CRYPTOCURRENCIES – December 22, 2024

BTCUSD cleared the horizontal resistance at 73.7K to new all-time highs. Clear breakout signal from the broadening pattern on weekly scale. Price is consolidating earlier gains. ETHUSD breaks the upper boundary of its short-term consolidation at 2,800 levels and pushes above the year-long average though still hasn't cleared the 4,000 levels. Read More

GLOBAL EQUITY MARKETS – December 21, 2024

REVIEW

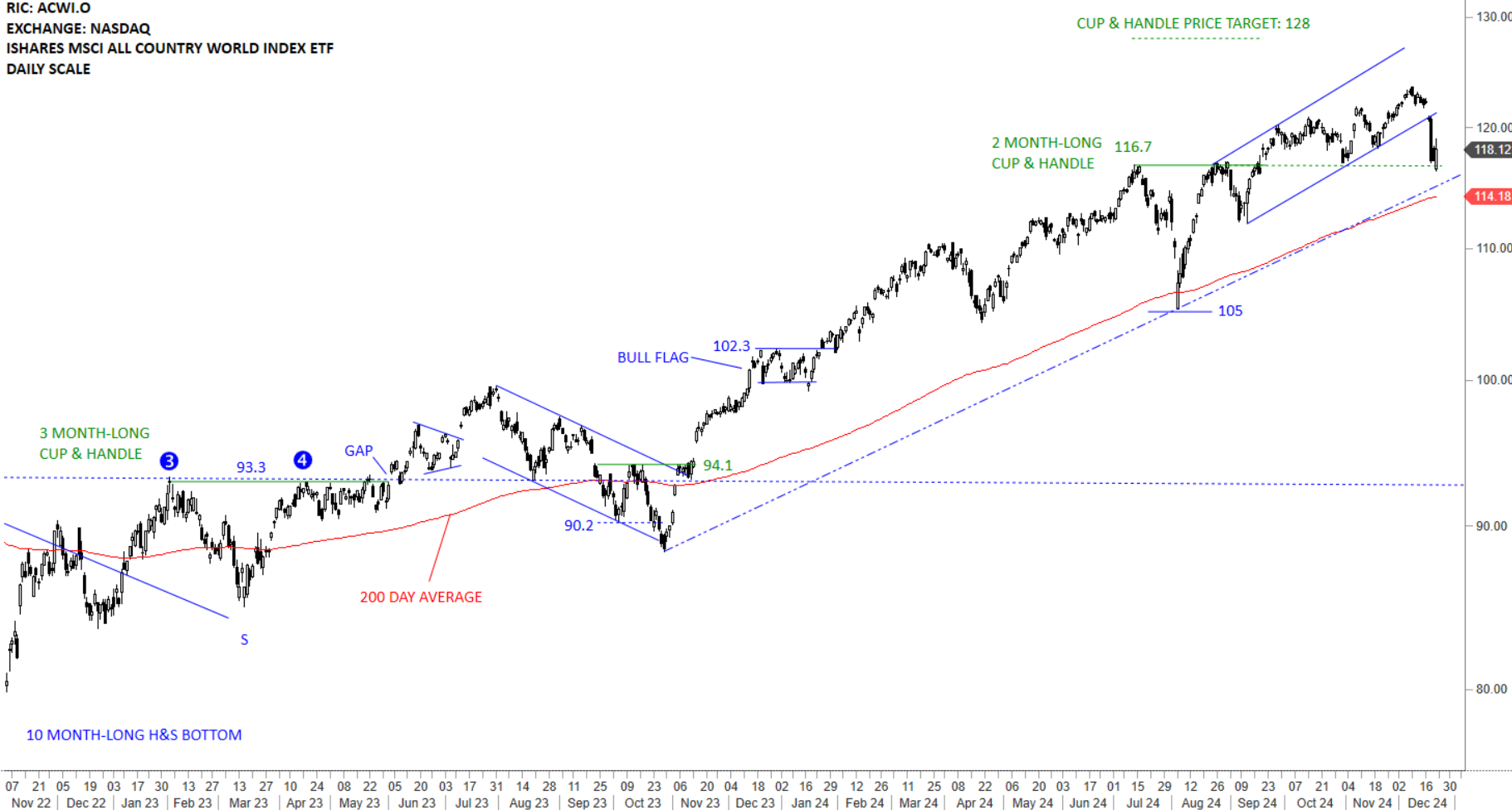

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is pulling back to strong support area between 114.18 and 116.7. The lower boundary of the upward sloping channel at 120 levels broke down with gap openings. While the uptrend is intact and the ETF is above the 200-day average, price action can remain weak and volatile in the short-term.

