GLOBAL EQUITY MARKETS – September 22, 2018

Reminder on Live Webinar

We are continuing our Member webinar series with another classical chart pattern; the symmetrical triangle. Live Webinar and Q&A with Aksel - Tuesday, September 25, 11am mountain. You can register here (Register for the Live Webinar)

REVIEW

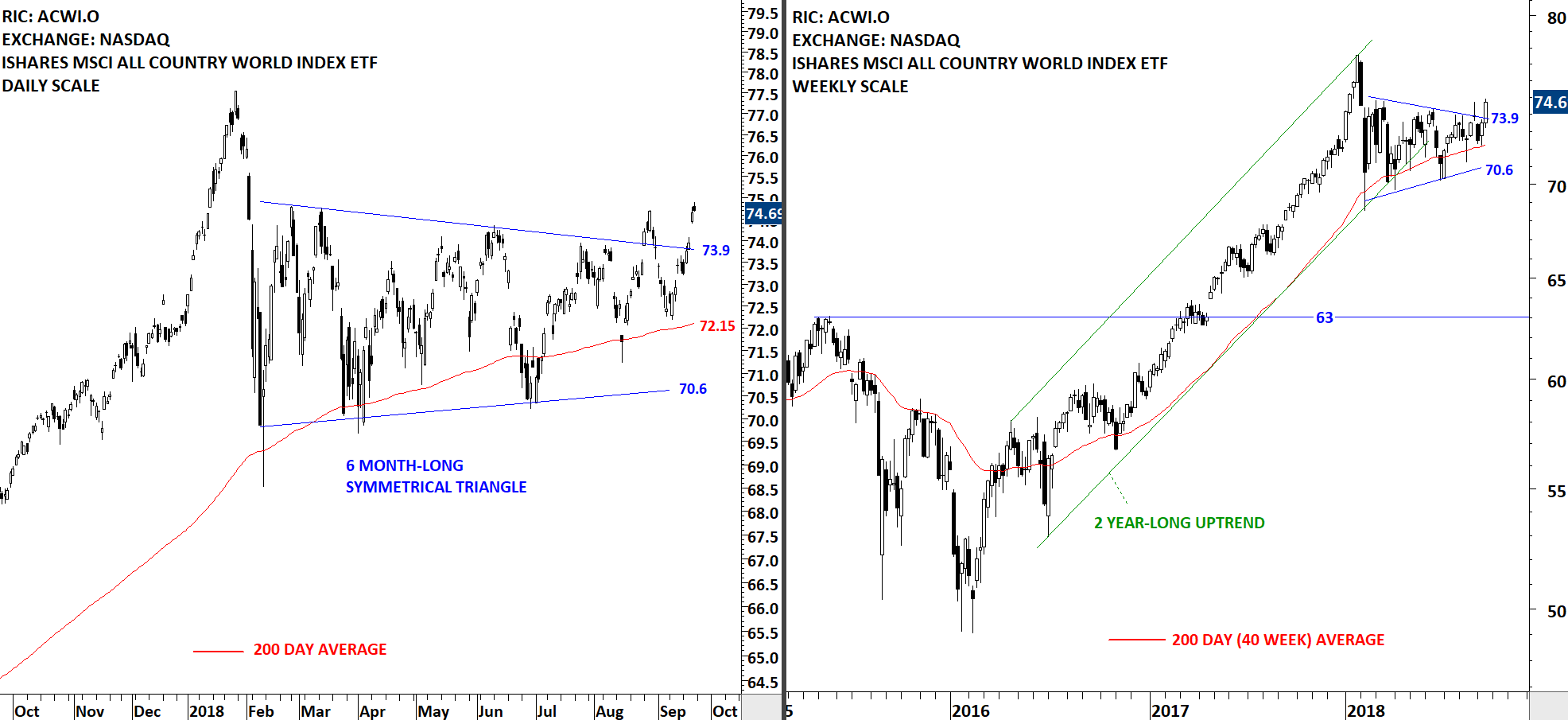

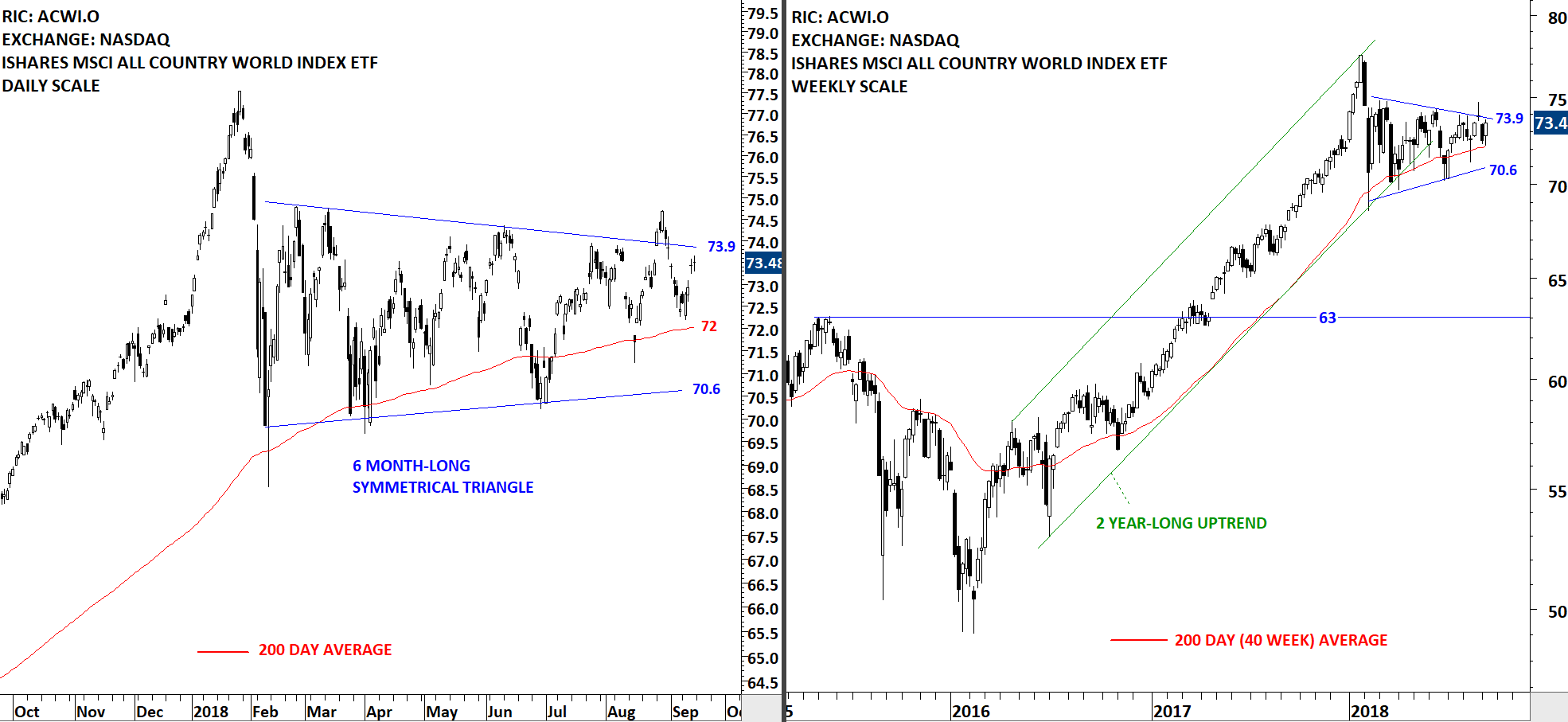

Global equity markets performance as measured by the iShares MSCI All Country World Index ETF (ACWI.O) made another attempt this week to break out of its multi-month long sideways consolidations. The weekly close was at the high of the weekly candlestick. This week's price action is possibly a "secondary completion" of the symmetrical triangle chart pattern. Follow through in the following week can resume uptrend towards 2018 high levels.

Read More

Read MoreLive Webinar and Q&A with Aksel – Tuesday, September 25, 11am mountain

Dear Tech Charts Members,

(Register below)

We are continuing our Member webinar series with another classical chart pattern; the symmetrical triangle. Symmetrical triangle is a chart pattern with diagonal boundaries and it is a neutral chart pattern. It can form as a reversal as well as a continuation chart pattern. A symmetrical triangle forms due to the indecision between buyers and sellers. Over the past couple of months the Global Equity Markets report has featured great chart setups that were identified as well-defined symmetrical triangles.

Scheduled for: Tuesday, September 25th at 11am MST (register below)

The upcoming webinar is dedicated to a thorough discussion on this popular diagonal chart pattern.

- We will review some of those chart pattern breakouts that were featured in the Global Equity Markets report.

- We will review some of the failed breakouts and try to analyze what differentiates a successful breakout from a failed breakout.

- We will look at some of the developing symmetrical triangle chart pattern setups.

- We will continue to highlight Tech Charts members favorite symmetrical triangle setups in different equity markets. I would like to discuss and share some of the best classical chart patterns that members identified or those charts that members might have questions about.

- As usual we will have a member Q&A at the end of the webinar.

GLOBAL EQUITY MARKETS – September 15, 2018

REVIEW

The iShares MSCI All Country World Index ETF (ACWI.O) rebounded from its long-term 200-day average and made another attempt to breakout above the upper boundary of its 6 month-long symmetrical triangle. Friday's close was around the upper boundary of the multi-month long sideways consolidation. In the last week of August the ACWI ETF breached the upper boundary but failed to trend higher. Renewed strength can help the iShares MSCI All Country World Index ETF breakout from the 6 month-long symmetrical triangle.

Read More

Read More