GLOBAL EQUITY MARKETS – September 19, 2020

Announcement:

On the 27th of September I will be making a presentation at the Online Traders Summit. I will discuss long-term aspects of classical charting principles with examples from Global Equity & FX markets. If you want to register (FREE) for the 2 day event, you can find the link here. I hope you can make it. I'm excited to hear and learn from several other great presenters.

REVIEW

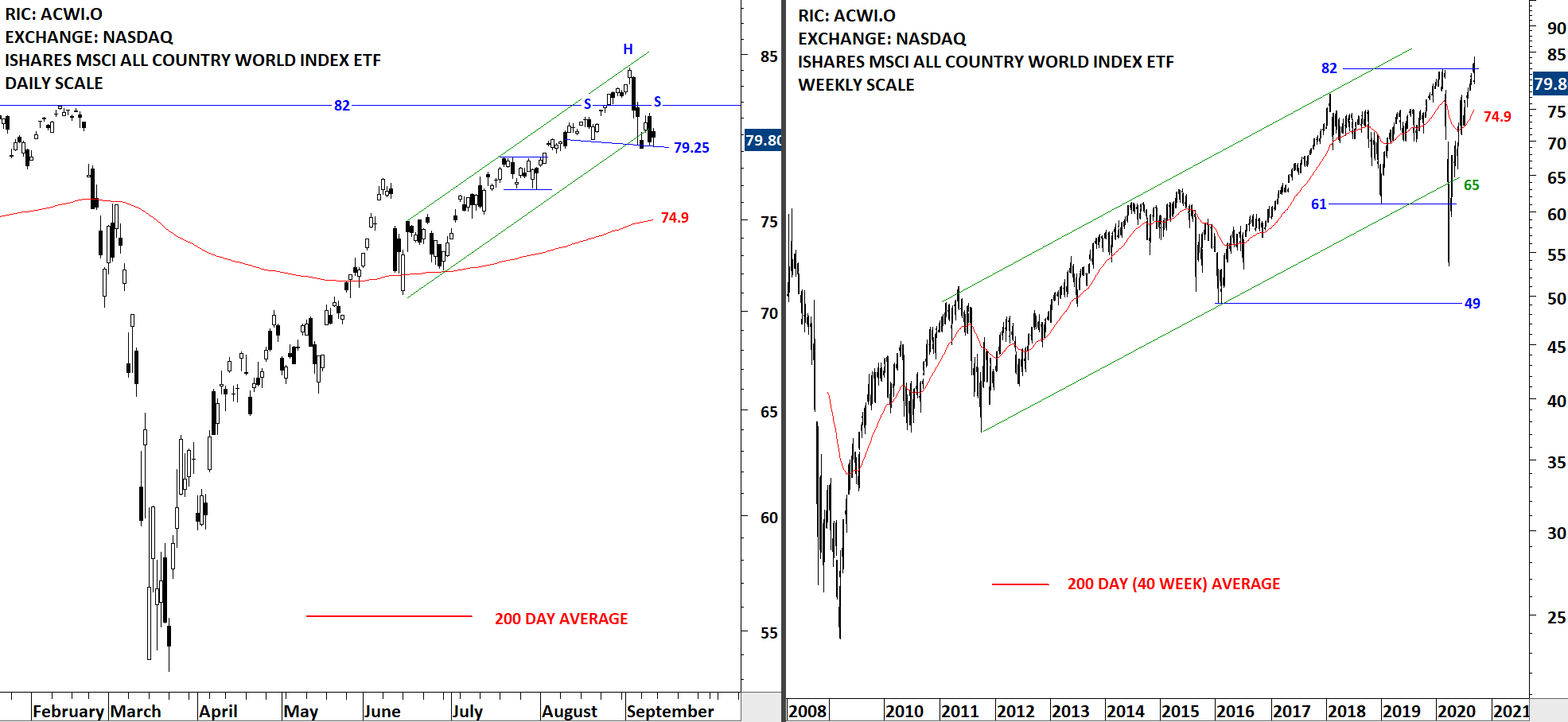

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) experienced its first setback after a lengthy uptrend. I've adjusted the boundary of the trend channel. The daily price chart might be forming a short-term H&S top with this week's price action completing the right shoulder. The neckline is at 79.25 levels. Breakdown below 79.25 levels can extend the correction towards the 200-day average at 75.3 levels. A breach above the high (82) of the right shoulder will result in a H&S failure and will suggest higher levels. Please note that this is a short-term chart pattern and the shorter -term the chart pattern the more prone it is to failure or morphing (eventually becoming part of a larger scale chart pattern). I'm reading several comments on social media, regarding the possibility of another sharp sell-off similar to Feb-March correction. While anything is possible in the markets, I want to draw your attention to the concept of recency bias.

Read MoreINTERIM UPDATE – September 14, 2020

Dear Tech Charts members, I'm adding 3 more breakout ideas to the Americas section of the report. I will cover those in the upcoming weekly report as well.

Read MoreGLOBAL EQUITY MARKETS – September 12, 2020

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) experienced its first setback after a lengthy uptrend. I've adjusted the boundary of the trend channel in order to focus on the latter stages of the uptrend. The ETF had difficulty to rebound from last week's sell-off. Close to the end of this week, ACWI ETF tested last week's lows. The daily price chart might be forming a short-term H&S top with this week's price action completing the right shoulder. The neckline is at 79.25 levels. Breakdown below 79.25 levels can extend the correction towards the 200-day average at 74.9 levels. A breach above the high (81.3) of the right shoulder will result in a H&S failure and will suggest higher levels. Please note that this is a short-term chart pattern and the shorter -term the chart pattern the more prone it is to failure or morphing (eventually becoming part of a larger scale chart pattern).

Read More

Read More