CRYPTOCURRENCIES – August 4, 2024

BTCUSD quickly recovered above 60K. Emphasizing the importance of focusing on the longer-term uptrend. Price is still above the year-long average and should be considered to be in an uptrend. ETHUSD re-tests the support at 2,800 levels. Possible rectangle with both boundaries well-defined. ETHBTC chart is challenging strong support area. While the long-term trading range remains between 0.05 and 0.08 levels, breakdown below the horizontal support can result in ETH underperformance. Read More

GLOBAL EQUITY MARKETS – August 3, 2024

REVIEW

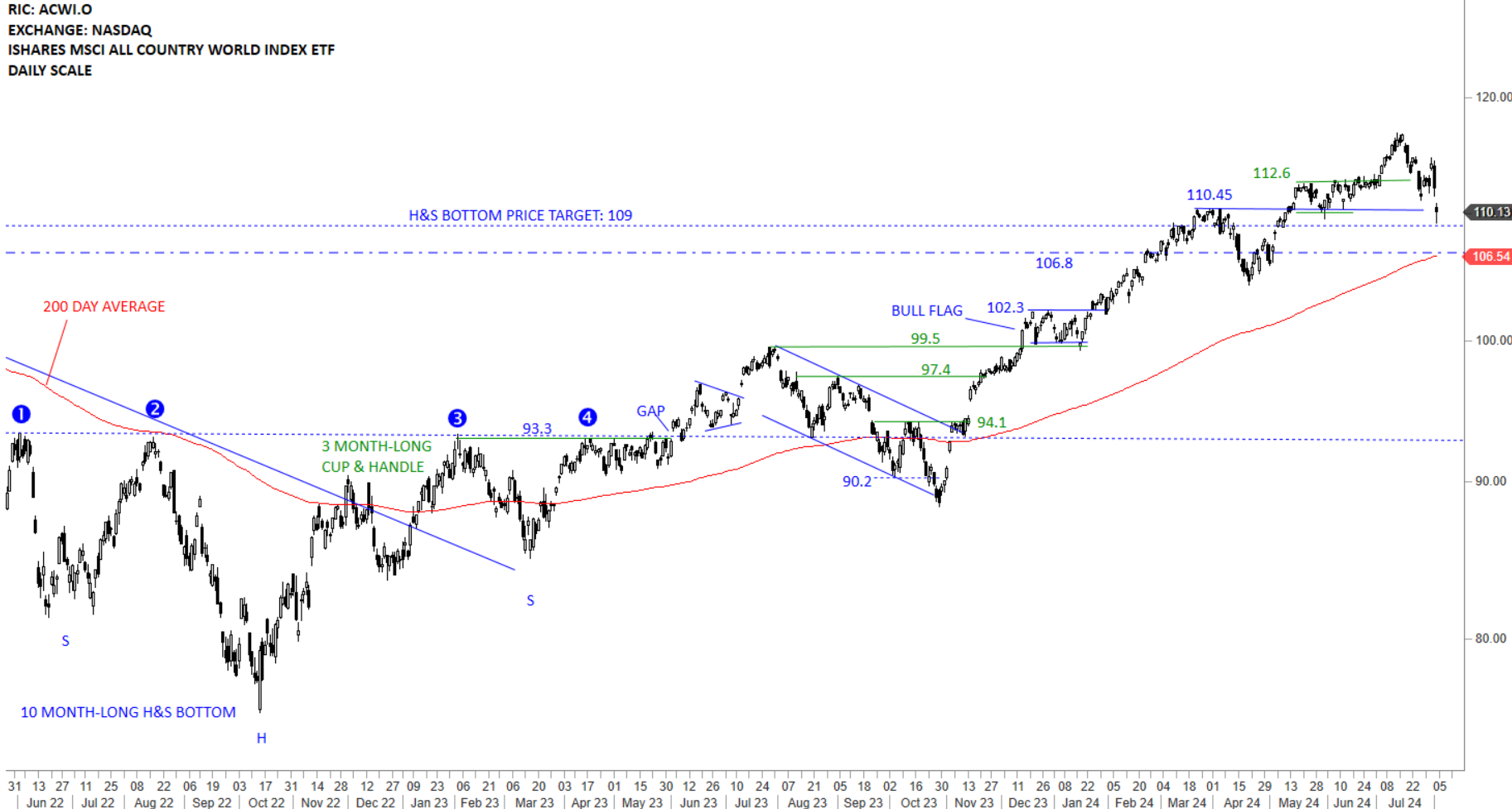

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is clearly above its long-term average and resuming the steady uptrend. Strong support area is between 110.45 and 112.6 levels. Short-term corrections and consolidations are part of any strong uptrend and should be expected with this ETF as well. This weeks continued weakness targeted the 200-day average around 106.54 levels. Volatility in Global Equities picked up. Many benchmarks are testing their 200-day averages or breaching support levels. Stocks or indices that hold well in such environment will be the first ones to resume higher when momentum returns.

