GLOBAL EQUITY MARKETS – January 1, 2022

Dear Tech Charts Members,

Another year is behind us. I want to take this opportunity to Thank you all for being part of Tech Charts community. As I shared knowledge with our members, I have learned a lot form our communications. It is definitely not a one way journey. Give and take... Like in every other part of life. Constructing ideas, putting them to test, being responsible to communicate them clearly, keeping track of statistics, getting feedback from many of you has added tremendous value over the past 5 years. I'm grateful for having you as members and part of our community. I look forward to serving you in the New Year with great chart pattern ideas, educational videos and with many more new interactive communications.

I wish you all a healthy and successful New Year.

Regards,

Aksel Kibar, CMT

REVIEW

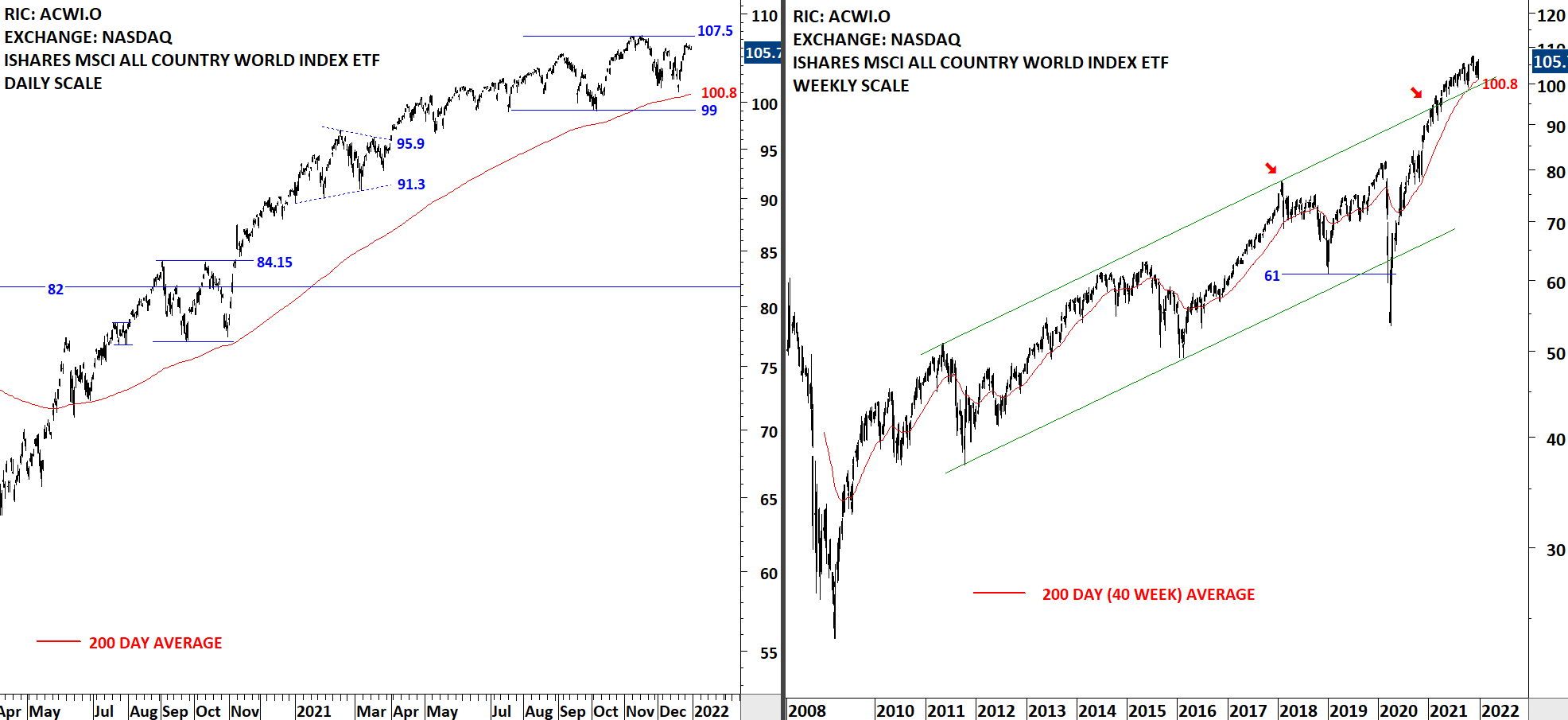

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. The ETF pulled back towards the long-term average at 100.8 levels and rebounded. Strong support area remains between 99 and 100.8. On the weekly scale price chart, the upper boundary of the trend channel formed support around the same level with the 200-day average. Breakdown below the long-term average can change the outlook to negative on ACWI ETF. Previous minor high at 107.5 will act as resistance in the following days.