CRYPTOCURRENCIES – February 18, 2024

BTCUSD reached the upper boundary of trend channel once again this time at 52K which is acting as a valid resistance. Breakout above the upper boundary of a rising trend channel can start a runaway price movement towards 65K. ETHUSD cleared the upper boundary of the possible rising wedge, held the support level and now accelerating the uptrend. Read More

GLOBAL EQUITY MARKETS – February 17, 2024

REVIEW

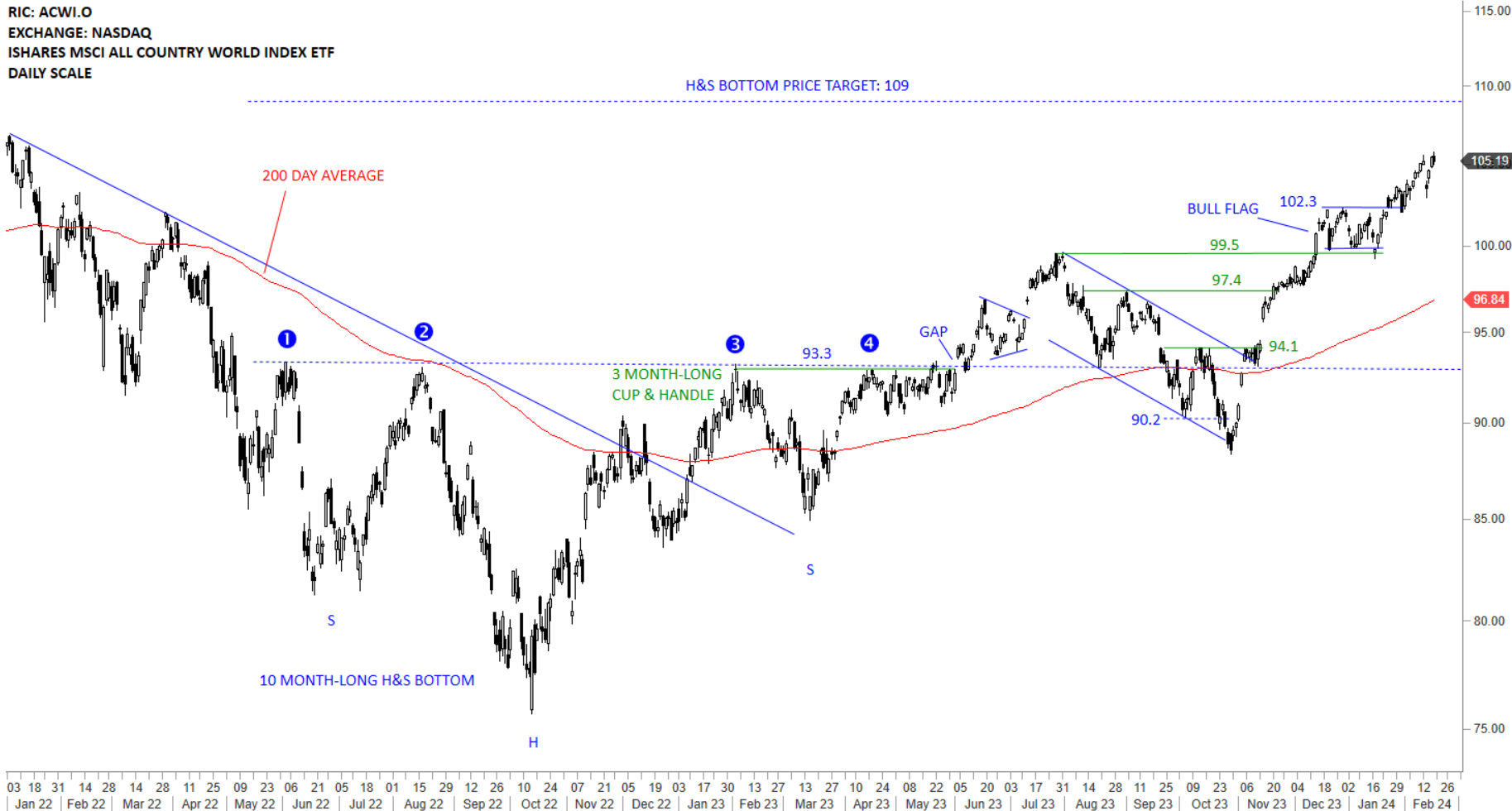

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is clearly above its 200-day average and in a steady uptrend. Long-term H&S bottom price target stands at 109 levels. The upper boundary of the flag at 102.3 will act as short-term support during any pullback. The ETF had a volatile week with a gap open lower followed by a sharp rebound to test the minor high at 105.6 levels. Short-term setbacks are part of a steady uptrend.

Read More

Read MoreINTERIM UPDATE – February 16, 2024

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop up during the week and is worth bringing to your attention before the week finalizes. Below are the latest additions to Tech Charts watchlist. These charts will also be included in the weekly update.

Read More