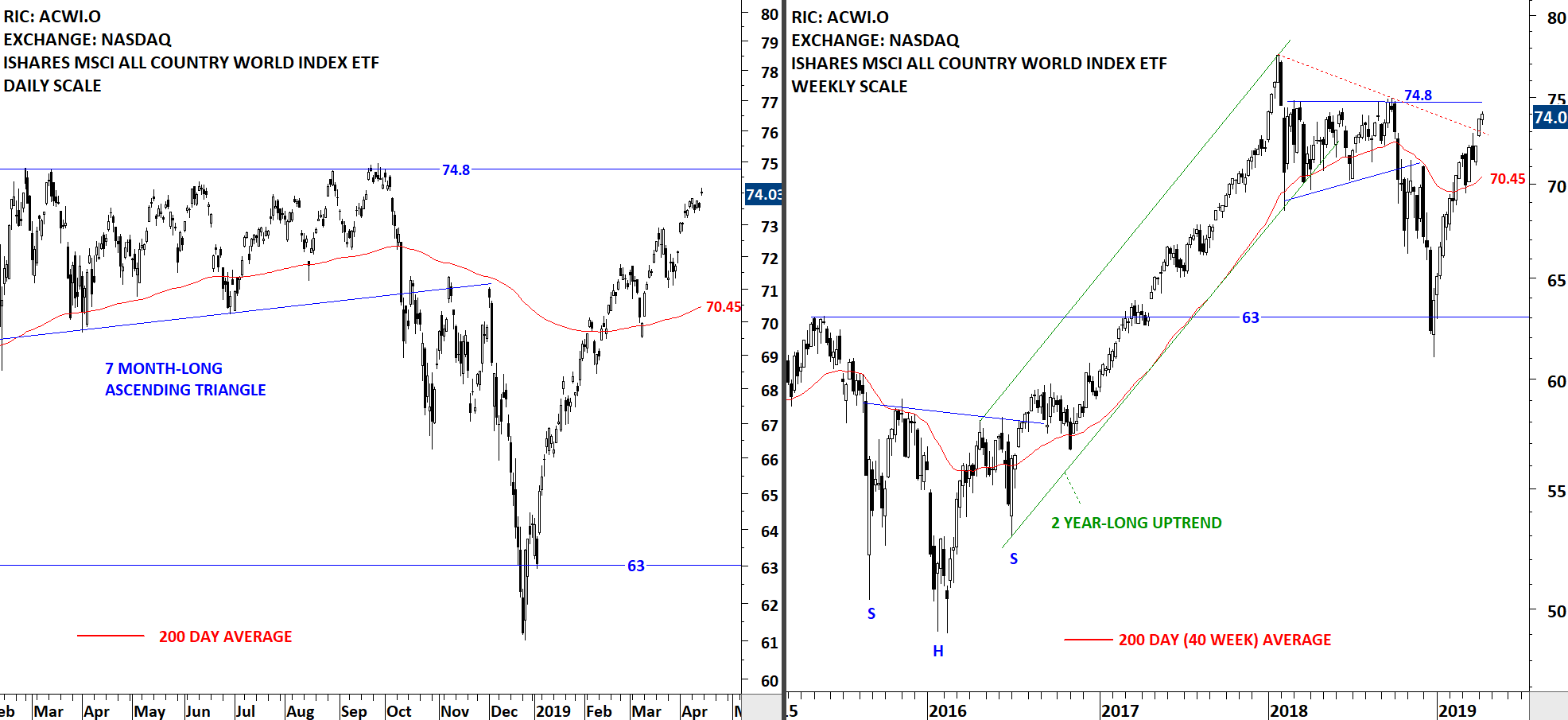

We are continuing our Member webinar series with inverse H&S chart pattern that acts as a bottom reversal and also as a continuation. Over the past few weeks Global equity markets report identified some well-defined and mature H&S bottom reversals and H&S continuation chart patterns. I hope to highlight differences between these two types of bullish chart patterns and discuss how they develop in the general context of overall price action.

Scheduled for: Thursday, April 18 at 8:30am MST (register below)

The upcoming webinar is dedicated to a thorough discussion on inverse head and shoulder (reversal) and bullish H&S continuation.

- We will review some of those chart pattern breakouts that were featured in the Global Equity Markets report.

- We will review some of the qualities we look for when identifying and differentiating H&S bottom and H&S continuation

- We will look at some of the developing bullish continuation chart patterns

- We will continue to highlight Tech Charts members favorite chart pattern setups in different equity markets. As always please feel free to send charts for discussion.

- We will have a member Q&A at the end of the webinar.

Read More