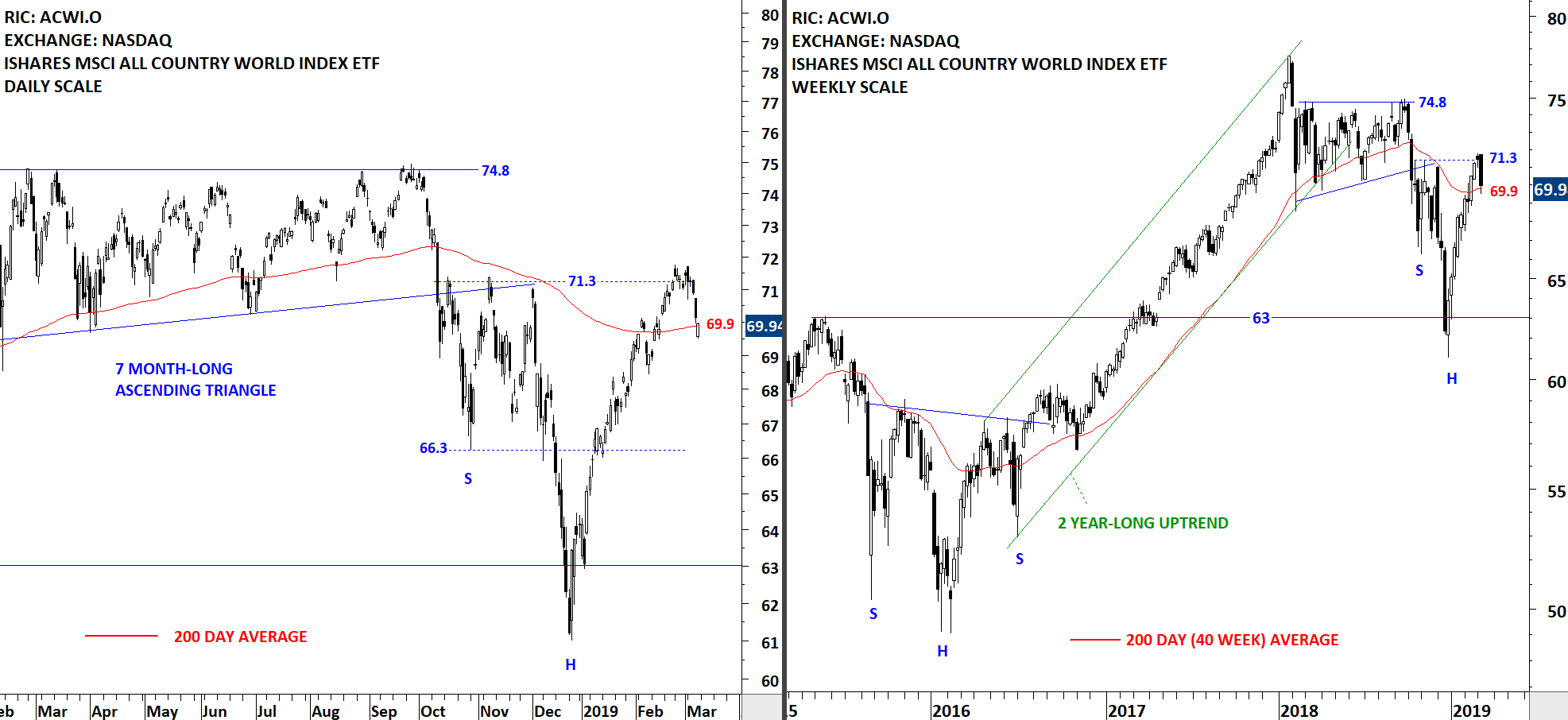

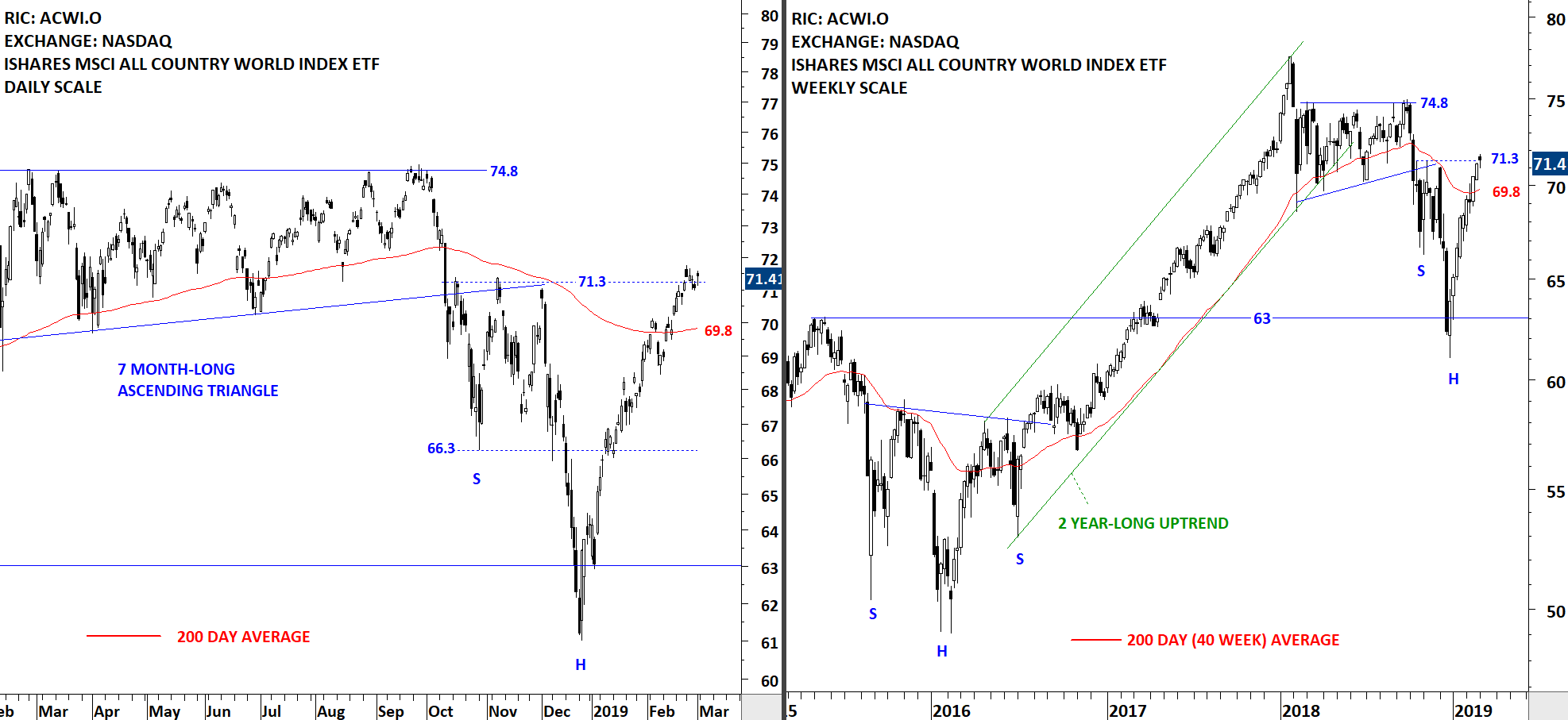

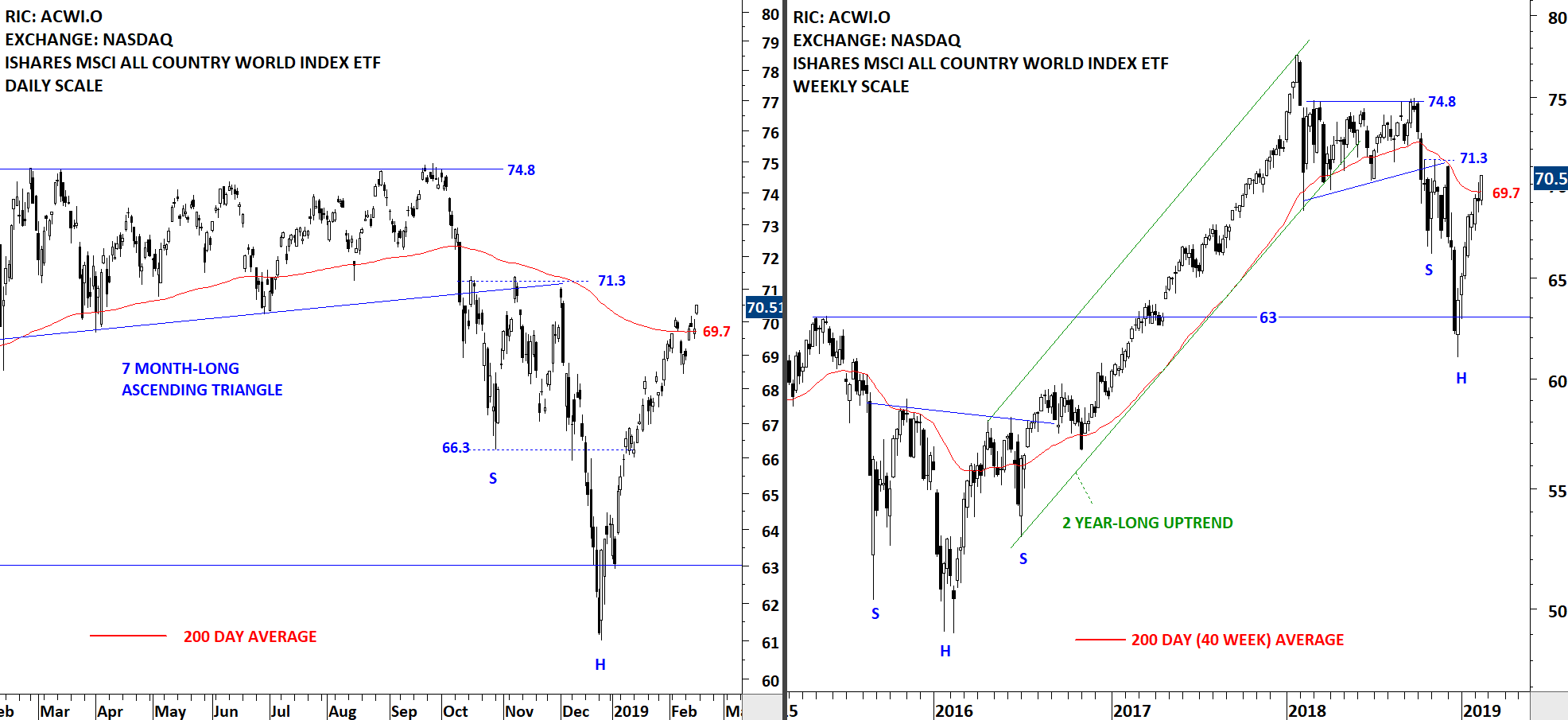