Read More

Read MoreGLOBAL EQUITY MARKETS – December 14, 2024

REVIEW

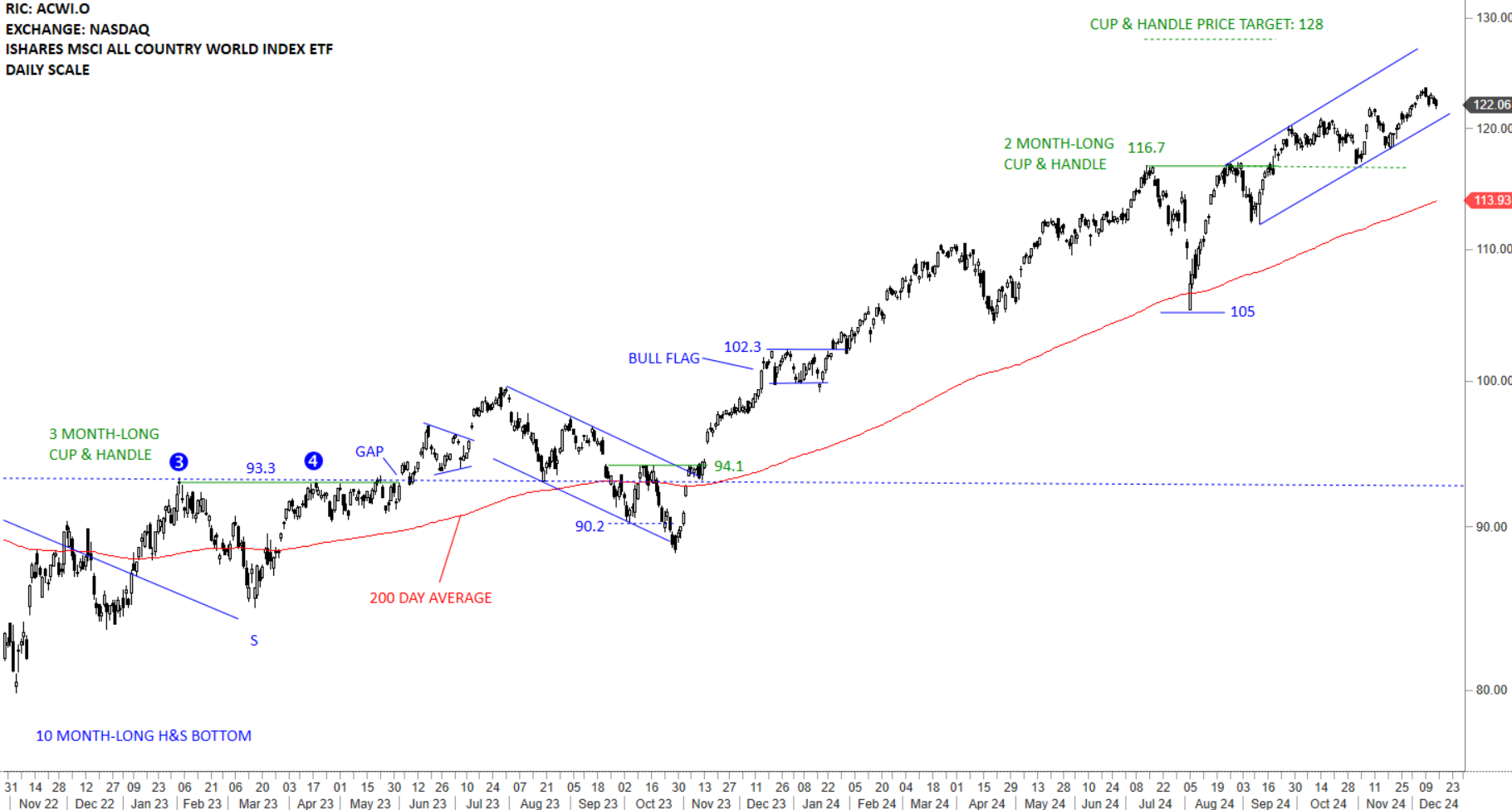

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) cleared the horizontal resistance at 116.7 levels and possibly completed a 2 month-long cup & handle continuation with a price target of 128 levels. Strong support area for ACWI ETF is between 113.93 and 116.7. Short-term support is the lower boundary of the upward sloping channel at 120 levels. Uptrend is intact. The ETF continues to remain in a rising trend channel with higher highs and higher lows. Breakout above the minor high at 121.85 is resuming the uptrend towards the cup & handle price objective.

Read More

Read More