INTERIM UPDATE – April 3, 2025

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop up during the week and is worth bringing to your attention before the week finalizes. Below are the latest additions to Tech Charts watchlist that are suggesting defense in U.S. equities. Continued weakness in equities can result in specific sectors outperform. These additions can help on the long side.

CRYPTOCURRENCIES – March 30, 2025

BTCUSD cleared the horizontal resistance at 73.7K to new all-time highs. Clear breakout signal from the broadening pattern on weekly scale. Price is consolidating earlier gains. The weekly candle confirmed the breakdown below the consolidation range (91.2K-109K). Previous resistance at 73.7K becomes the new support. Previous support at 91.2K is the new resistance. Read More

GLOBAL EQUITY MARKETS – March 29, 2025

REVIEW

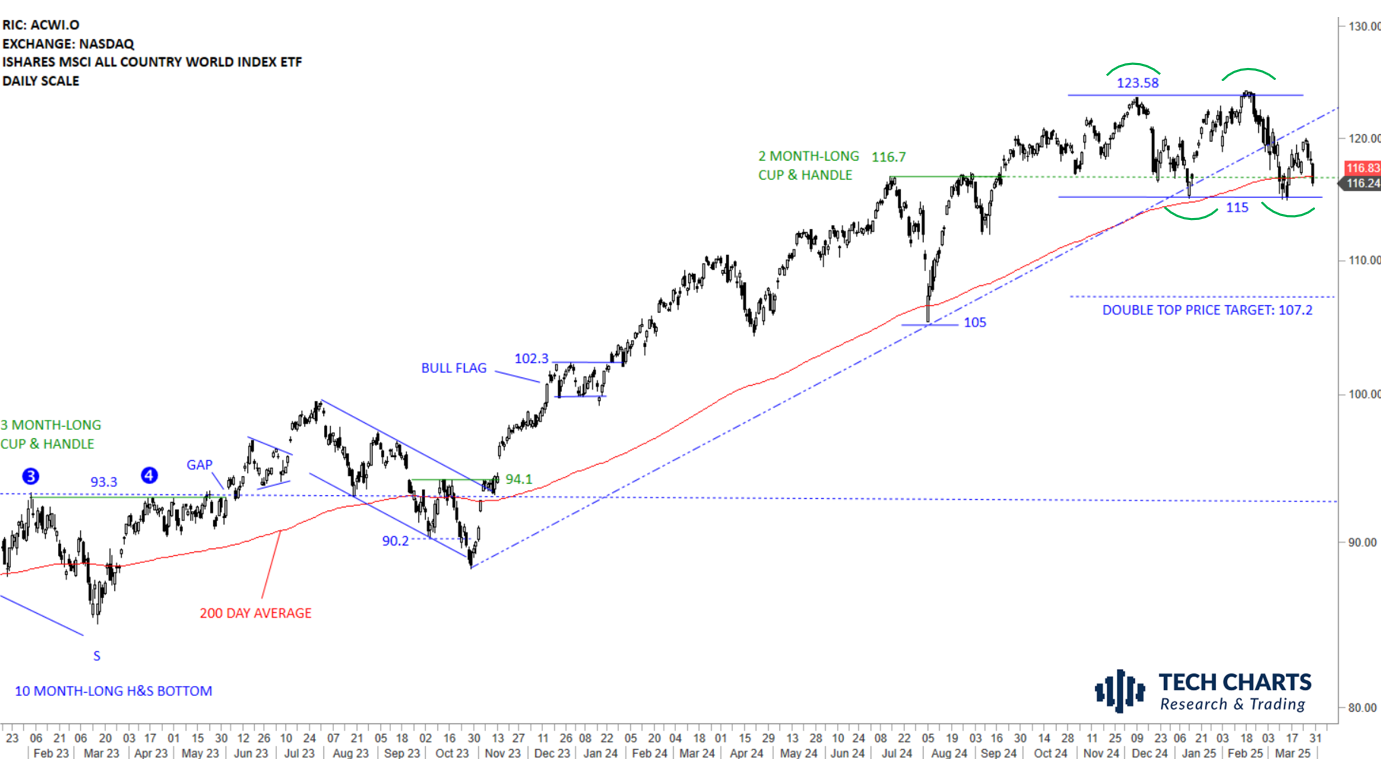

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) found support at the lower boundary and the 200-day average. Uptrend is intact in Global Equities. Failure to hold above 115 levels can complete the consolidation as a double top. The ETF is possibly looking for direction above the year-long average. If the developing pattern is a double top, the neckline at 115 levels will be the level to monitor for a breakdown confirmation. Stability above the year-long average can resume the sideways trading between 115 an 123.58 levels. Double top price target stands at 107.2 levels.

Read More

Read More