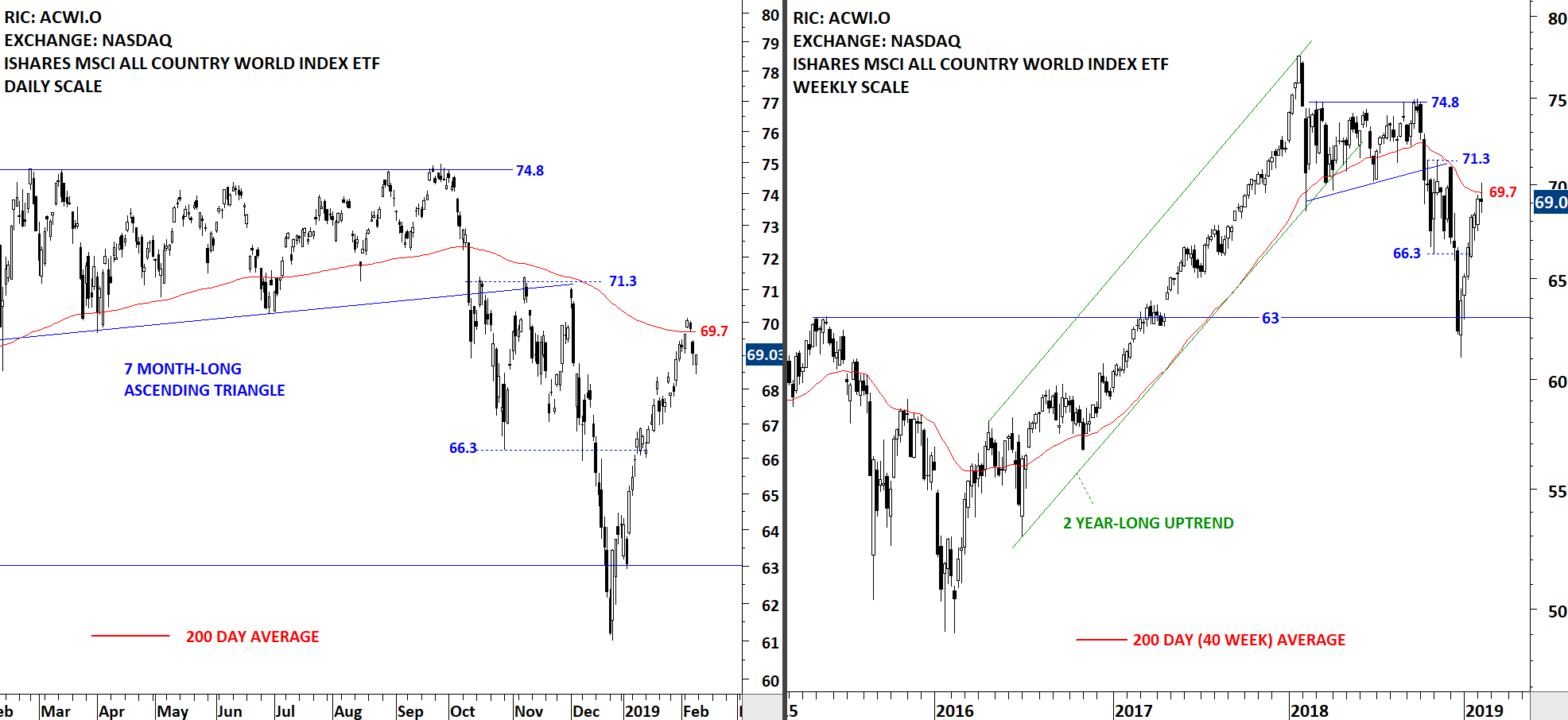

GLOBAL EQUITY MARKETS – March 16, 2019

REVIEW

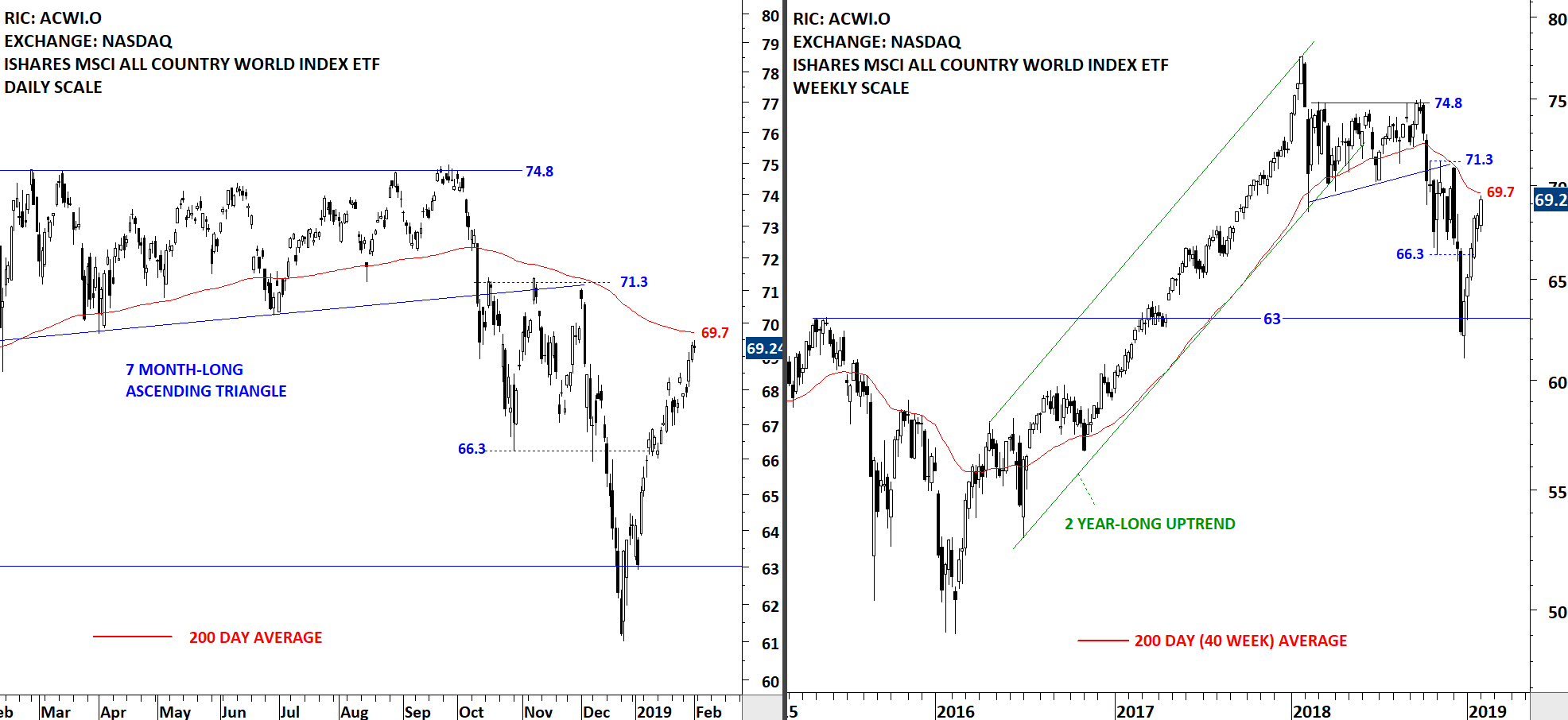

