CRYPTOCURRENCIES – June 23, 2024

BTCUSD is consolidating earlier gains below the strong resistance area between 65K - 68K. Breakout above the upper boundary of a rising trend channel started a runaway price movement towards the resistance area. 60K continues to be an important support and an inflection point. ETHUSD had a sharp rebound from 2,800 levels and kept the uptrend intact. Price might be forming a possible cup & handle continuation. ETHBTC chart rebounded from strong support area. Strong monthly close in May kept the trading range between 0.05 and 0.08 levels. Read More

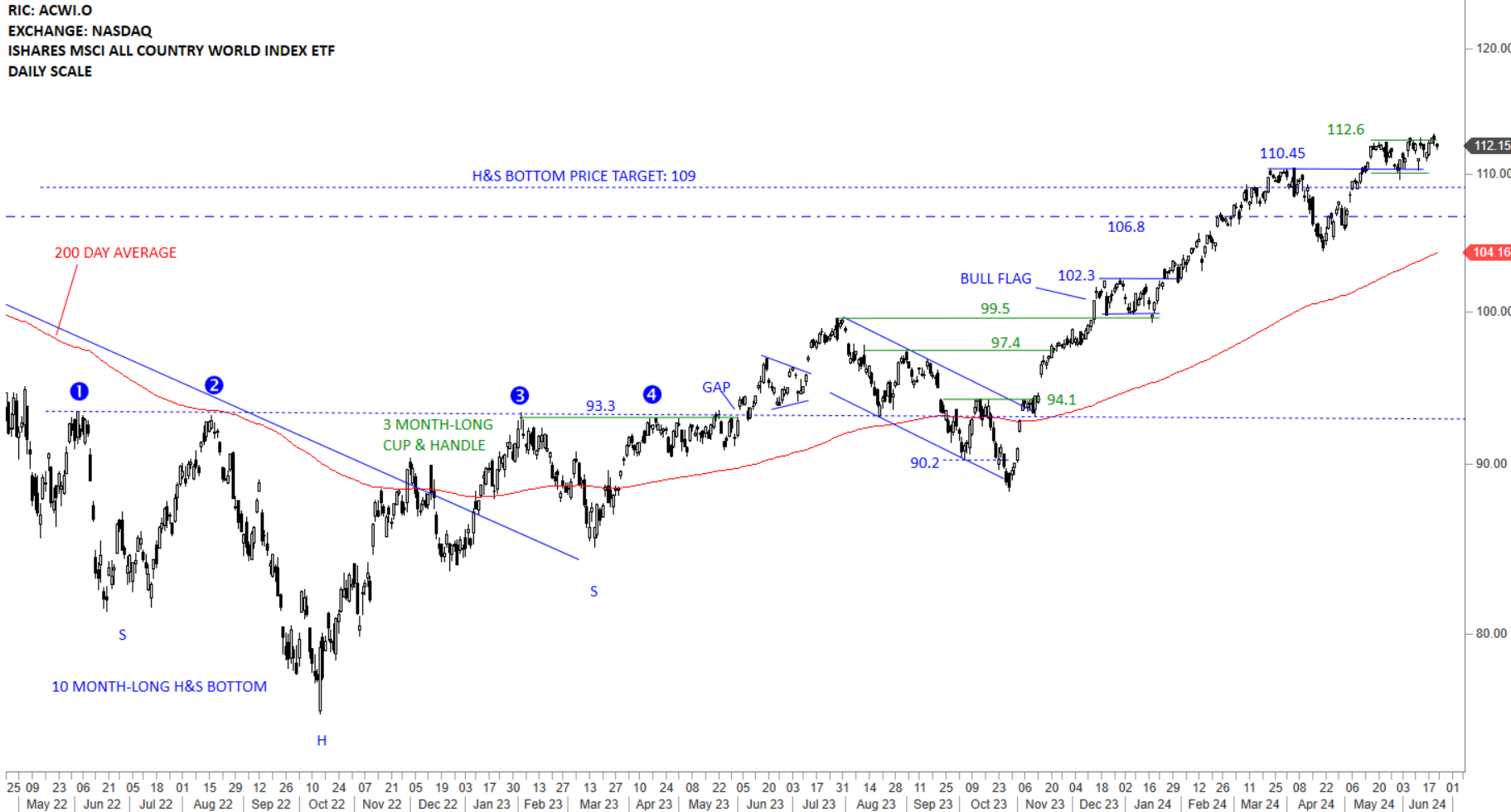

GLOBAL EQUITY MARKETS – June 22, 2024

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. Price is clearly above the long-term average and the uptrend is intact. 110.45 levels becomes the short-term support. A wider support area is between 106.8 and 110.45 levels. There is a possibility of a one month-long bullish flag forming between 110.45 and 112.6 levels. Breakout can resume the uptrend. Failure to hold above 110.45 levels can result in a pullback towards the 200-day average around 104.16 levels. Bullish flag price target is around 120 levels.

