INTERIM UPDATE – October 1, 2020

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop during the week and is worth bringing to your attention before the week finalizes. Below are latest additions to Tech Charts watchlist in case they experience breakouts in the last two days of the week. These charts will also be included in the weekly update.

Read MoreTRADERS SUMMIT – SUMMARY

Dear Tech Charts members,

On the 27th of September, I gave a presentation at the Online Traders Summit. You might have missed the opportunity to attend. If you have registered for the event a recording will probably be sent out.

I wanted to summarize the main points I've discussed at the online event also you can find attached the charts I've shared with the attendees. You might find these long-term charts interesting. Though, the first part of the presentation where I discuss the general concepts for classical charting might be familiar if you have been a long-time Tech Charts member.

Read MoreGLOBAL EQUITY MARKETS – September 26, 2020

Announcement:

On the 27th of September I will be making a presentation at the Online Traders Summit. I will discuss long-term aspects of classical charting principles with examples from Global Equity & FX markets. If you want to register (FREE) for the 2 day event, you can find the link here. I hope you can make it. I'm excited to hear and learn from several other great presenters.

REVIEW

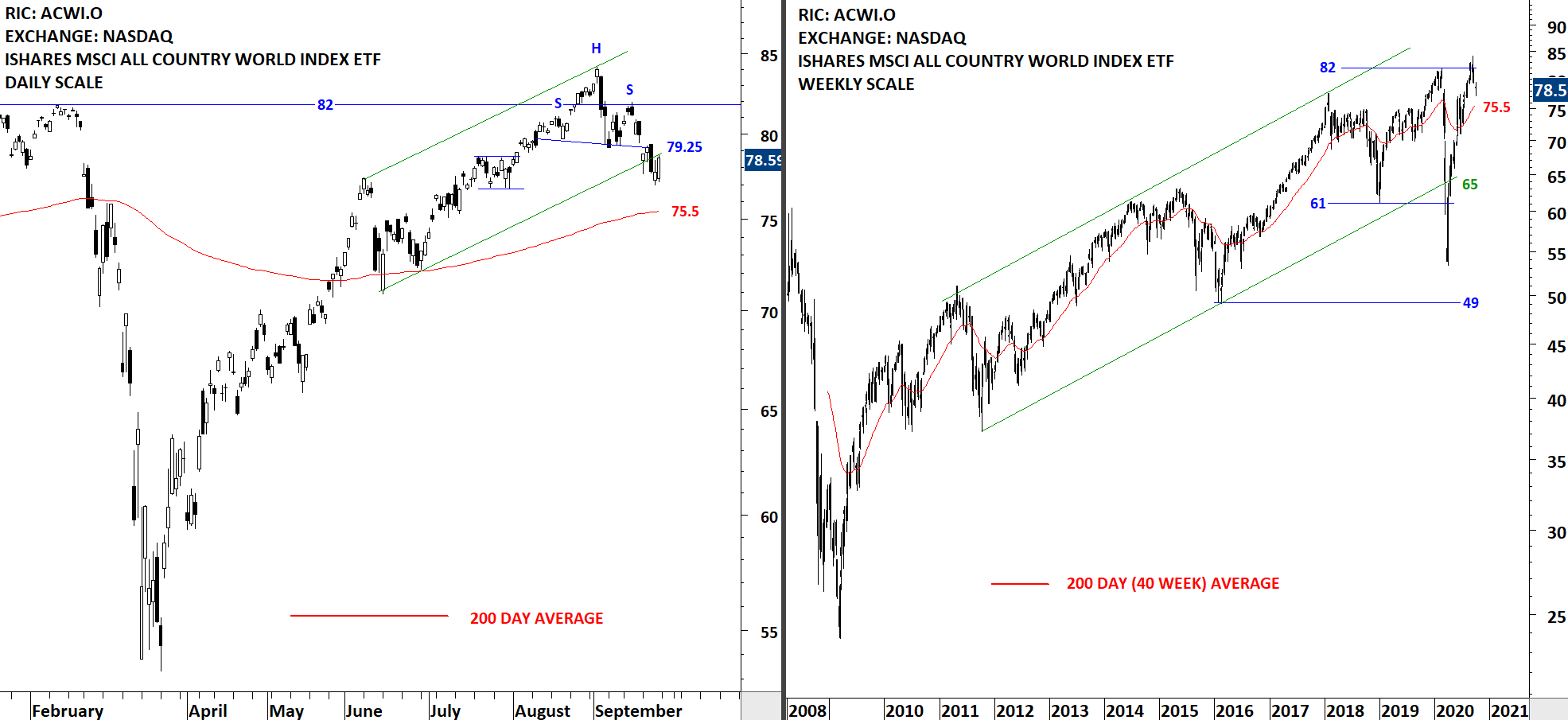

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) broke down the neckline of a possible short-term H&S top. The 200-day average is acting as support at 75.5 levels. Please note that this is a short-term chart pattern and the shorter -term the chart pattern the more prone it is to failure or morphing (eventually becoming part of a larger scale chart pattern). Friday's price action was strong and reversed back to close slightly below the neckline. The following week will offer more insight of the H&S is successful and price will test the 200-day average. Several equity benchmarks have already reached their 200-day averages during the latest correction. As we are still above the 200-day average for the ACWI ETF, It is difficult for me to put my bear market cap on. I continue to view any correction or weakness in the market as reversion to the mean.

Read More

Read More