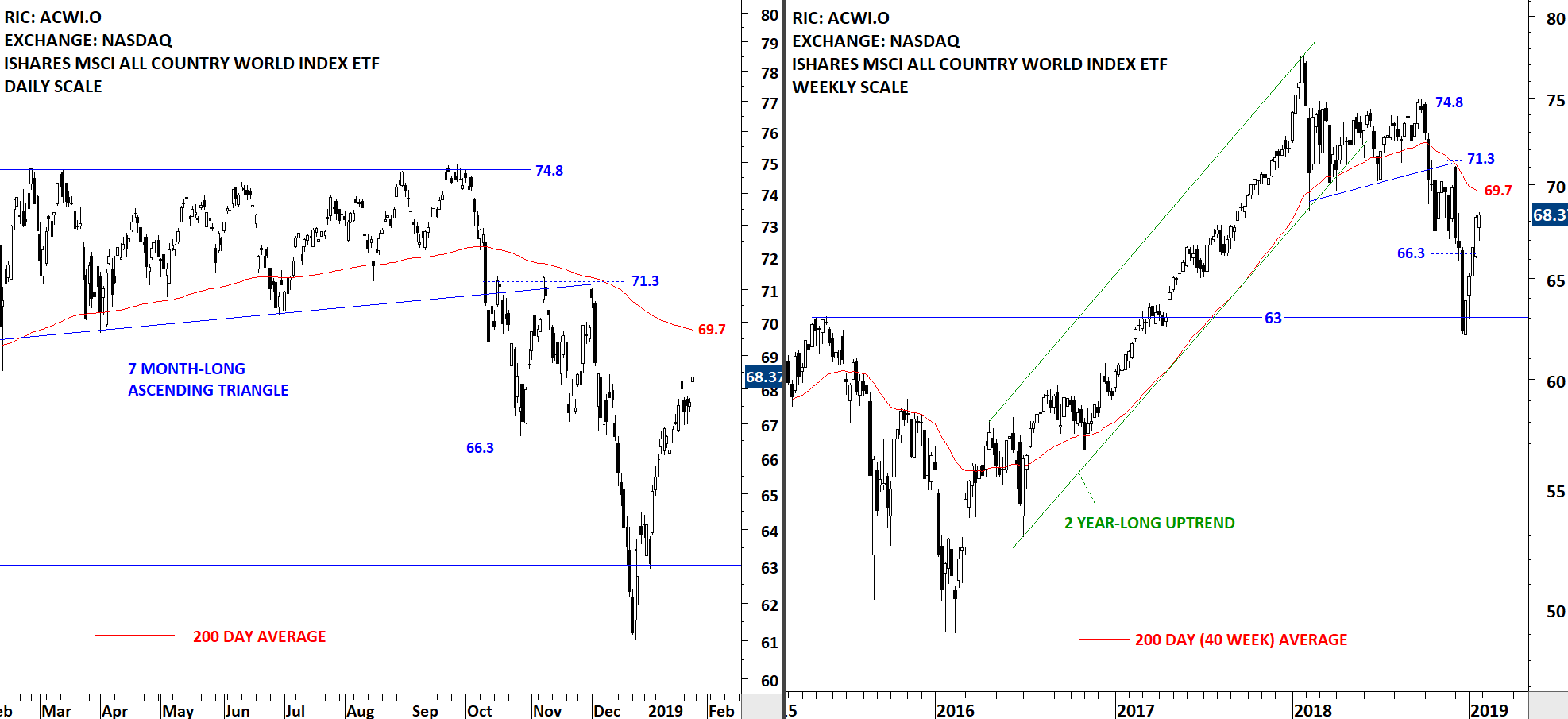

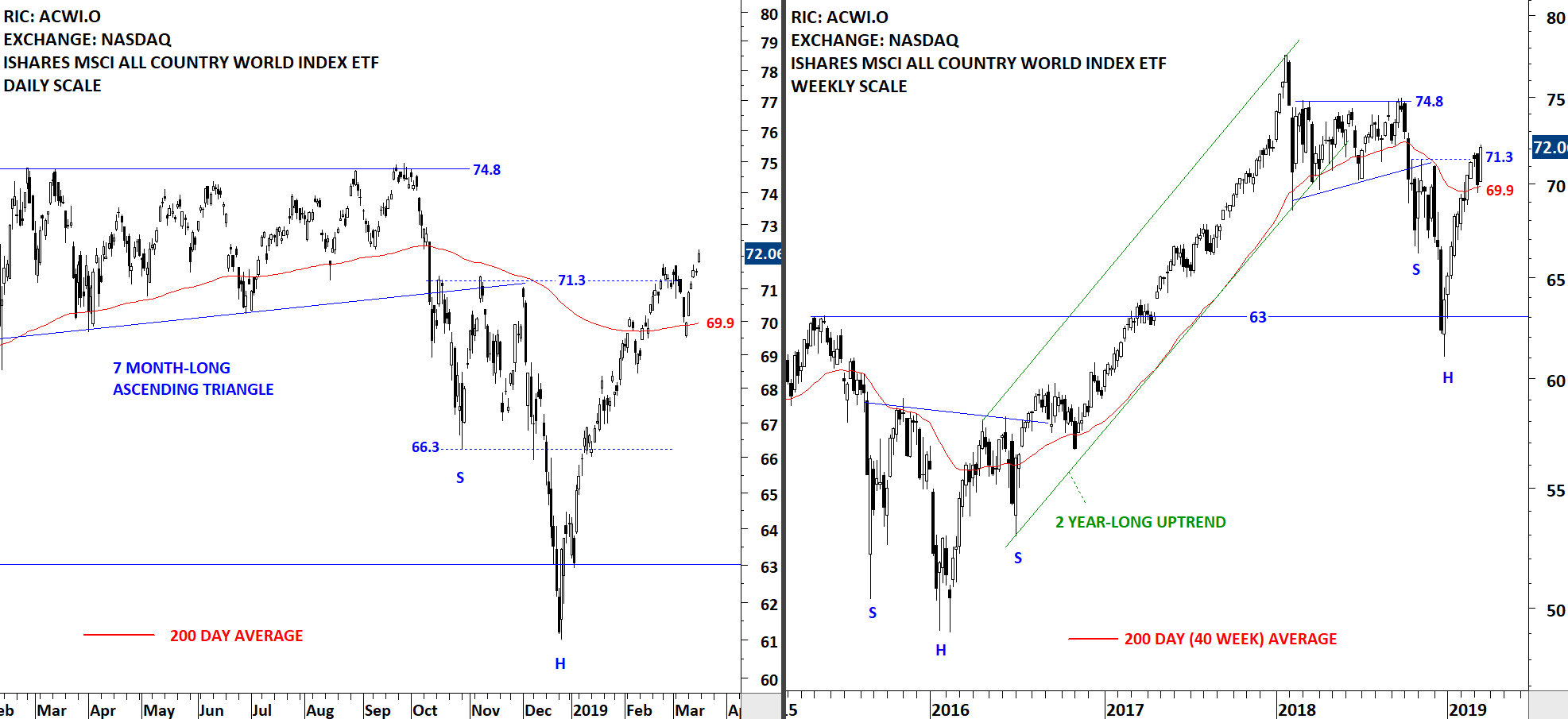

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) found support above its 200-day (40 week) average. Sharp V-reversal from the low of January 2019 didn't encounter a pullback/correction. I analyze the price action that manages to consolidate and find support above its long-term average as positive and review the ACWI ETF with a bullish bias. During any pullback or further sideways consolidation, the 200-day moving average at 69.9 levels will act as support.

Read More

Read More