INTERIM UPDATE – September 12, 2024

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop up during the week and is worth bringing to your attention before the week finalizes. Below are the latest additions to Tech Charts watchlist from different regions in single equities. These charts will be covered in the weekly report as well.

Read MoreGLOBAL EQUITY MARKETS – September 7, 2024

REVIEW

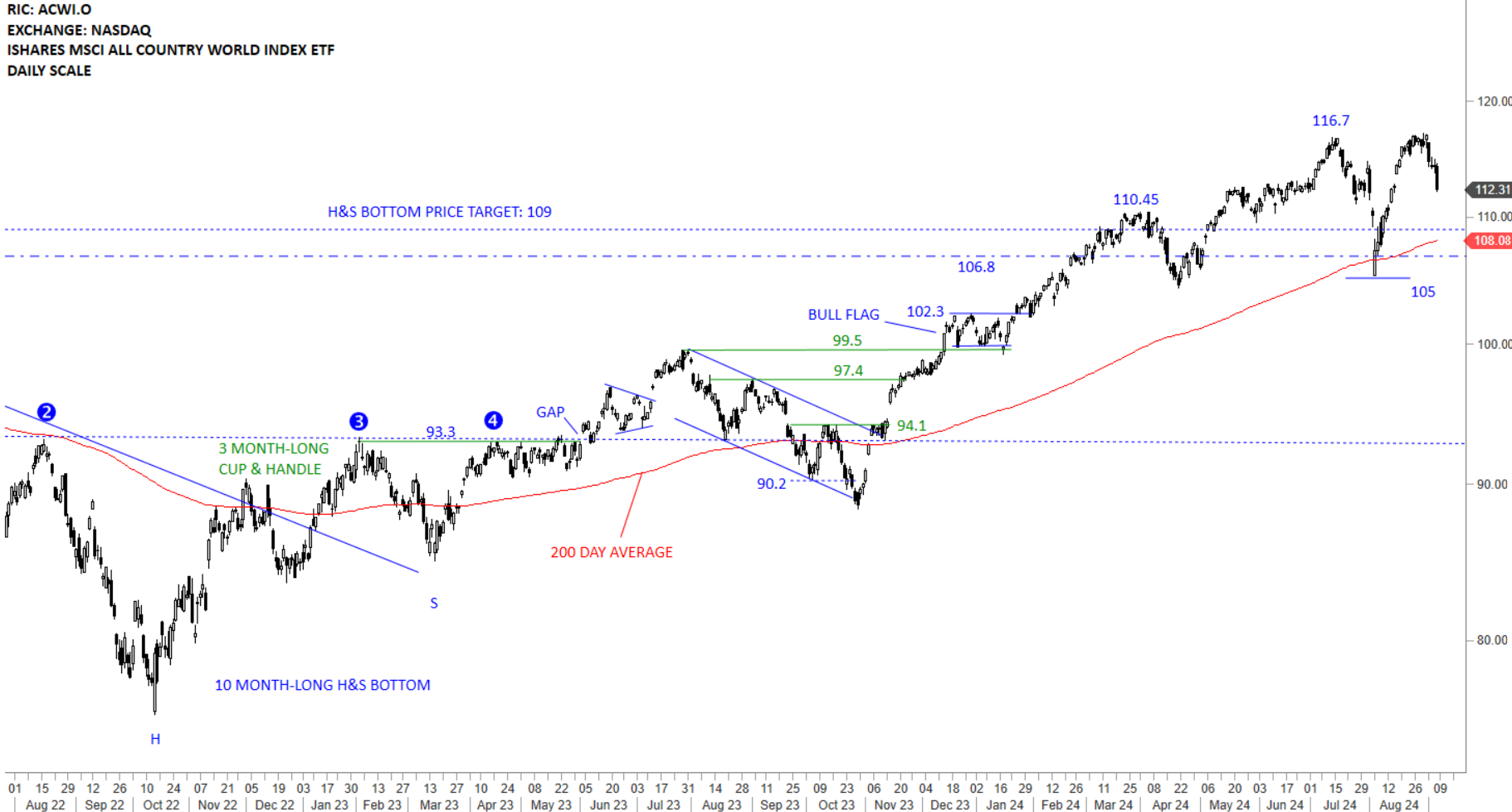

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) found resistance at its previous high around 116.7 levels. Short-term corrections and consolidations are part of any strong uptrend and should be expected with this ETF as well. Stability above the 200-day average can result in a drop in volatility and offer long entry conditions with better defined chart patterns. Strong support area for ACWI ETF is between 110.45 and 108.08. Short-term resistance is at 116.7. It has been a steep rebound and the ETF might continue consolidating the gains from the earlier rebound from the 200-day average.

Read More

Read MoreCRYPTOCURRENCIES – September 1, 2024

BTCUSD holding the lower boundary of a possible trend channel and the year-long (52 week) average. Price is still above the year-long average and should be considered to be in an uptrend. ETHUSD is having difficulty below its support at 2,800 levels. Breakdown below the horizontal support resulted in a sharp correction towards 2,000 levels. ETHBTC slipped below support at 0.05 levels. Breakdown below the horizontal support (monthly confirmation required) can result in ETH underperformance. Read More