Read More

Read MoreGLOBAL EQUITY MARKETS – July 27, 2024

REVIEW

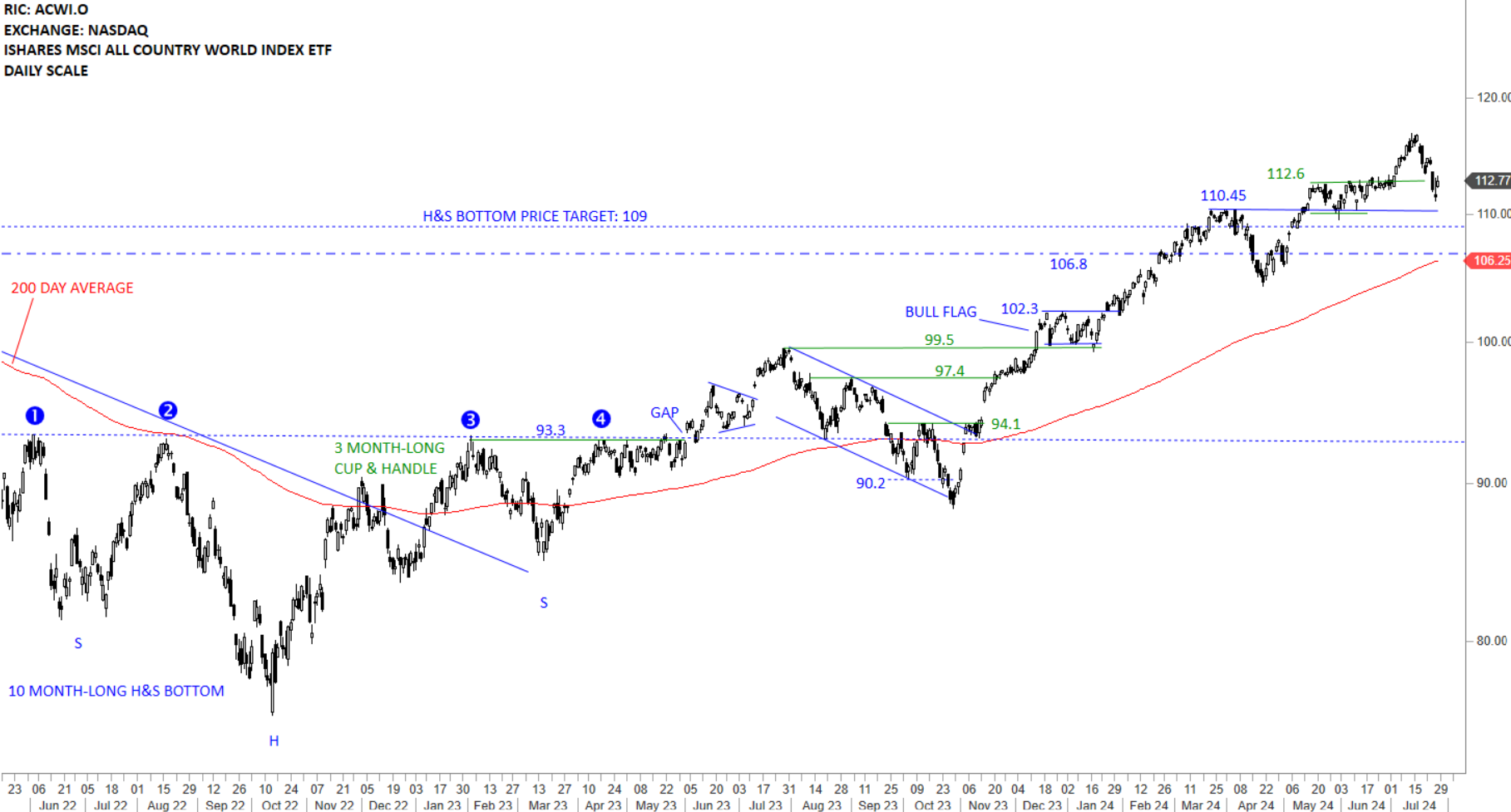

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is clearly above its long-term average and resuming the steady uptrend. Strong support area is between 110.45 and 112.6 levels. Short-term corrections and consolidations are part of any strong uptrend and should be expected with this ETF as well. Larger-scale correction can target the 200-day average around 106.25 levels. This week's sharp pullback found support between 110.45-112.6 area.

Read More

Read More