GLOBAL EQUITY MARKETS – January 12, 2019

REVIEW

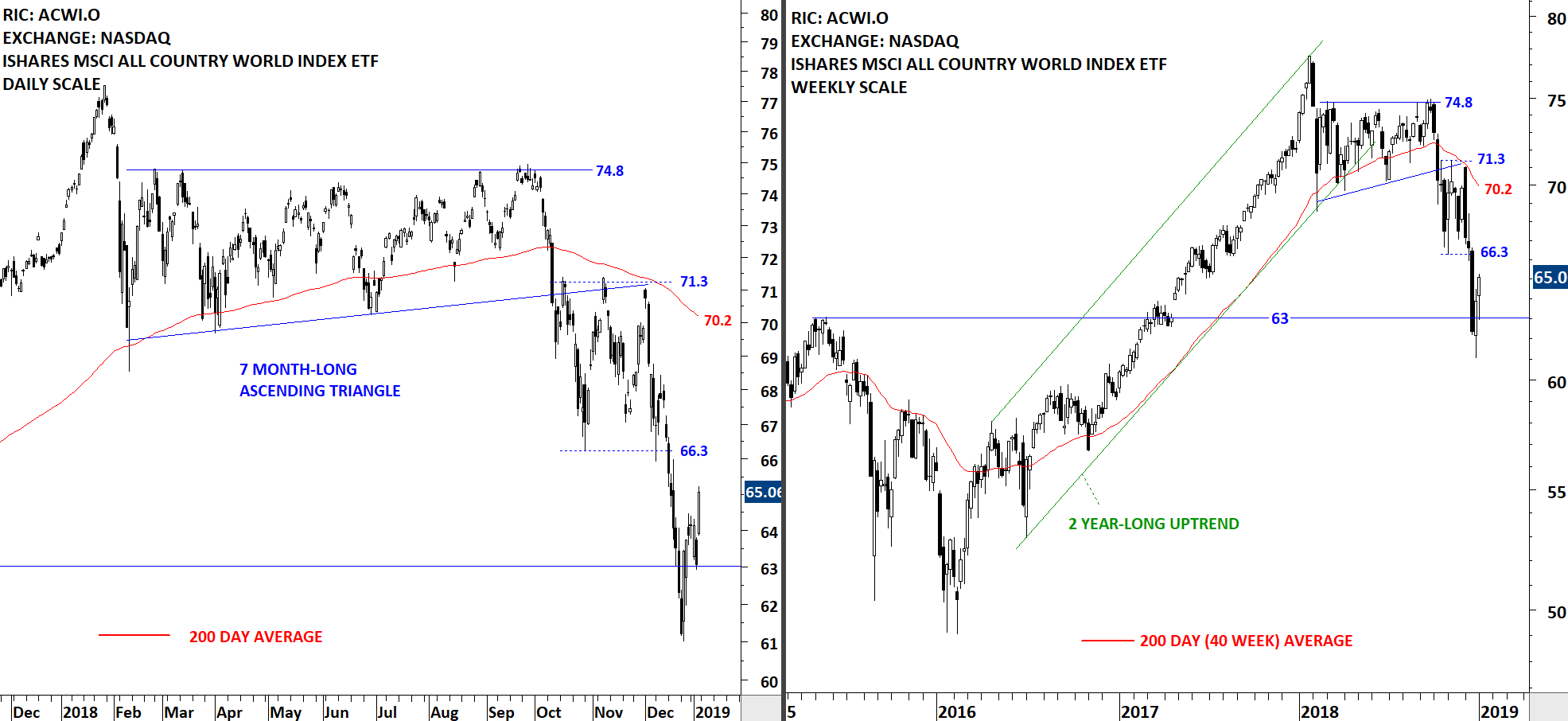

The iShares MSCI All Country World Index ETF, a measure of Global equity markets performance, had a sharp rebound from the support level at 63. Back to back weekly gains pushed the index towards the resistance area between 66.3 and 70. Is the recent rebound part of a bottoming process or a counter-trend rally in a downtrend? The answer lies in the following week's price action. V-bottom reversals are difficult to analyze and trade. If we have seen a V bottom and the ETF keeps climbing higher in the following weeks, I will wait for the price to stabilize above the long-term average. If there is a re-test of previous lows in an attempt to form a double bottom, then I will monitor the ETF for a long opportunity. The other possibility is that we see a short-term consolidation before moving higher. That again will alert me to look for bullish setups.

