Tech Charts Year in Review – Year Seven, May 2024 Webinar

- A study on Chart Pattern Reliability with the available sample data over the past year.

- H&S continuation has been the most reliable chart pattern over the past year. Rectangle continued to be in the top 3 reliable chart patterns.

- Detailed statistics on different types of breakouts.

- The impact of different market cycles on chart pattern opportunities.

- Live Q&A

- Do you always use Log scale? Or, in some cases, use regular? 42:40

- So, if you want to be aggressive in looking for Type 1 & Type 2 breakout, you have a stop width of 3% (confirmation level minus pattern boundary), right? 43:26

- Would you recommend going long at the lower support level of a rectangular pattern (assuming we are in a bull market) to capture first the move to the resistance level and then the breakout? 44:47 (Rectangle - Trading Range-Bound Price Action & Candlestick Patterns at Support and Resistance)

- Given the large monthly pattern, how would you set trailing stops for $GOLD / $SILVER? 46:11 (ATR Trailing Stop-Loss - H&S Top)

- Is Type 3 based on closing price or intraday? 47:15

- Do you ever use price-relative charts for equities? If not, why? 48:13

- How do you manage entries during the earning season? Do you skip patterns when earnings are in the next x days? 48:47

- Can the success rate of cart pattern breakouts be improved by incorporating volume? 49:13

- When calculating ATR Trailing Stop Loss, how many periods do you use to calculate the ATR? 51:27

- Do you ever add to a trade when you realize it is Type 1? 52:39

- How much leeway can you give when drawing the horizontal boundary? You don't negate the pattern if it goes slightly over the boundary or slightly below the lower boundary. Is it subjective, or is it a specific rule? 53:12

GLOBAL EQUITY MARKETS – May 18, 2024

REVIEW

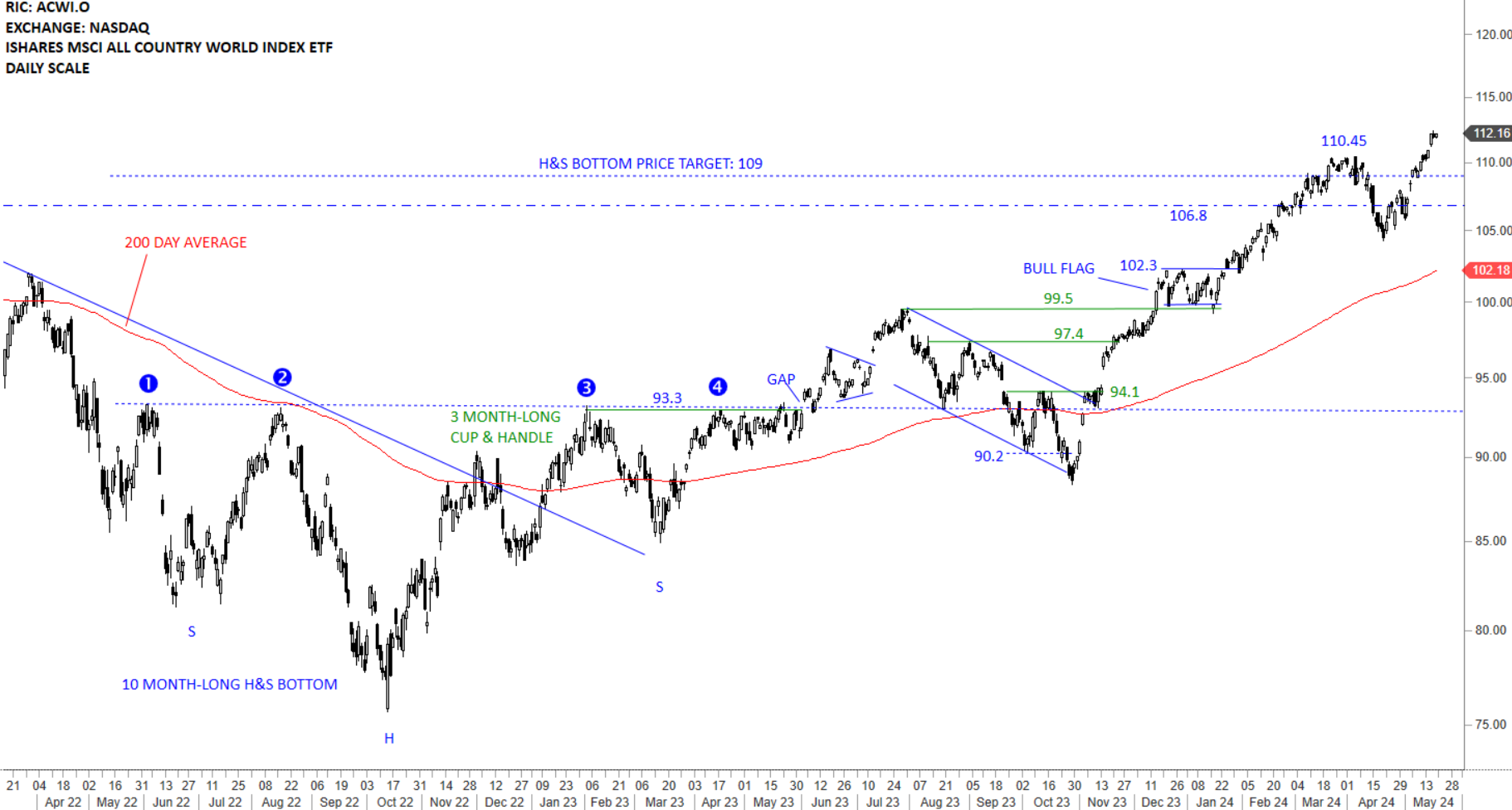

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. Price is clearly above the long-term average and the uptrend is intact. The ETF with this week's strength breached its minor high at 110.45 levels. 110.45 levels becomes the short-term support. A wider support area is between 106.8 and 110.45 levels. There is no top reversal chart pattern on daily or weekly scale price charts.

Read More

Read MoreINTERIM UPDATE – May 15, 2024

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop up during the week and is worth bringing to your attention before the week finalizes. Below are the latest additions to Tech Charts watchlist from different regions in single equities. These charts will be covered in the weekly report as well.

Read More