CRYPTOCURRENCIES – April 2, 2023

Cryptocurrency markets are taking their time to accelerate/start new trends.

GLOBAL EQUITY MARKETS – April 1, 2023

REVIEW

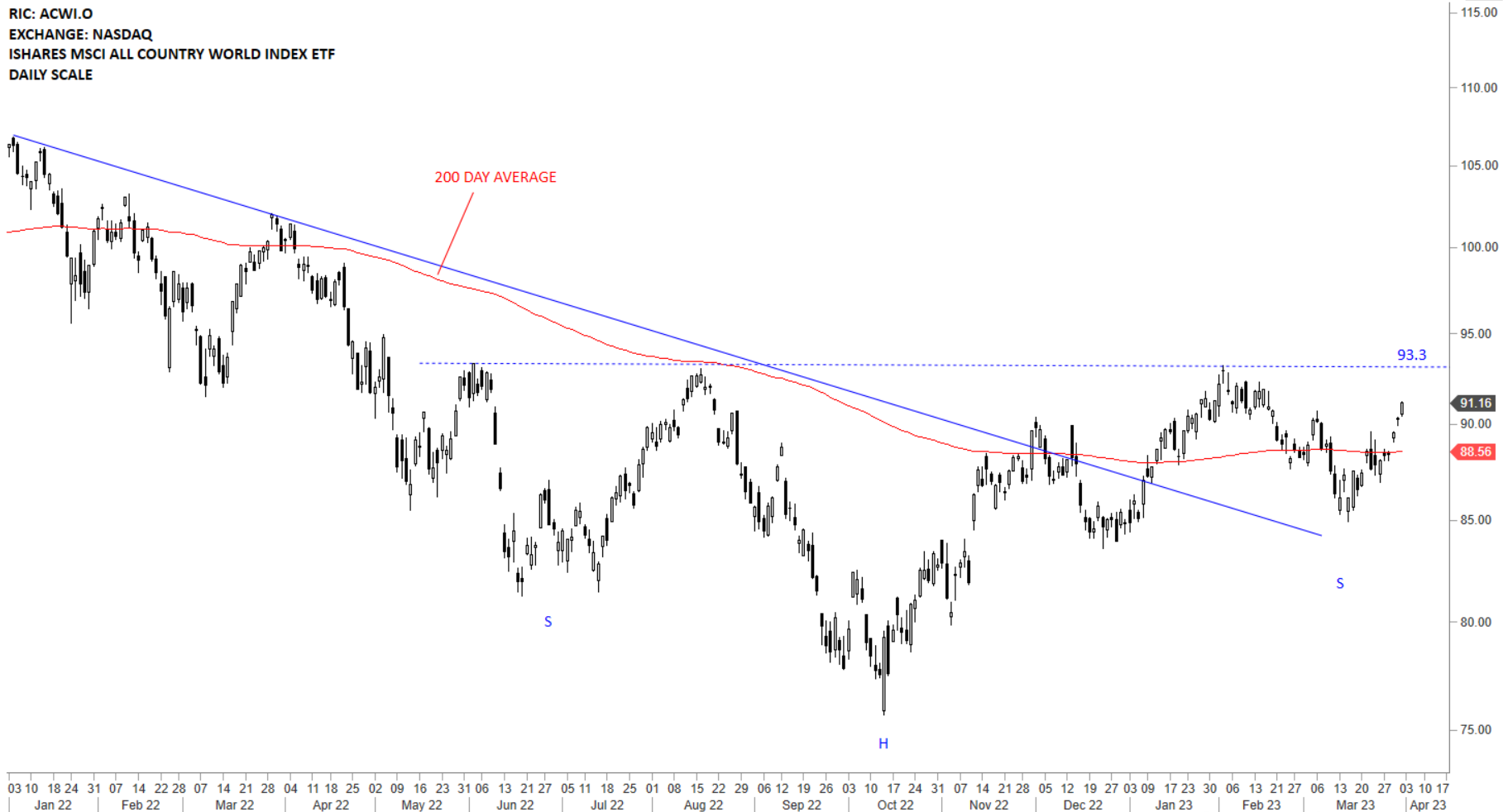

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is looking for direction. So far price action has been volatile around the 200-day average. After this week's strong rally above the 200-day average, I'm weighing the possibility of a large scale H&S bottom reversal with the neckline standing at 93.3 levels. The ETF might be completing the right shoulder of a multi-month long H&S bottom reversal.

Read More

Read MoreLive Webinar and Q&A with Aksel – Wednesday, March 29, 8:30 am mountain

Dear Tech Charts Members,

We are continuing our Member webinar series with chart pattern reliability and how the latest market conditions have impacted success rates on different chart patterns. We plan to have an interactive session and an open discussion to answer members' questions on different markets and specific charts of interest. Please send your charts and questions to aksel@techcharts.net, and I will add them to the webinar discussion points.

Scheduled for: Wednesday, March 29, 8:30 am mountain (register below)

Read More