INTERIM UPDATE – September 25, 2024

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop up during the week and is worth bringing to your attention before the week finalizes. Below are the latest additions to Tech Charts watchlist from different regions in single equities. These charts will be covered in the weekly report as well.

GLOBAL EQUITY MARKETS – September 21, 2024

REVIEW

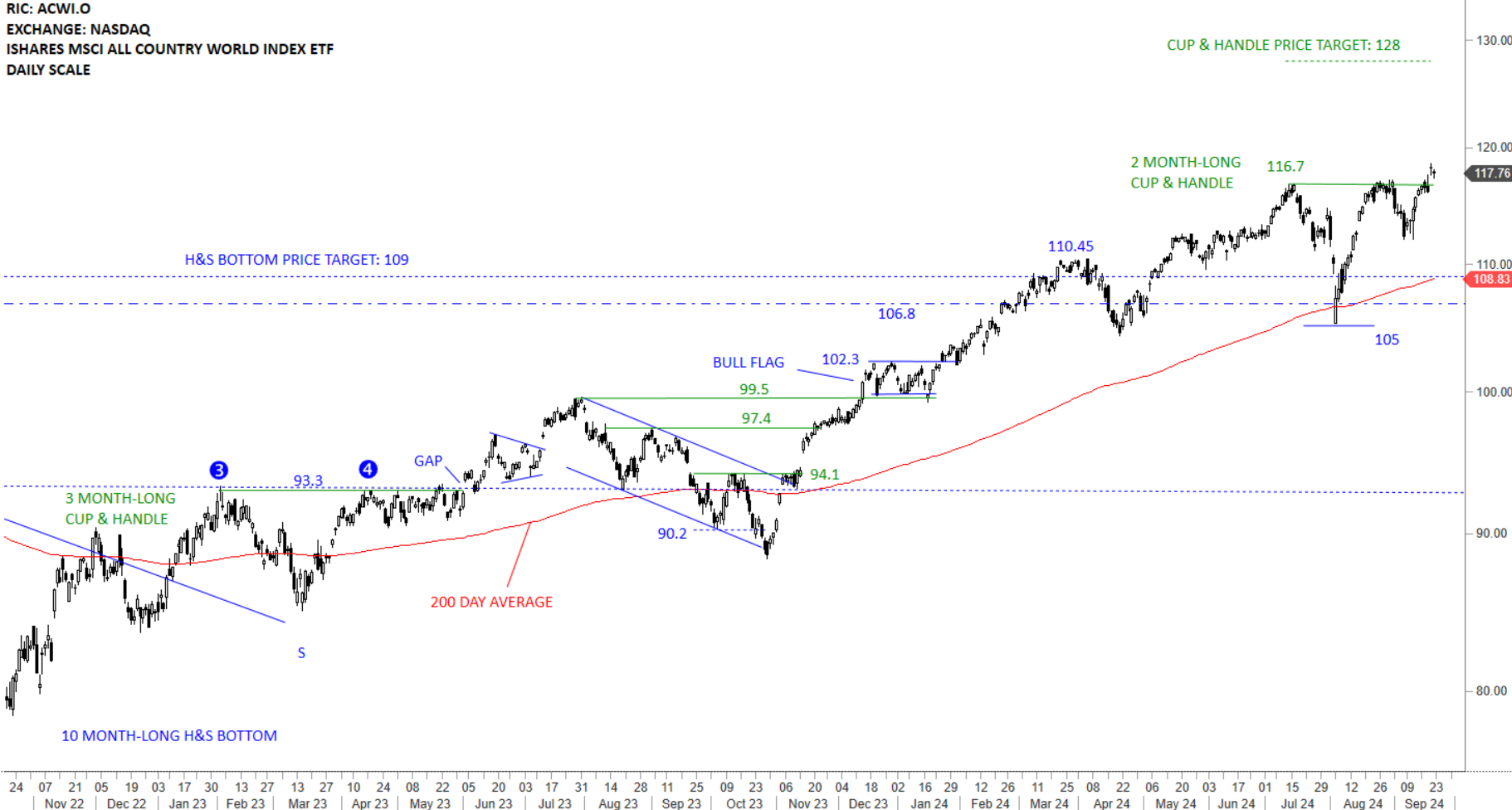

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) cleared the horizontal resistance at 116.7 levels and possibly completed a 2 month-long cup & handle continuation with a price target of 128 levels. Strong support area for ACWI ETF is between 110.45 and 108.83. Short-term support is the horizontal pattern boundary at 116.7 levels.

Read More

Read MoreINTERIM UPDATE – September 16, 2024

I'm adding two breakout setups to the watchlist. I came across those opportunities during the weekend review and I think they are more likely to breakout during the week. I will discuss those in the upcoming report as well. Read More