GLOBAL EQUITY MARKETS – April 27, 2024

REVIEW

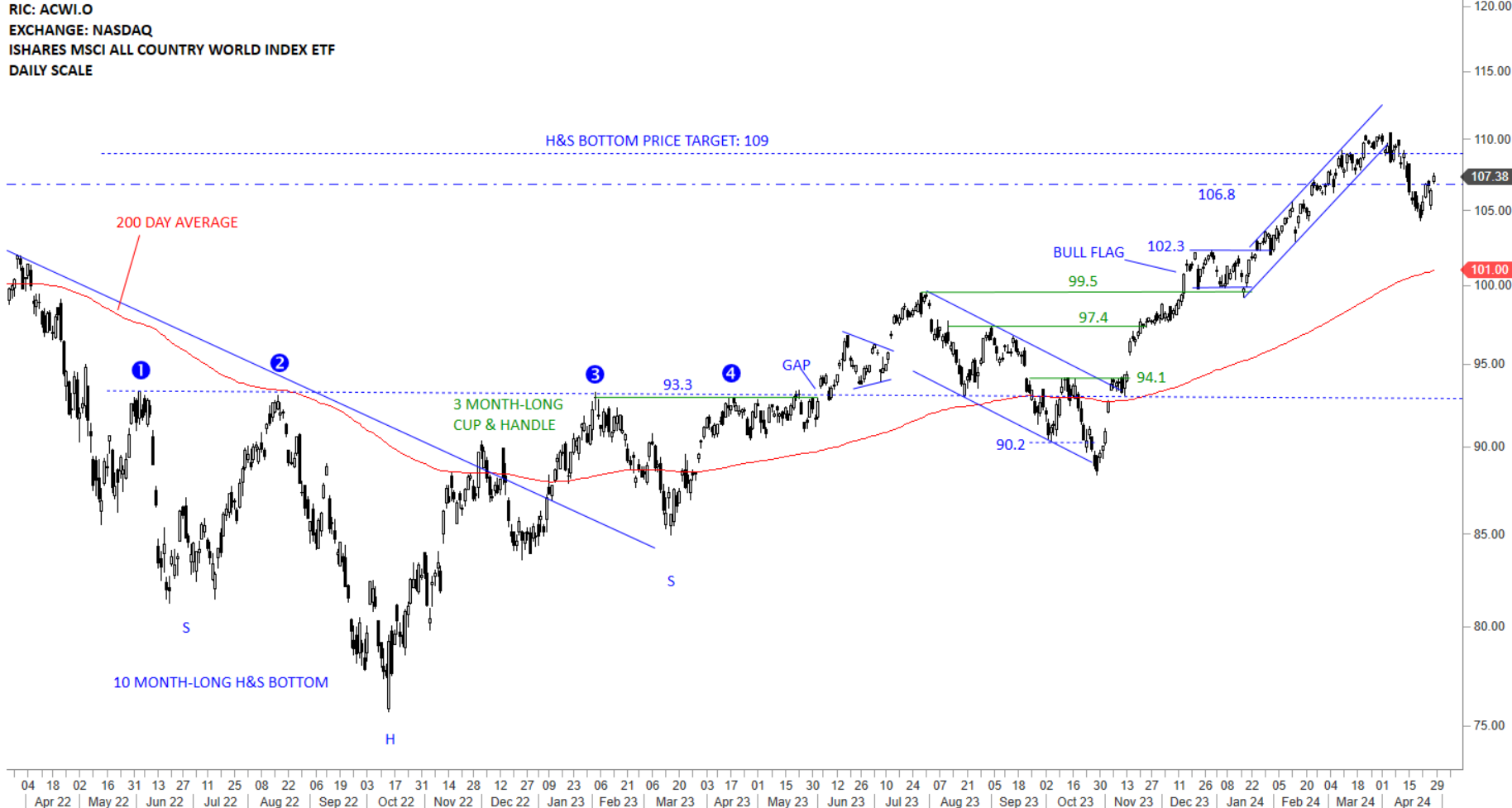

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. The ETF earlier completed a bullish flag which has helped the uptrend resume higher. The ETF breached the lower boundary of the short-term uptrend and this is now resulting a pullback towards the support area between 106.8-102.3. Price is clearly above the long-term average and the uptrend is intact. Much deeper correction can target the 200-day average at 101 levels. Since October 2023, the index had a strong run and it is totally normal to see consolidation of earlier gains towards the long-term average.

