Tech Charts Year in Review with Aksel – Thursday, May 16th, 830 am mountain

- A study on Chart Pattern Reliability with the available sample data over the past year.

- H&S continuation has been the most reliable chart pattern over the past year. Rectangle continued to be in the top 3 reliable chart patterns.

- Detailed statistics on different types of breakouts.

- The impact of different market cycles on chart pattern opportunities.

- Live Q&A

CRYPTOCURRENCIES – May 12, 2024

BTCUSD is consolidating earlier gains below the strong resistance area between 65K - 68K. Breakout above the upper boundary of a rising trend channel started a runaway price movement towards the resistance area. 60K continues to be an important support and an inflection point. ETHUSD is weaker and challenging the support level around 2,800 levels. ETHBTC chart can move in favor of BTC. Monitoring the pair for the month of May close. Read More

GLOBAL EQUITY MARKETS – May 11, 2024

REVIEW

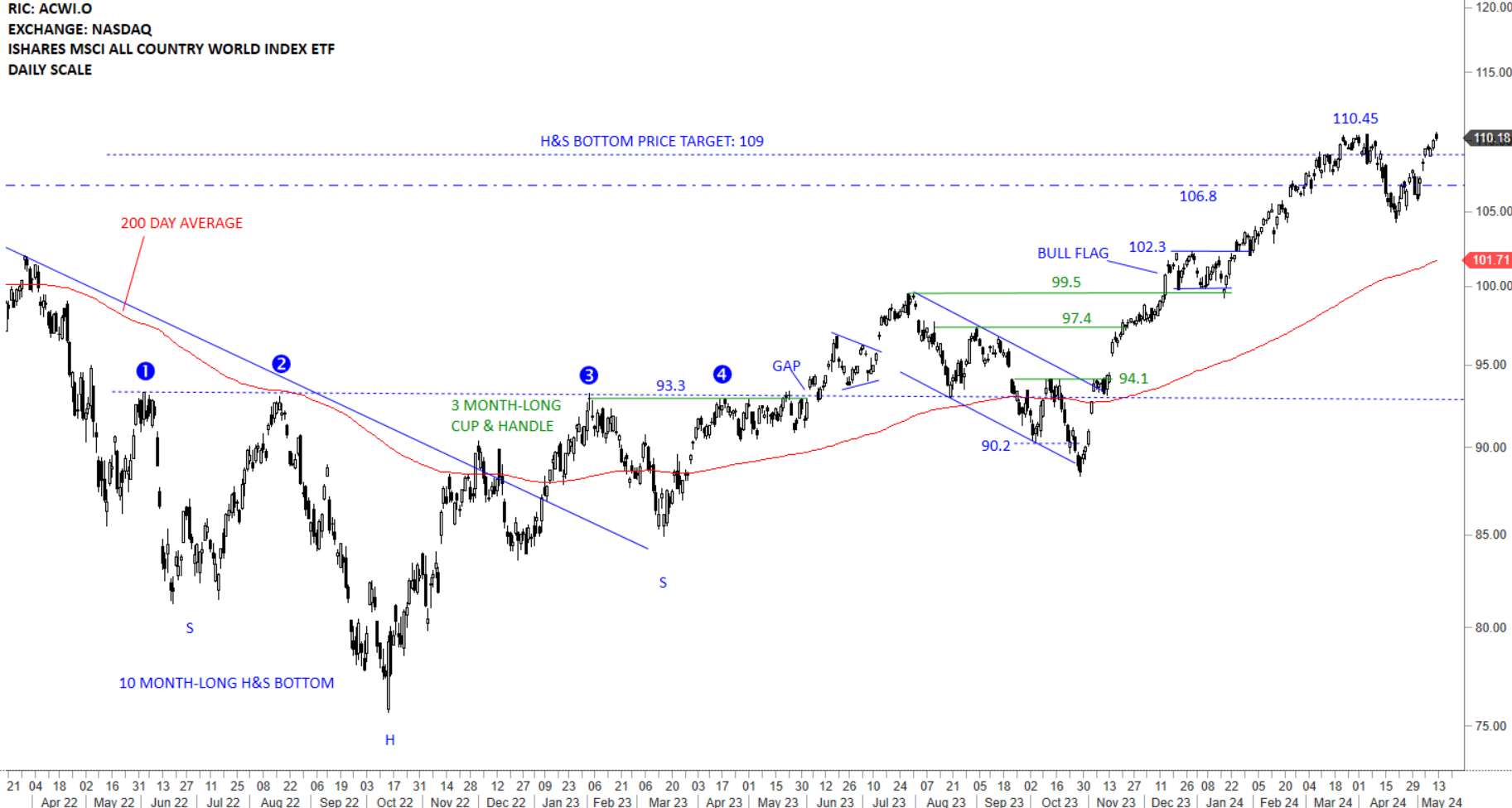

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. Price is clearly above the long-term average and the uptrend is intact. The ETF is testing its minor high at 110.45 levels which can act as short-term resistance. Since October 2023, the index had a strong run and it is totally normal to see consolidation of earlier gains above the long-term average. If the minor high acts as resistance, I will expect a wide consolidation between 105 and 110.45 levels.

Read More

Read More