CRYPTOCURRENCIES – March 3, 2024

BTCUSD cleared the upper boundary of trend channel and once again tested the 65K resistance. Breakout above the upper boundary of a rising trend channel started a runaway price movement towards 65K. ETHUSD cleared the upper boundary of the possible rising wedge, held the support level and now accelerating the uptrend with long back to back white candles. Read More

GLOBAL EQUITY MARKETS – March 2, 2024

REVIEW

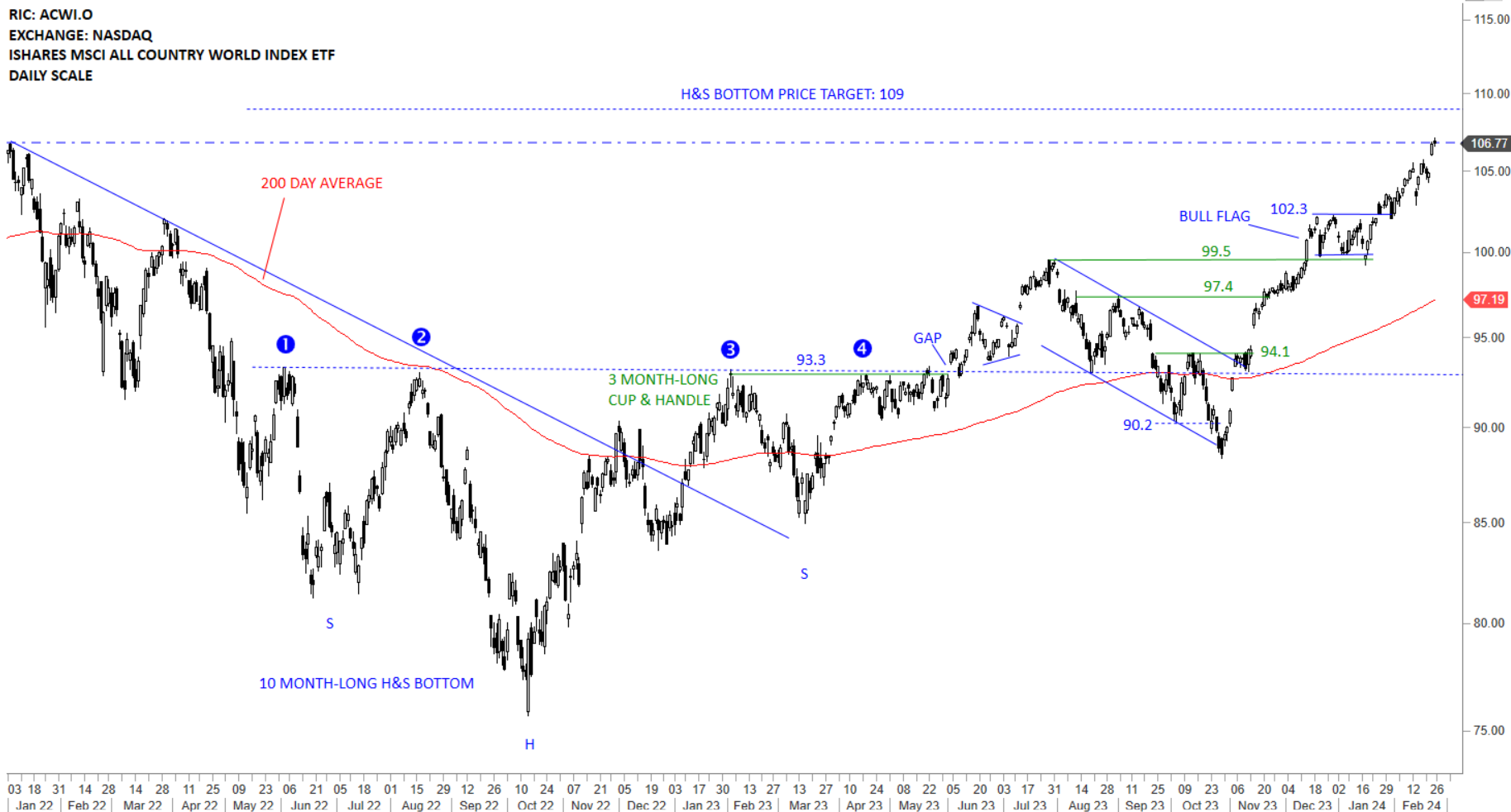

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is trending towards the long-term H&S bottom price target at 109 levels. The ETF earlier completed a bullish flag which has helped the uptrend resume higher. Global Equity benchmark is now getting closer to a resistance area. 106.8-109 area can act as resistance and pause the existing uptrend. There is no top reversal chart pattern at this stage.

