SPAIN IBEX 35 – ITALY MIBTEL – PORTUGAL PSI 20

It has been a challenging week for the equity markets. Especially in Europe, fears on Spain’s debt triggered heavy speculation in the equity and bond markets. Yields have jumped and equities sold-off. Weakness in Spain spread to Italy and Portugal. We have seen clear technical sell signals in Spain, Italy and Portugal. These were the weak markets of euro zone and as a result they were the first one to experience further set backs.

It has been a challenging week for the equity markets. Especially in Europe, fears on Spain’s debt triggered heavy speculation in the equity and bond markets. Yields have jumped and equities sold-off. Weakness in Spain spread to Italy and Portugal. We have seen clear technical sell signals in Spain, Italy and Portugal. These were the weak markets of euro zone and as a result they were the first one to experience further set backs.

In this post I’m updating Spain, Italy and Portugal’s equity indices. On the 3rd of April, I reviewed all the European equity indices and since then there has been major breakdowns that needed to be revisited. Spain’s IBEX 35 index is now breaking down the 7 month-long consolidation range at 7,800 levels. Sideways consolidation was a symmetrical triangle and breakdowns from these type of continuation patterns are usually followed by weakness. Next support for IBEX 35 is at 6,700 levels.

Italy’s MIBTEL Index is also breaking down its sideways consolidation at 15,000 levels. 7 month-long choppy sideways consolidation is likely to be followed by a downtrend towards the next support at 12,300 levels.

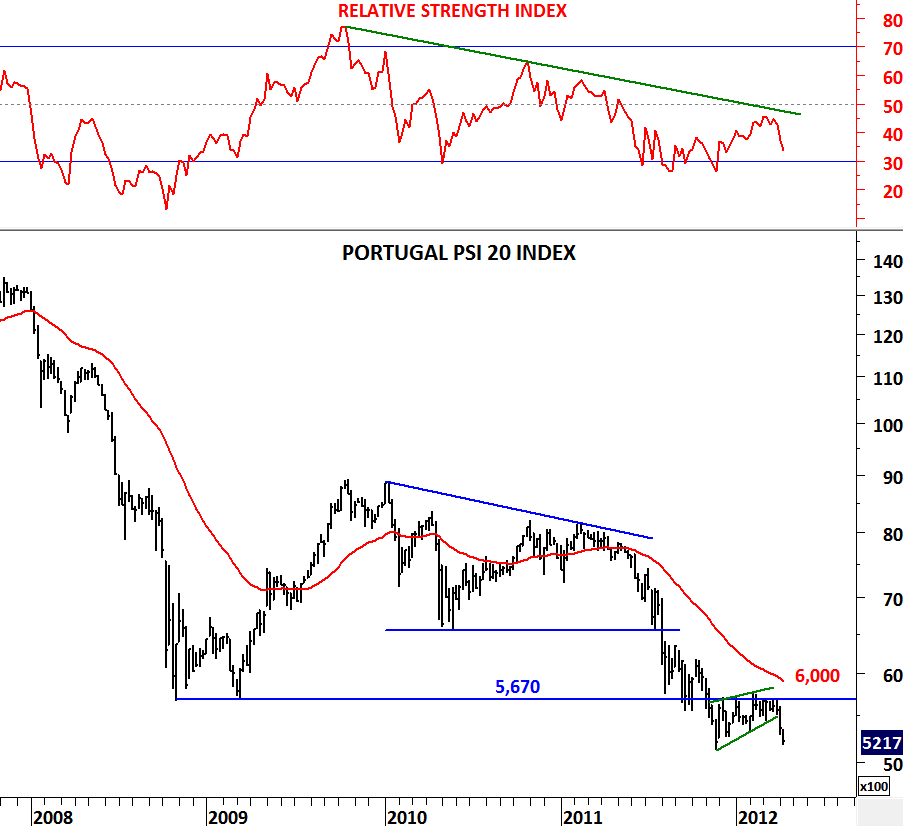

Portugal’s PSI 20 index is another poor performer that is now breaking down its bearish wedge pattern. Unless the index moves back above 5,670-6,000 area, PSI 20 will experience more selling pressure.