Read More

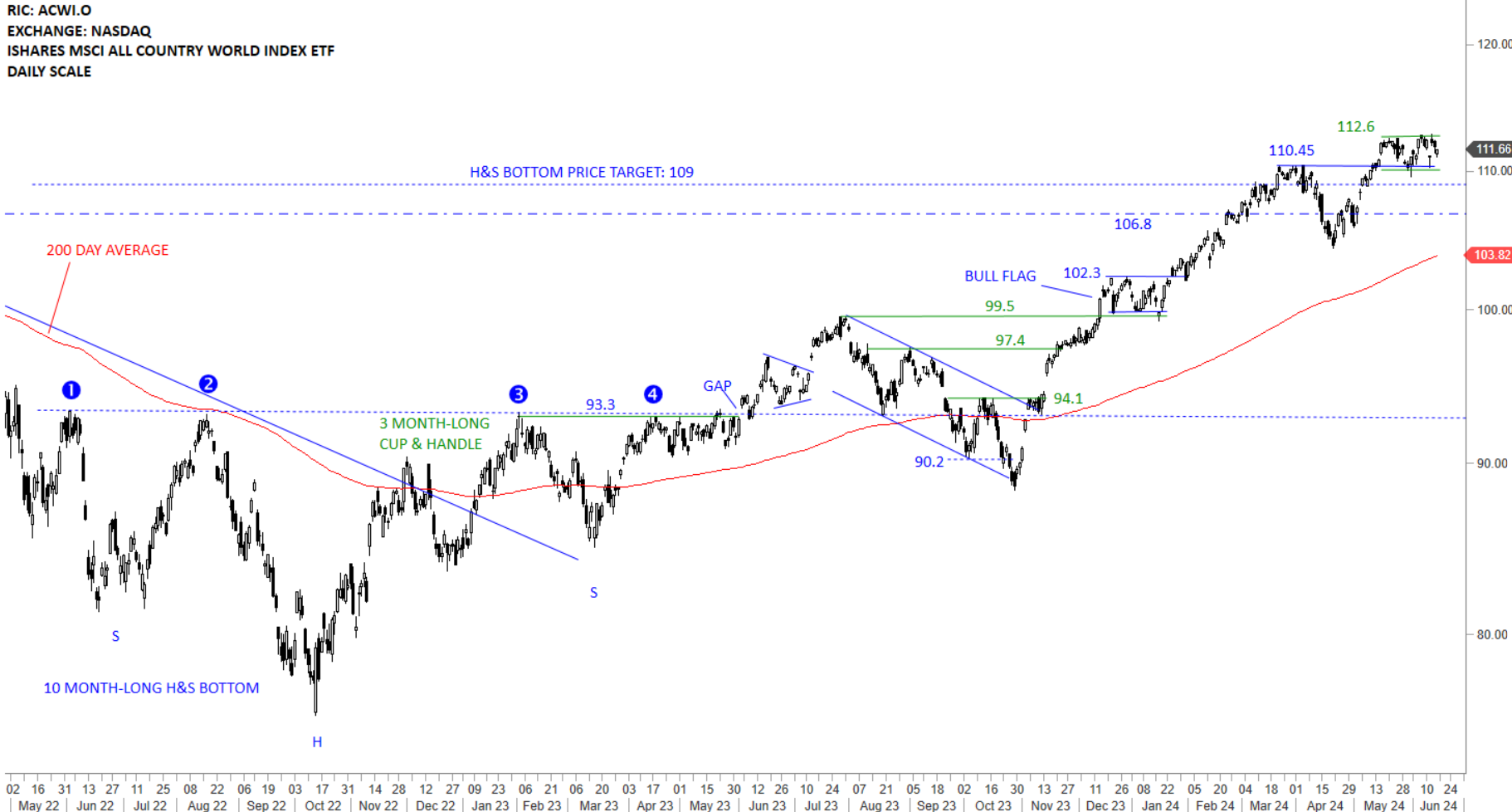

Read MoreGLOBAL EQUITY MARKETS – June 15, 2024

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. Price is clearly above the long-term average and the uptrend is intact. The ETF re-tested and rebounded from its minor high at 110.45 levels. 110.45 levels becomes the short-term support. A wider support area is between 106.8 and 110.45 levels. There is a possibility of a one month-long bullish flag forming between 110.45 and 112.6 levels. Breakout can resume the uptrend. Failure to hold above 110.45 levels can result in a pullback towards the 200-day average around 103.82 levels.

Read More

Read More