GLOBAL EQUITY MARKETS – April 18, 2020

REVIEW

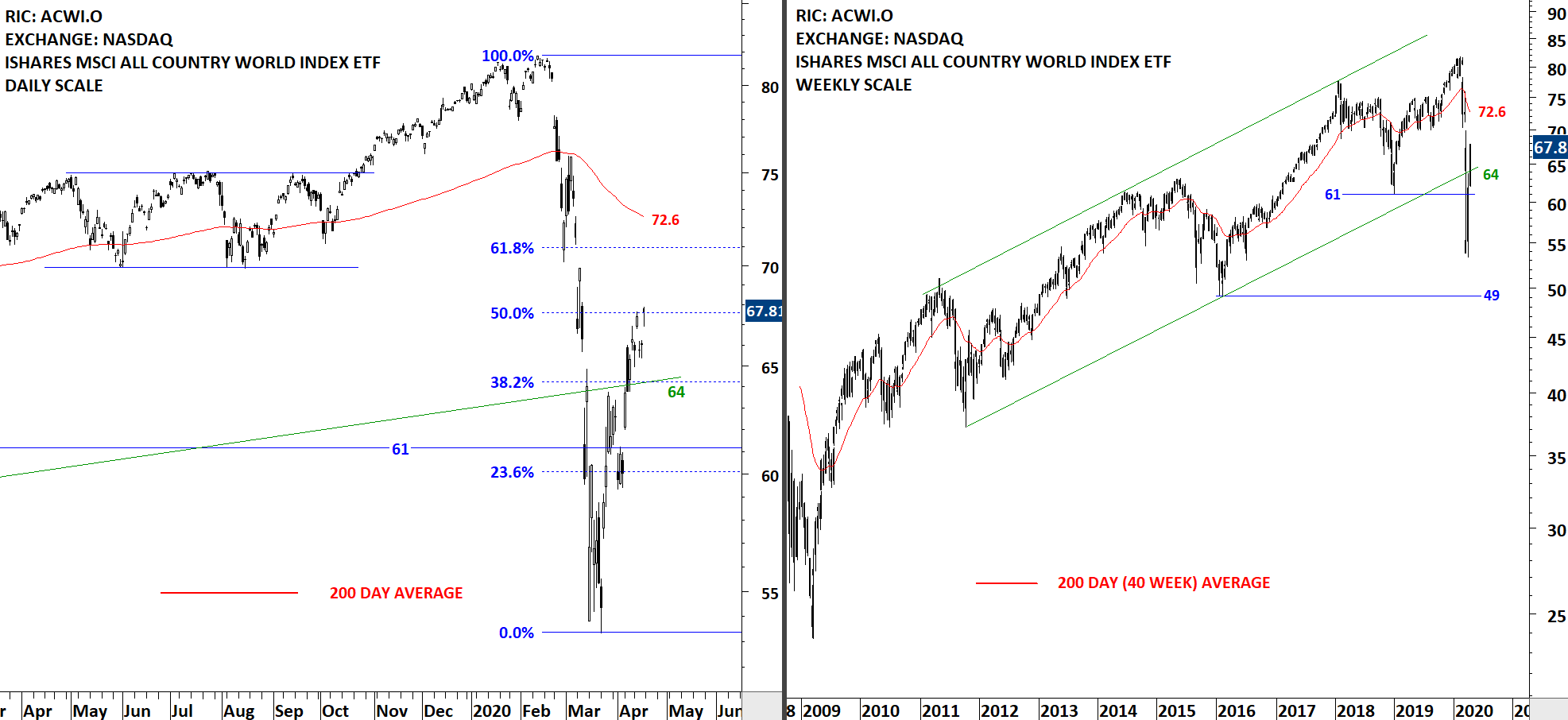

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) recovered above the lower boundary of a possible upward trend channel at 64 levels. Support area between 61-64 area was broken down and now price is above this area. From the lows, the ETF recovered 50% of the decline that started in February. The 200-day moving average is far from the price at 72.6 levels. There is no clear chart pattern development on daily and weekly scale price charts. The ETF is in a downtrend below the 200-day average.

Read More

Read MoreGLOBAL EQUITY MARKETS – April 11, 2020

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) recovered above the lower boundary of a possible upward trend channel at 64 levels. Support area between 61-64 area was broken down and now price is above this area. From the lows, the ETF recovered 50% of the decline that started in February. The 200-day moving average is far from the price at 72.9 levels. There is no clear chart pattern development on daily and weekly scale price charts. The ETF is in a downtrend below the 200-day average.

