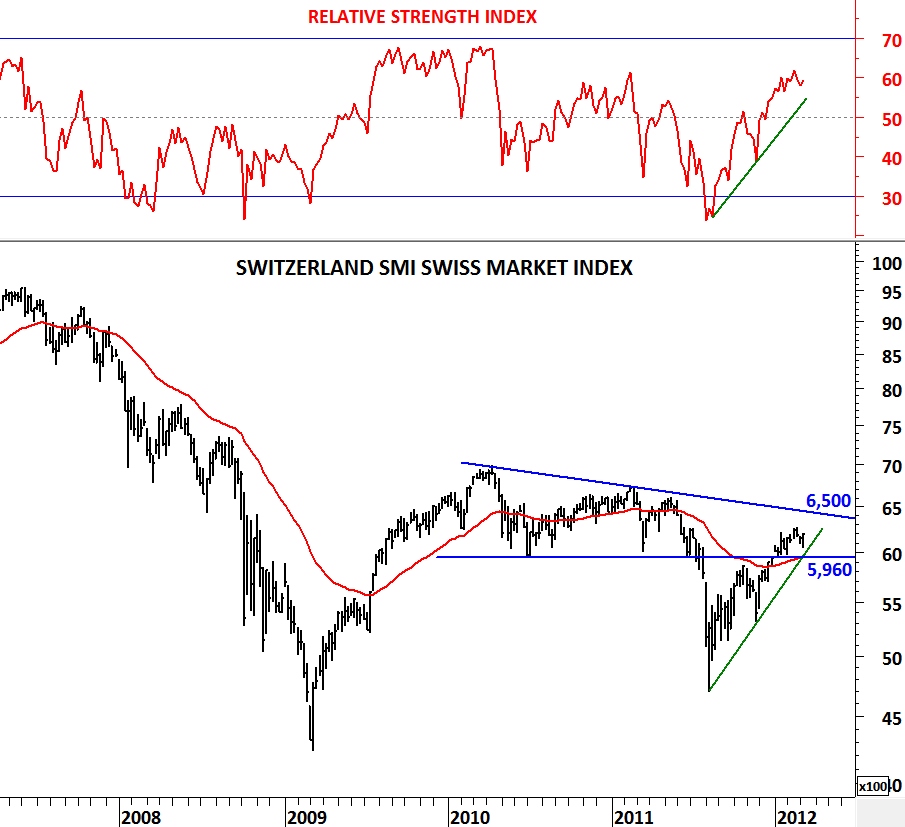

SWITZERLAND SMI

Switzerland SMI index has been volatile due to euro zone debt problems. Until mid-2011 price action between 2010 and 2011 was more like a sideways consolidation. However, index broke down the strong support at 5,960 levels in July 2011. This triggered a sharp sell-off towards 4,600 levels. Recovery took 6 months and by the end of 2011 SMI was back above the previously broken support level and the 200 day moving average. I think this was the most important technical action that put the index back to positive territory. Being able to push back above the long-term moving average and the resistance at 5,960 level helped the index to find firm ground.

In the past few months we have seen SMI consolidating above the trend support and the long-term moving average. Index is likely to challenge the resistance at 6,500 levels in the following weeks. Unless we see 5,960 level break down again, we should expect a positive trend.