Read More

Read MoreGLOBAL EQUITY MARKETS – April 20, 2024

REVIEW

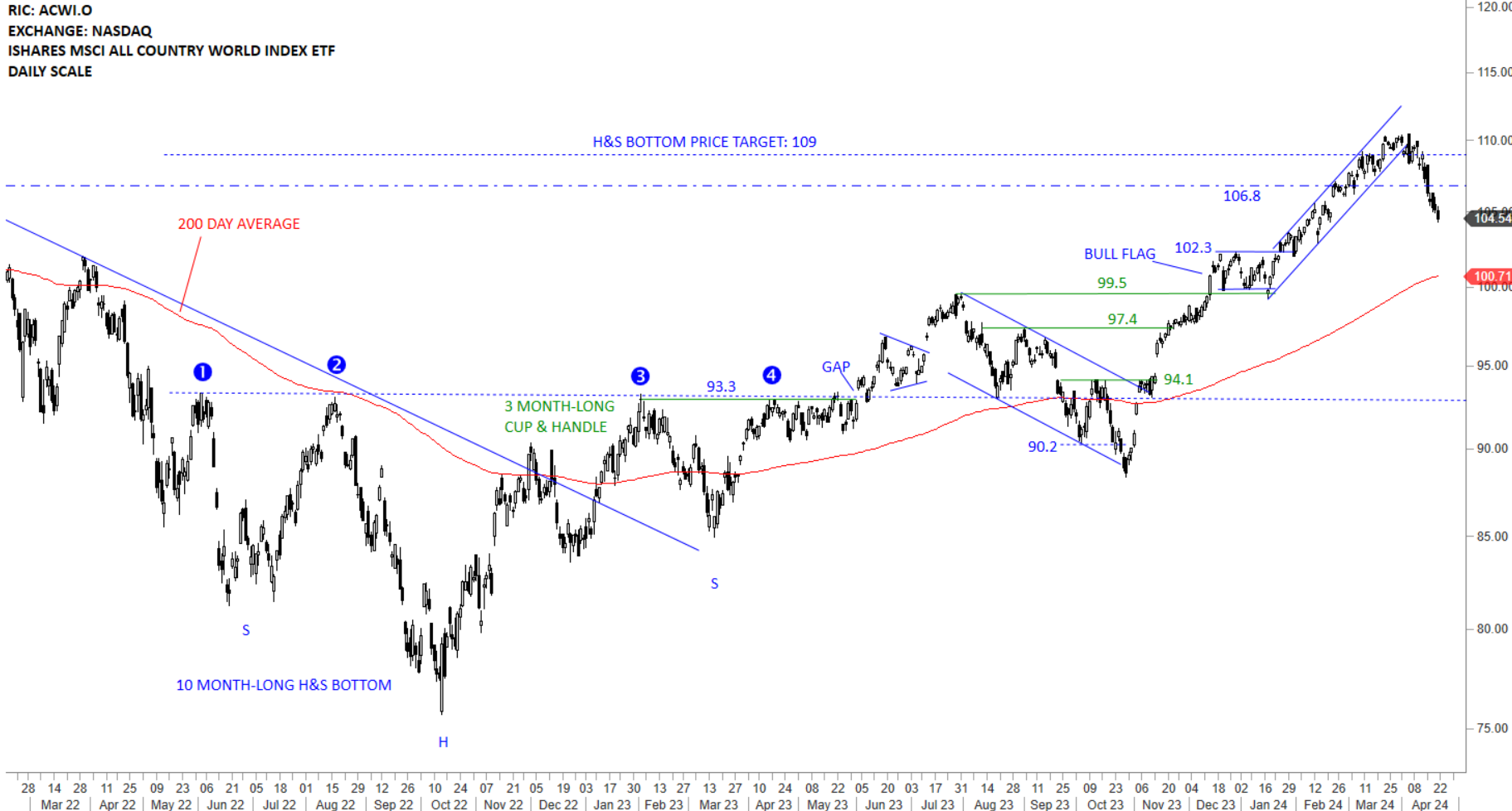

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. The ETF earlier completed a bullish flag which has helped the uptrend resume higher. The ETF breached the lower boundary of the short-term uptrend and this is now resulting a pullback towards the support area between 106.8-102.3. Price is clearly above the long-term average and the uptrend is intact. Much deeper correction can target the 200-day average at 100.47 levels. Since October 2023, the index had a strong run and it is totally normal to see consolidation of earlier gains towards the long-term average.

Read More

Read MoreINTERIM UPDATE – April 18, 2024

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop up during the week and is worth bringing to your attention before the week finalizes. Below are the latest additions to Tech Charts watchlist from China equities. Given the bullish outlook on the SSE50 benchmark, I think it is worth paying attention to individual names. These charts will also be included in the weekly update.

Read More