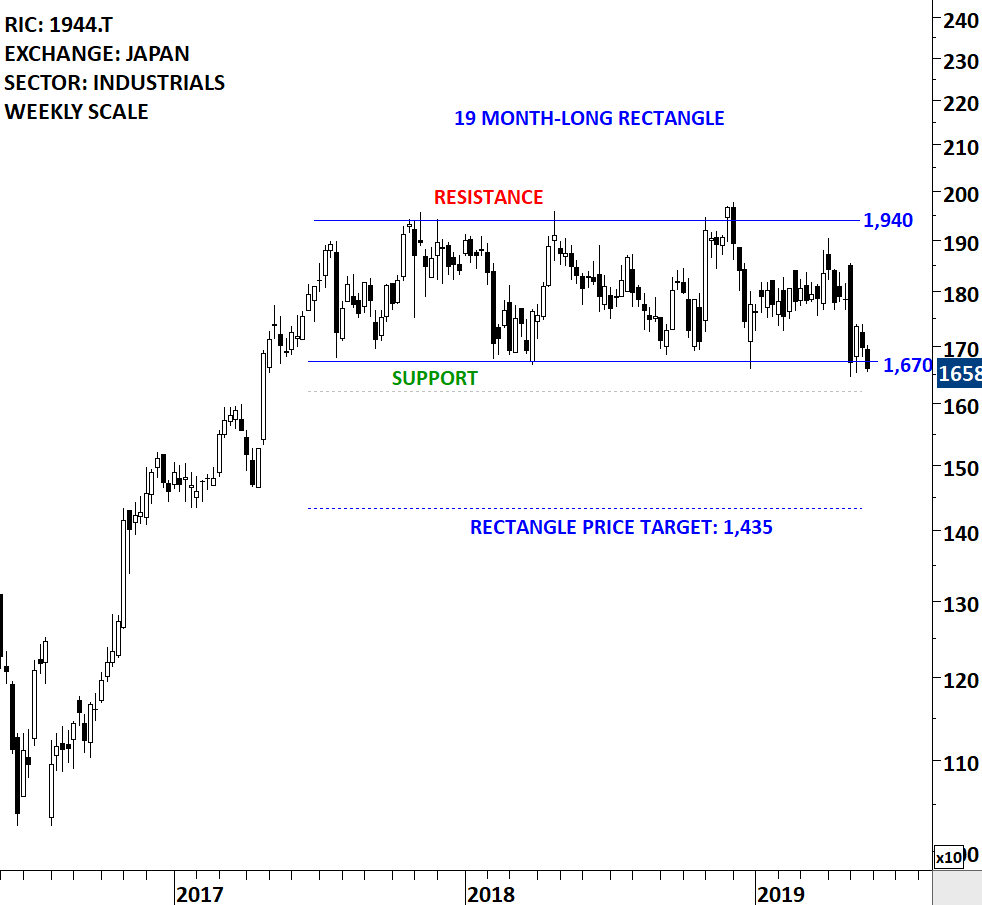

KINDEN CORP (1944.T)

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section KINDEN CORP., listed on the Nikkei Stock Exchange.

KINDEN CORP (1944.T)

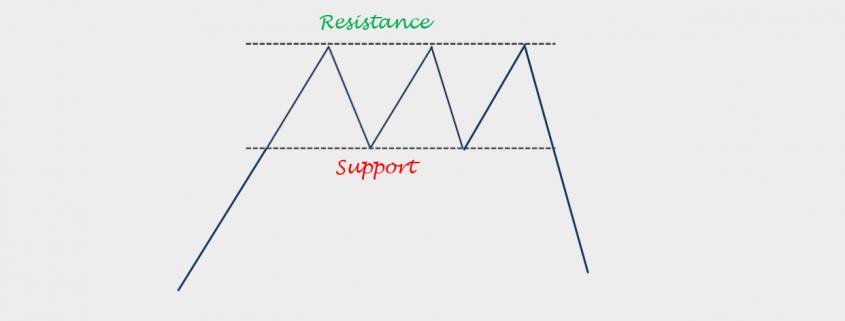

KINDEN CORPORATION is a Japan-based construction company. The stock is listed on the Tokyo Stock Exchange. Price chart formed a 19 month-long rectangle with the lower boundary acting as strong support at 1,670 levels and the upper boundary as resistance at 1,940 levels. KINDEN CORPORATION is trading between well-defined chart pattern boundaries. Multi-month long rectangle chart pattern with well-defined horizontal boundaries is offering good trading opportunity. A daily close below 1,620 levels can confirm the rectangle chart pattern as a top reversal with the possible chart pattern price target of 1,435 levels. Breakdown after several tests of chart pattern boundary can be followed by a strong directional move. Data as of 28/05/2019

Tech Charts Membership

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

As a Premium Member of Aksel Kibar’s Tech Charts,

You will receive:

-

Global Equities Report. Delivered weekly.

-

Classical charting principles. Learn patterns and setups.

-

Actionable information. Worldwide indices and stocks of interest.

-

Risk management advice. The important trading points of each chart.

-

Information on breakout opportunities. Identify the ones you want to take action on.

-

Video tutorials. How patterns form and why they succeed or fail.

-

Watch list alerts. As they become available so you can act quickly.

-

Breakout alerts. Usually once a week.

-

Access to everything (now and as it becomes available)o Reports

o Videos and video series -

Multi-part webinar course. You learn the 8 most common charting principles.

-

Webinars. Actionable and timely advice on breaking out chart patterns.

For your convenience your membership auto renews each year.