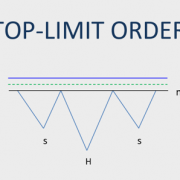

Stop-limit order and early entry

This content is for members only

GLOBAL EQUITY MARKETS – February 25, 2023

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) failed to hold above the neckline of the possible H&S continuation chart pattern at 90.1 levels. The ETF also close below its 200-day average, though it is still not conclusive if price broke down the long-term average or not. Failure to quickly recover above 88.64-90.1 area can result in a change in trend and suggest lower prices in the coming weeks.

Read More

Read MoreCRYPTOCURRENCIES – February 19, 2023

Several cryptocurrency pairs have rebounded from oversold levels and many more are forming possible bottom reversal chart patterns. In this update I discuss possibilities of bottom reversals in those pairs. Read More