Read More

Read MoreGLOBAL EQUITY MARKETS – April 4, 2020

REVIEW

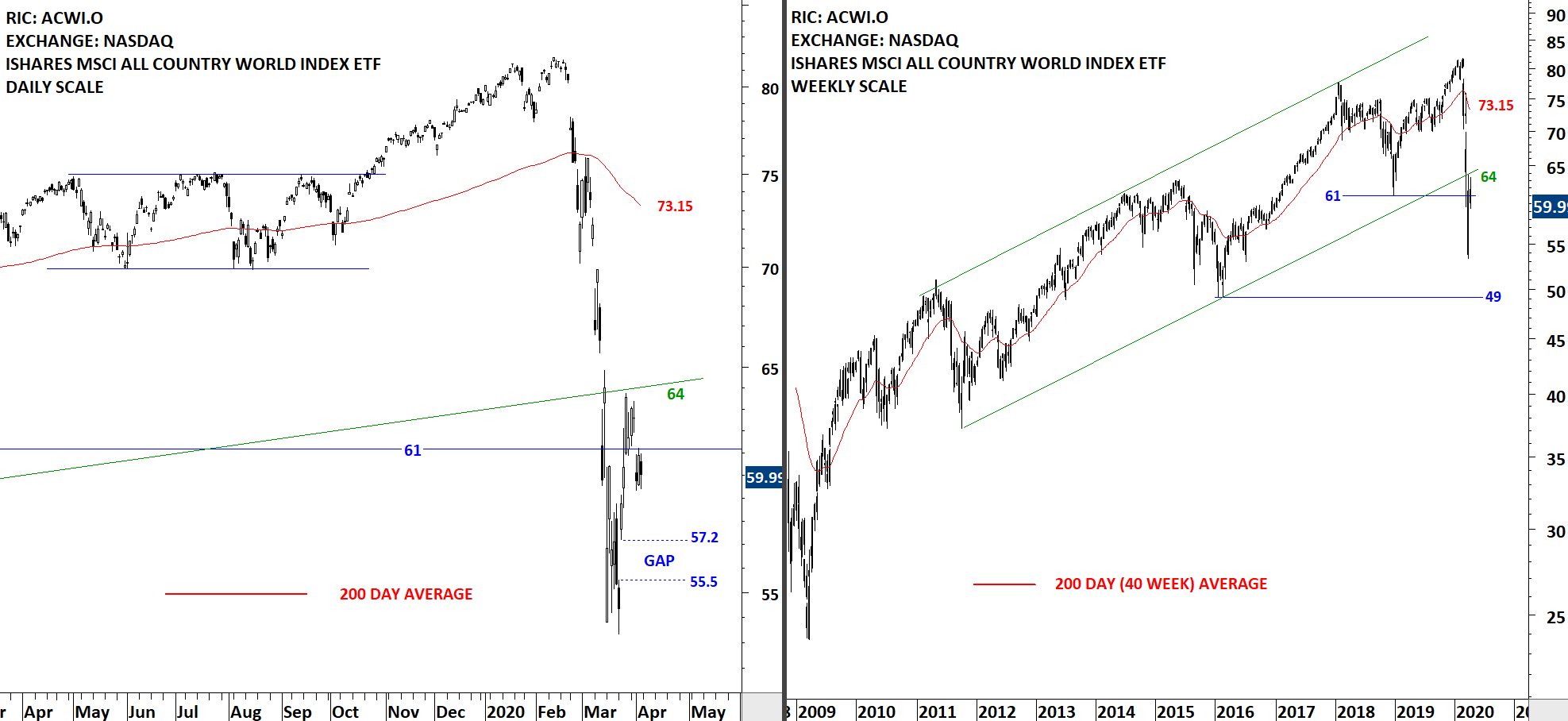

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) found resistance at 64 levels, the lower boundary of a possible upward trend channel. Support area between 61-64 area was broken down and now it is acting as resistance during the rebound. The minor low of 2016 stands as the next support at 49 levels. I will continue to monitor short-term price charts for a possible bottom reversal chart pattern. Patterns I'm looking for are double bottom, rectangle and H&S bottom. A re-test of the lows or another down leg to test 49 levels can offer a short/medium-term bottom opportunity. There is a gap opening between 55.5 and 57.2 levels. I will monitor next week, if any weakness develops, the GAP area as a possible support.

Read More

Read More