GLOBAL EQUITY MARKETS – May 16, 2020

REVIEW

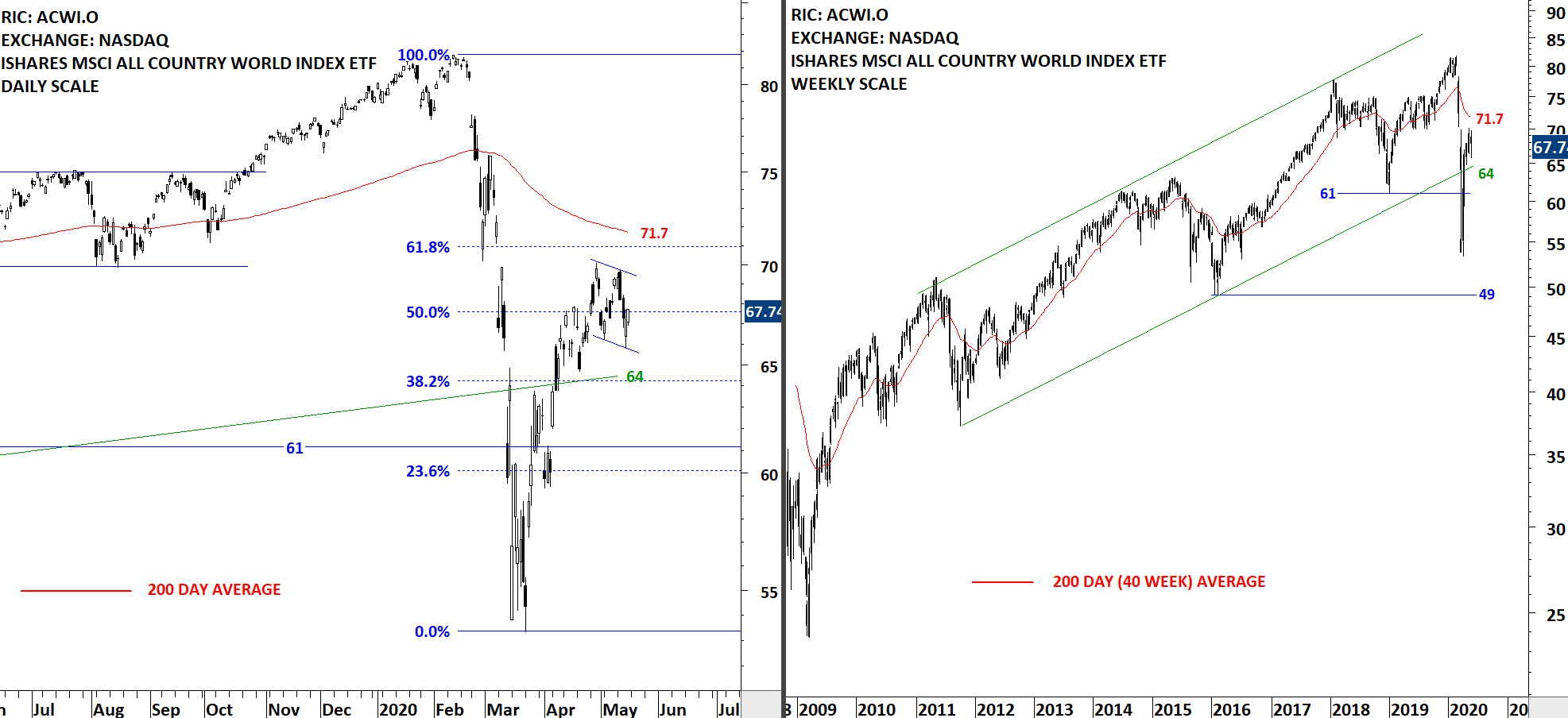

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is possibly forming a short-term consolidation after its strong rebound from the March lows. The ETF recovered close to 62% of the decline that started in February. Price came close to its 200-day moving average which is now at 71.7 levels. The ETF is in a downtrend below the 200-day average.

Read More

Read MoreGLOBAL EQUITY MARKETS – May 9, 2020

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continued to hold on to its gains after the ETF experienced a setback. The ETF recovered close to 62% of the decline that started in February. Price came close to its 200-day moving average which is now at 71.9 levels. The ETF is in a downtrend below the 200-day average. I continue to monitor this ETF for a possible short-term chart pattern development.

Read More

Read MoreGLOBAL EQUITY MARKETS – May 2, 2020

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) experienced a setback after the ETF recovered close to 62% of the decline that started in February. Price came close to its 200-day moving average which is now at 72.1 levels. The ETF is in a downtrend below the 200-day average. The chart is in the process of moving to low volatility conditions. It is looking for a balance between demand and supply. A short-term chart pattern that can take the form of a flag/pennant or symmetrical triangle can offer the low risk long/short opportunity. There is no clear chart pattern development on the daily scale price chart.

Read More

Read More