GLOBAL EQUITY MARKETS – February 24, 2024

REVIEW

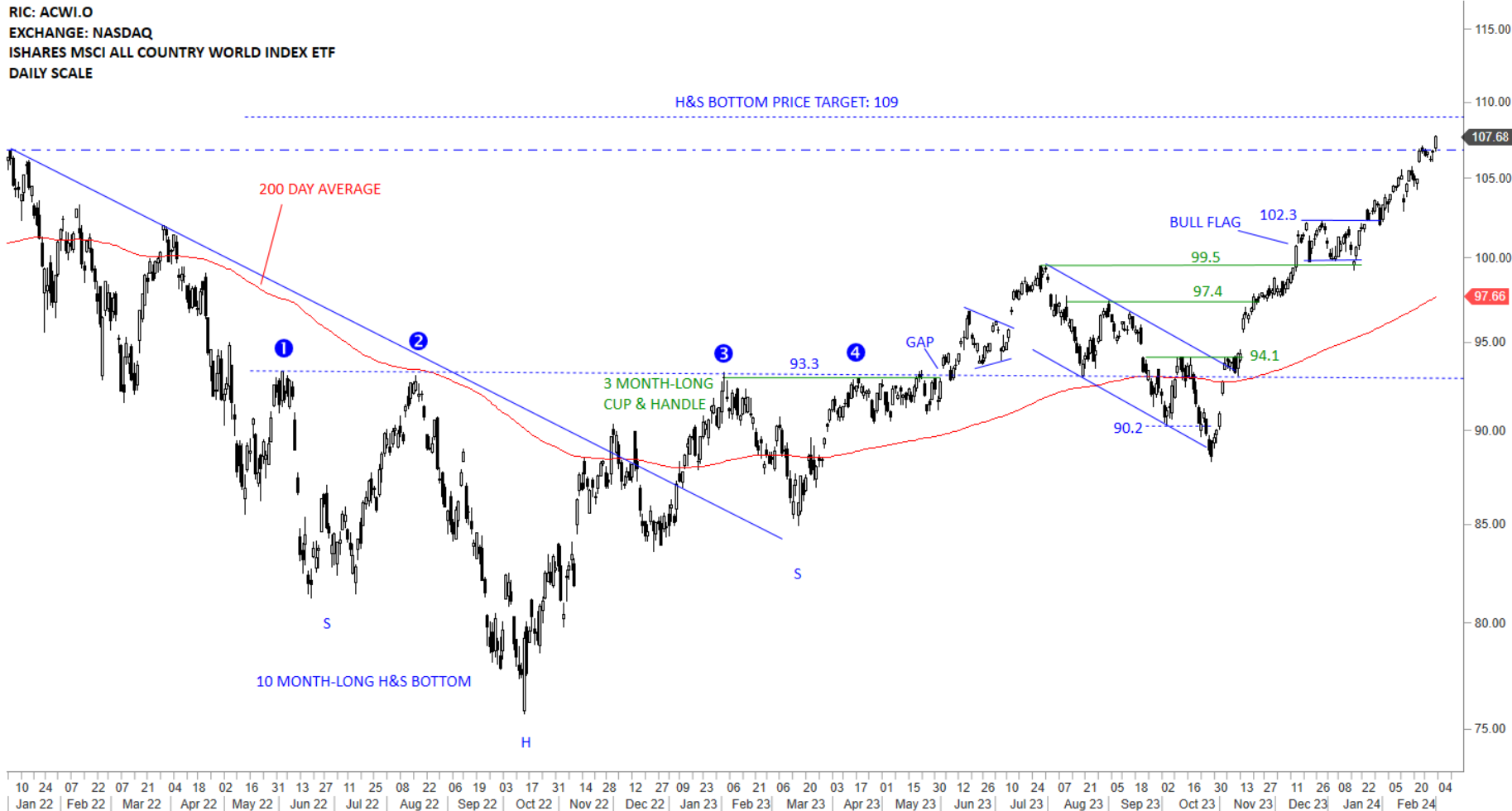

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is trending towards the long-term H&S bottom price target at 109 levels. The ETF earlier completed a bullish flag which has helped the uptrend resume higher. Global Equity benchmark is now getting closer to a resistance area. 106.8-109 area can act as resistance and pause the existing uptrend. There is no top reversal chart pattern at this stage.