GLOBAL EQUITY MARKETS – May 30, 2020

REVIEW

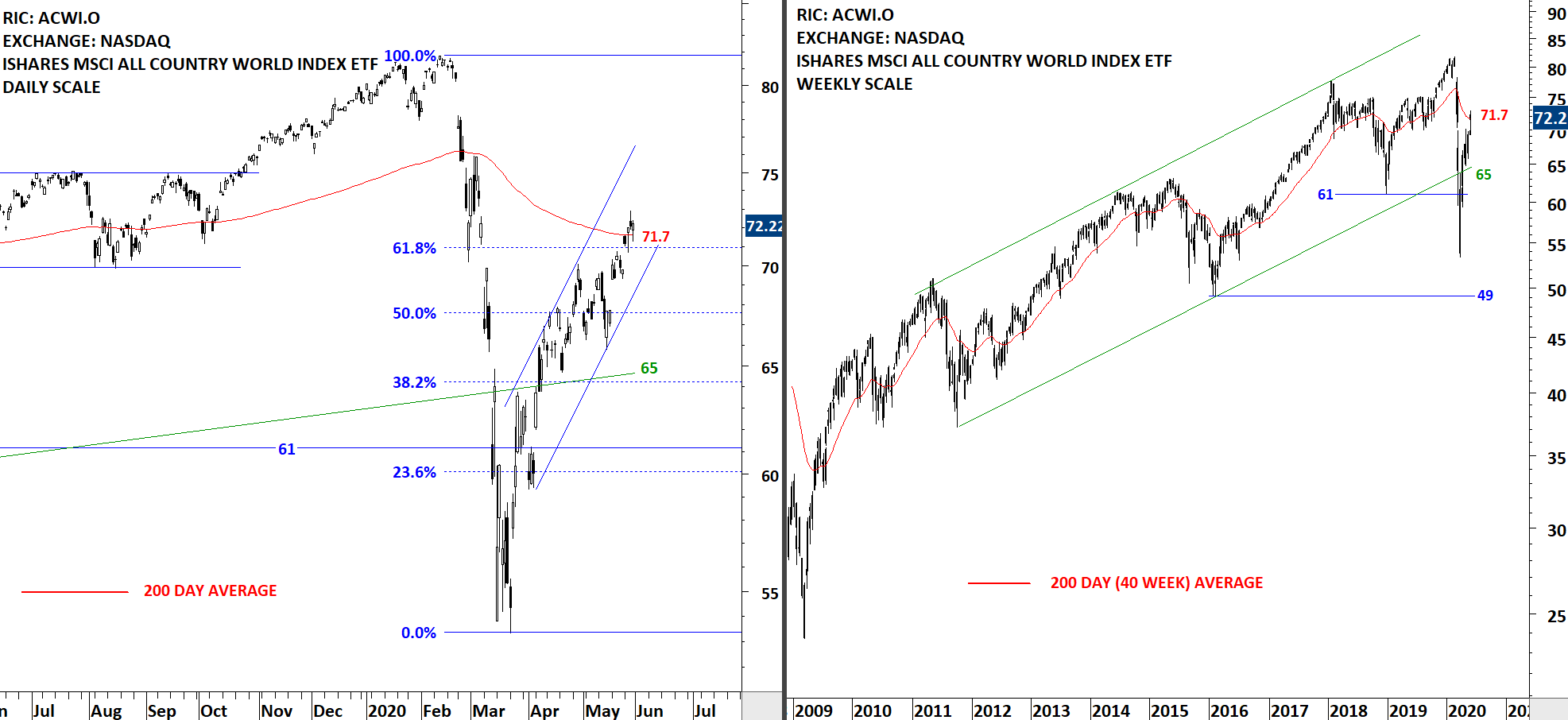

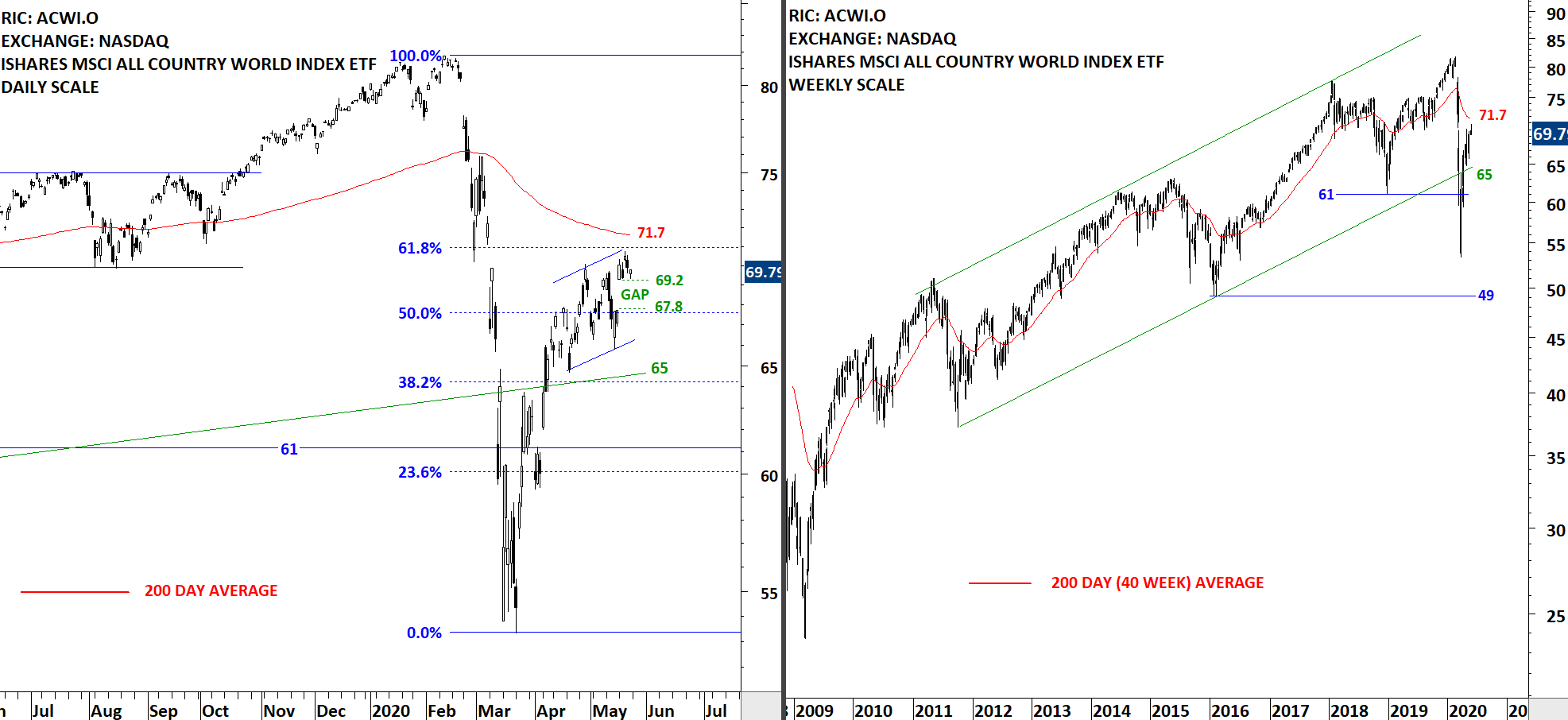

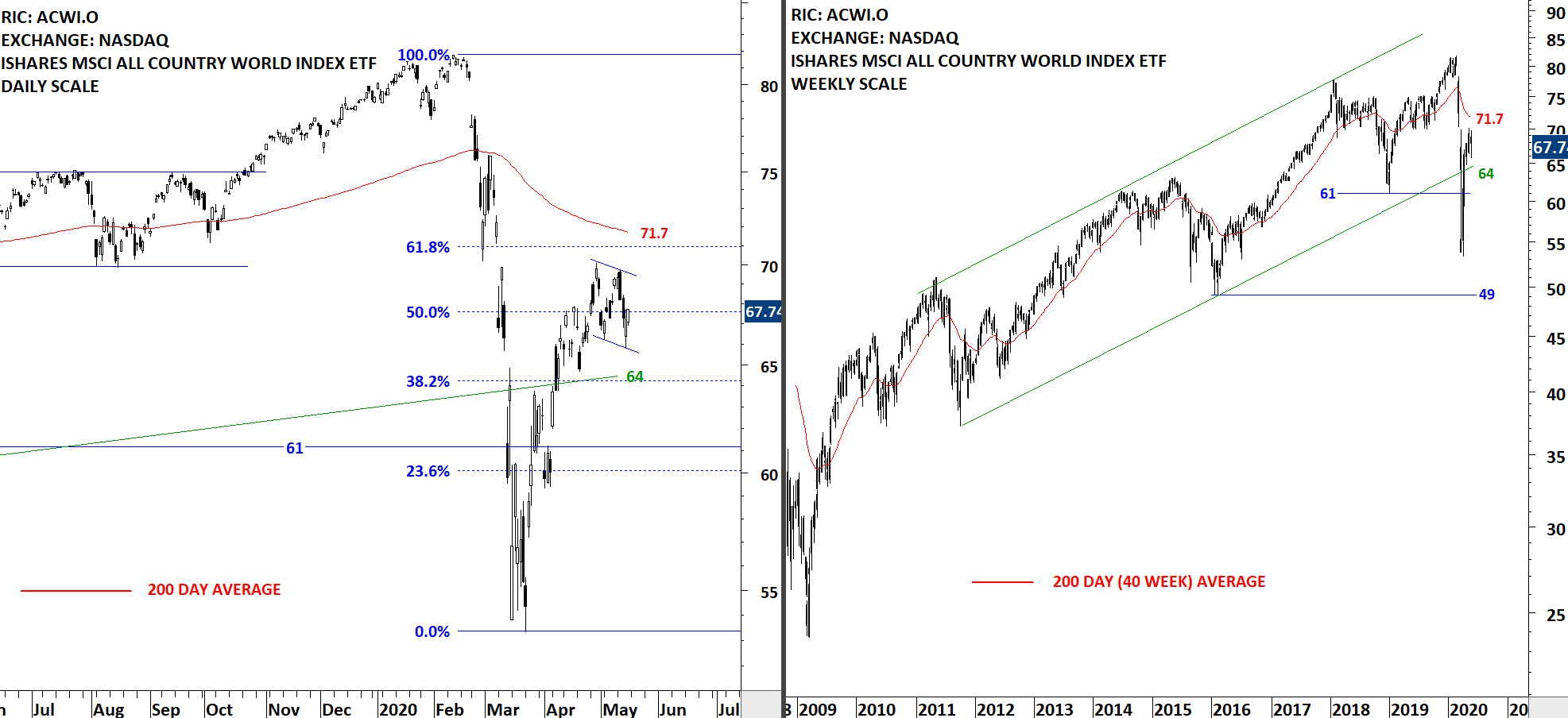

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is testing its 200-day moving average that is acting as resistance at 71.7 levels. Last two month's price action can be identified as a rising channel. Price can remain inside the trend channel. There is a gap opening between 69.2 and 67.8 levels which can be filled during a possible pullback.