S&P/CASE-SHILLER HOME PRICE INDEX

Source: S&P/Case-Shiller

Source: S&P/Case-Shiller

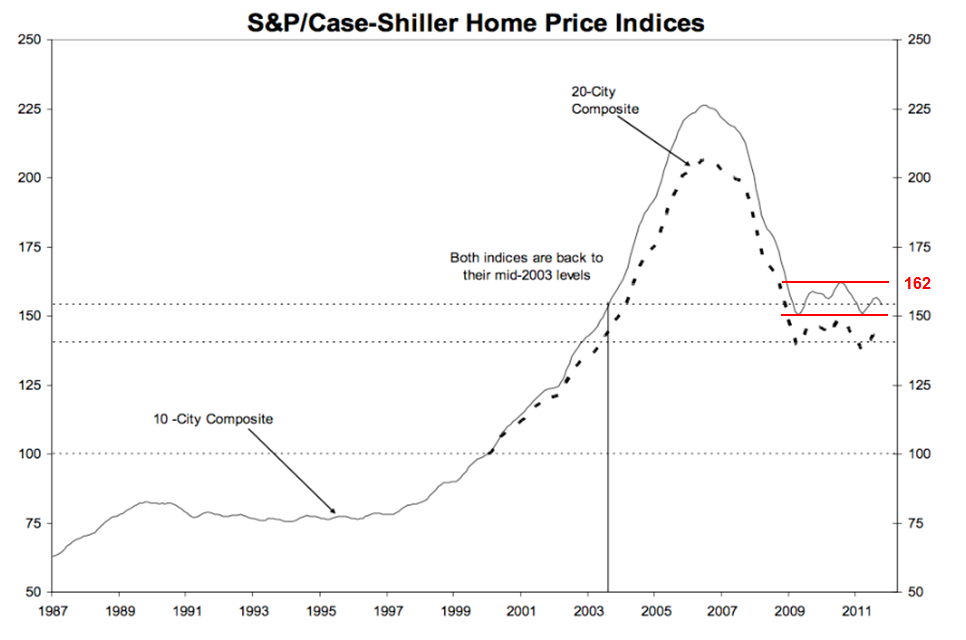

The S&P/Case-Shiller home price index tracks monthly changes in the value of residential real estate in 20 metropolitan regions across the U.S. The composite indexes and the regional indexes are seen by the markets as measuring changes in existing home prices and are based on single-family home re-sales. The key composite series tracked are for the expanded 20-city composite indexes. The original series (still available) covered 10 cities. A national index is published quarterly. The indexes are based on single-family dwellings with two or more sales transactions. Condominiums and co-ops are excluded as is new construction. The latest data are reported with a two-month lag.

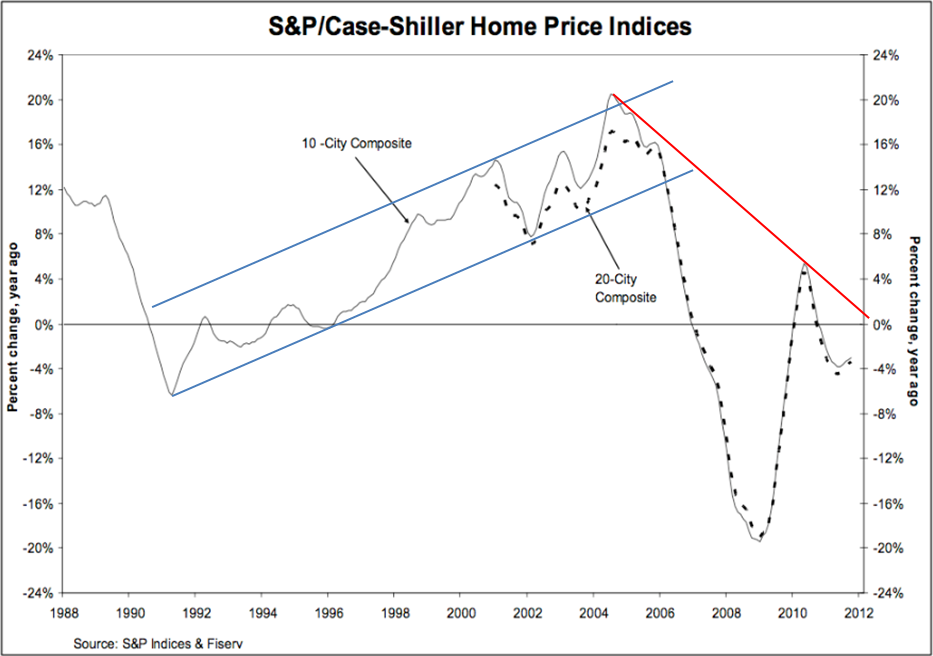

The two charts above show the S&P/Case-Shiller Home Price Index and the YoY change on the index. U.S. home prices fell ~1.2% respectively in October versus September, with 19 of 20 cities covered by the indices decreasing over the month. Year over year drops of the 10 and 20-City Composites fell -3.0% and -3.4% respectively versus October 2010.

Where do we go from here?

It is clear that the recovery in the housing market has been anemic and at best we have seen a stabilization but not a recovery or any sort of a sharp rebound. The index fell from 225 levels to 150 levels between 2007 and 2009 and recovered to 162 levels in 2010. In the same year YoY change moved to positive territory for the first time since 2007. However, in 2011 both the index and the YoY change failed to hold on to their recovery highs. S&P Case-Shiller Index fell back to 2009 lows and the YoY change fell back into negative territory.

We should closely watch two important levels on the home price index in 2012. 162 levels as resistance and 150 levels as support. A break above 162 levels can confirm the last 3 years stabilization as a base pattern and give a positive outlook for 2012-2014. A break below 150 levels can confirm the last 3 years stabilization as a continuation pattern and deepen the correction in the housing market.

YoY change should move above 0% to help the technical outlook to improve on the S&P/Case-Shiller Home Price Index.