GLOBAL EQUITY MARKETS – April 16, 2022

REVIEW

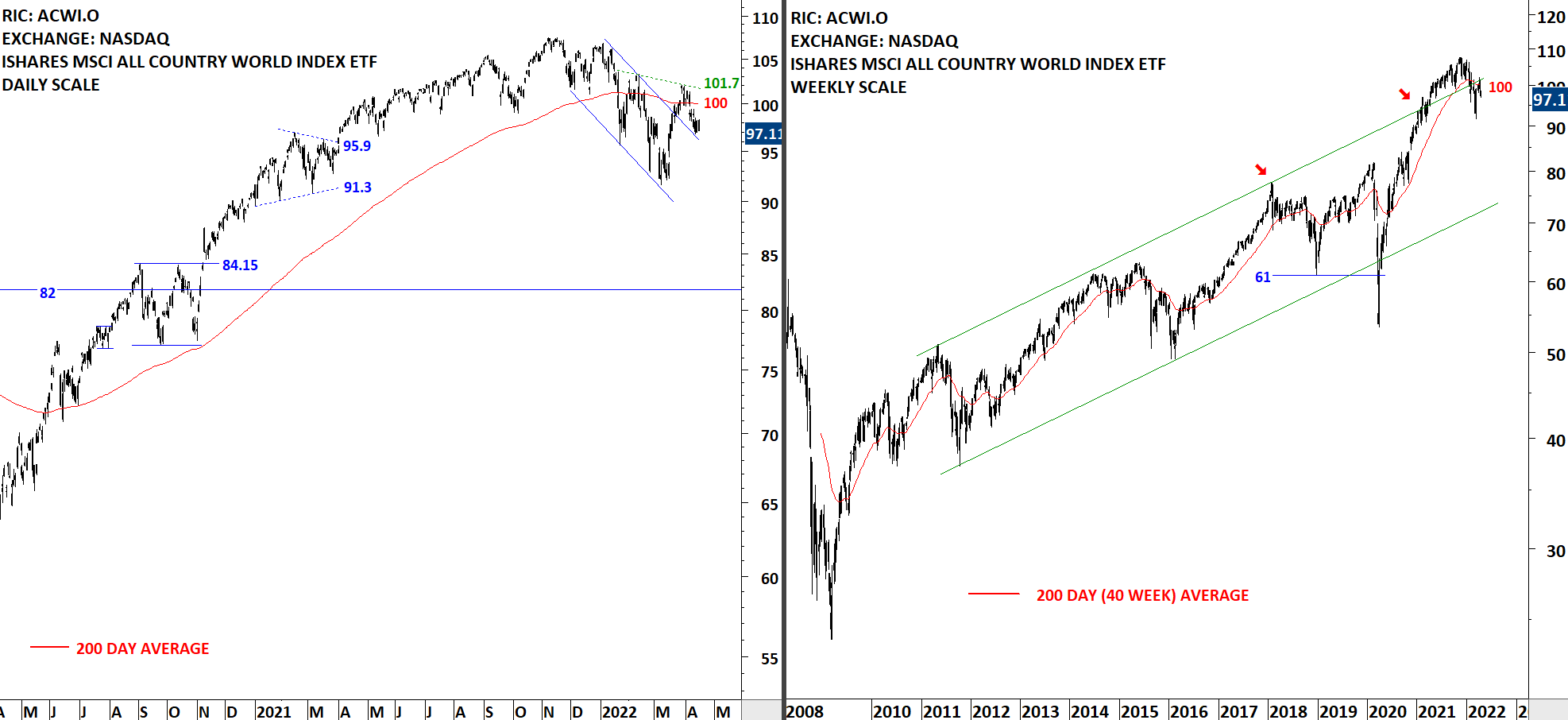

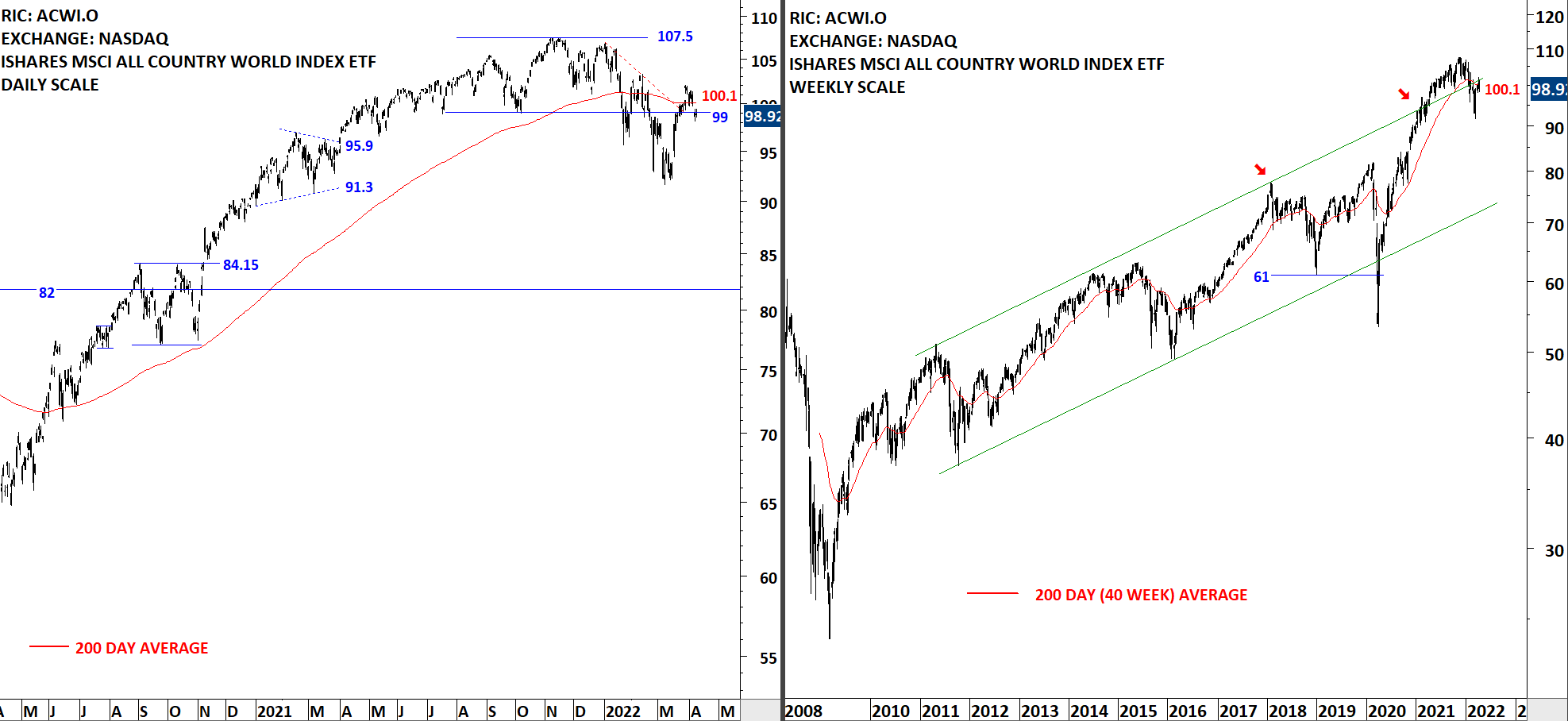

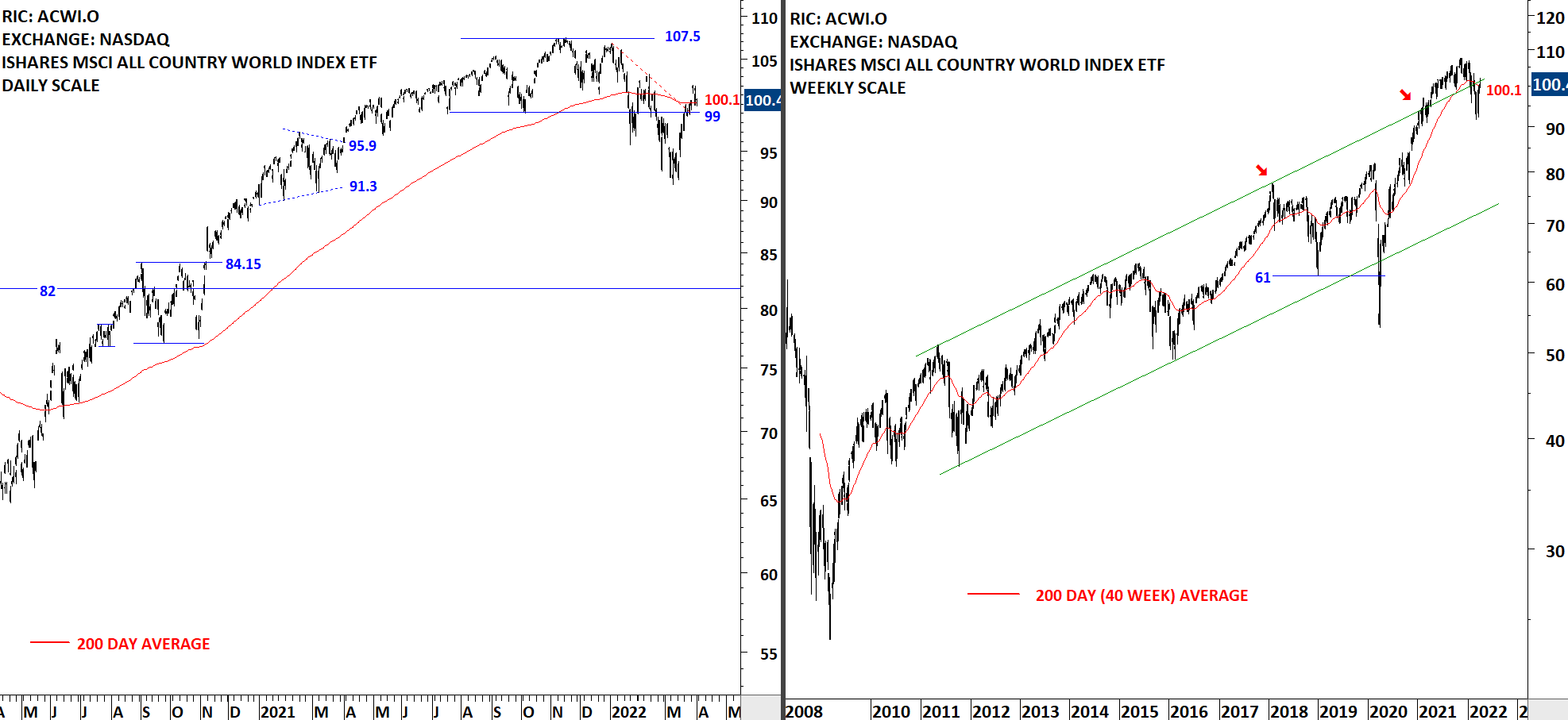

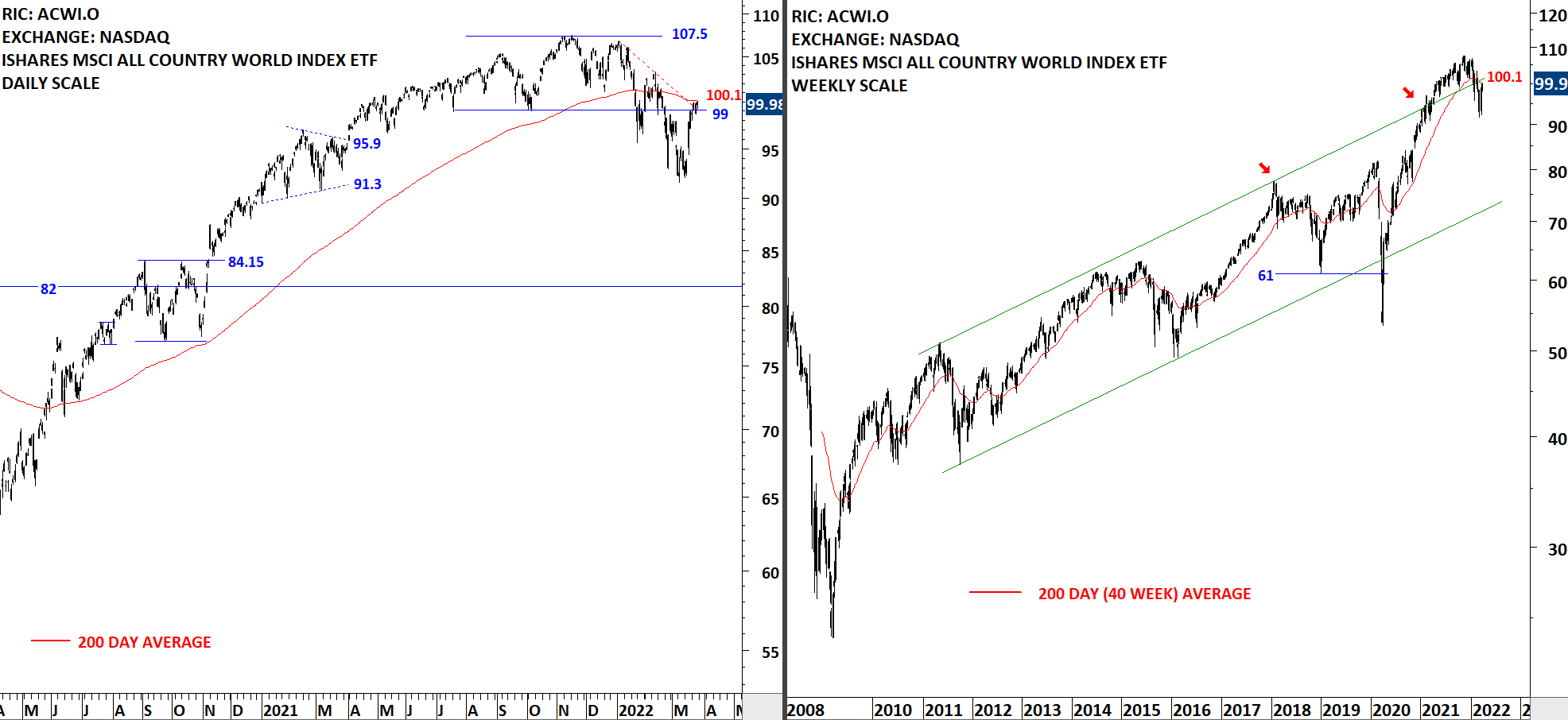

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is consolidating around its 200-day average. To get bullish on Global Equities, I want to see the ETF clearing the 200-day average and settling above it. Until that happens I will view this as a counter trend rebound. We can see more sideways consolidation around the 200-day average until the index finds direction. The 200-day average is currently at 100 levels. The bullish case would be the formation of a H&S bottom reversal with the right shoulder being in progress. An upward move towards 100-101.7 area will increase my confidence on the H&S bottom reversal development.