Read More

Read MoreINTERIM UPDATE – January 8, 2019

This interim update reviews 2 long-term developing breakout opportunities in Sweden equity market. Both charts patterns are mature and well-defined. Breakouts from these lengthy consolidations can push these stocks to all-time highs. Both chart patterns can act as bullish continuations.

Read MoreGLOBAL EQUITY MARKETS – January 5, 2019

REVIEW

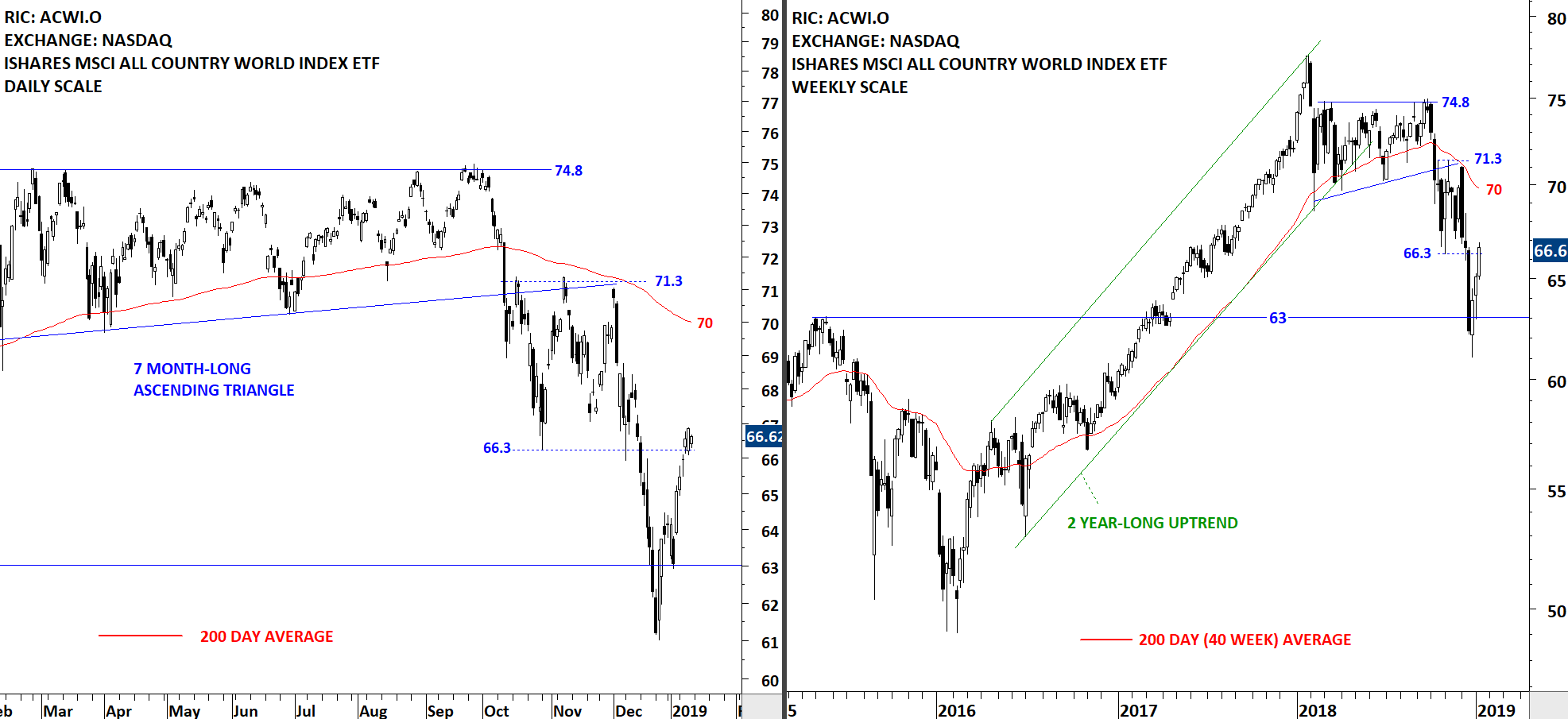

The iShares MSCI All Country World Index ETF (ACWI.O) had another strong weekly close thanks to the Friday's price action. I'm analyzing the latest strength as a rebound in a downtrend. 63 levels remains as the strong support level. Previous support that was breached on the downside will act as resistance at 66.3 levels.

Read More

Read More