INTERIM UPDATE – December 16, 2020

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop during the week and is worth bringing to your attention before the week finalizes. Below are latest additions to Tech Charts watchlist in case they experience breakouts during the week. These charts will also be included in the weekly update.

Read MoreGLOBAL EQUITY MARKETS – December 12, 2020

REVIEW

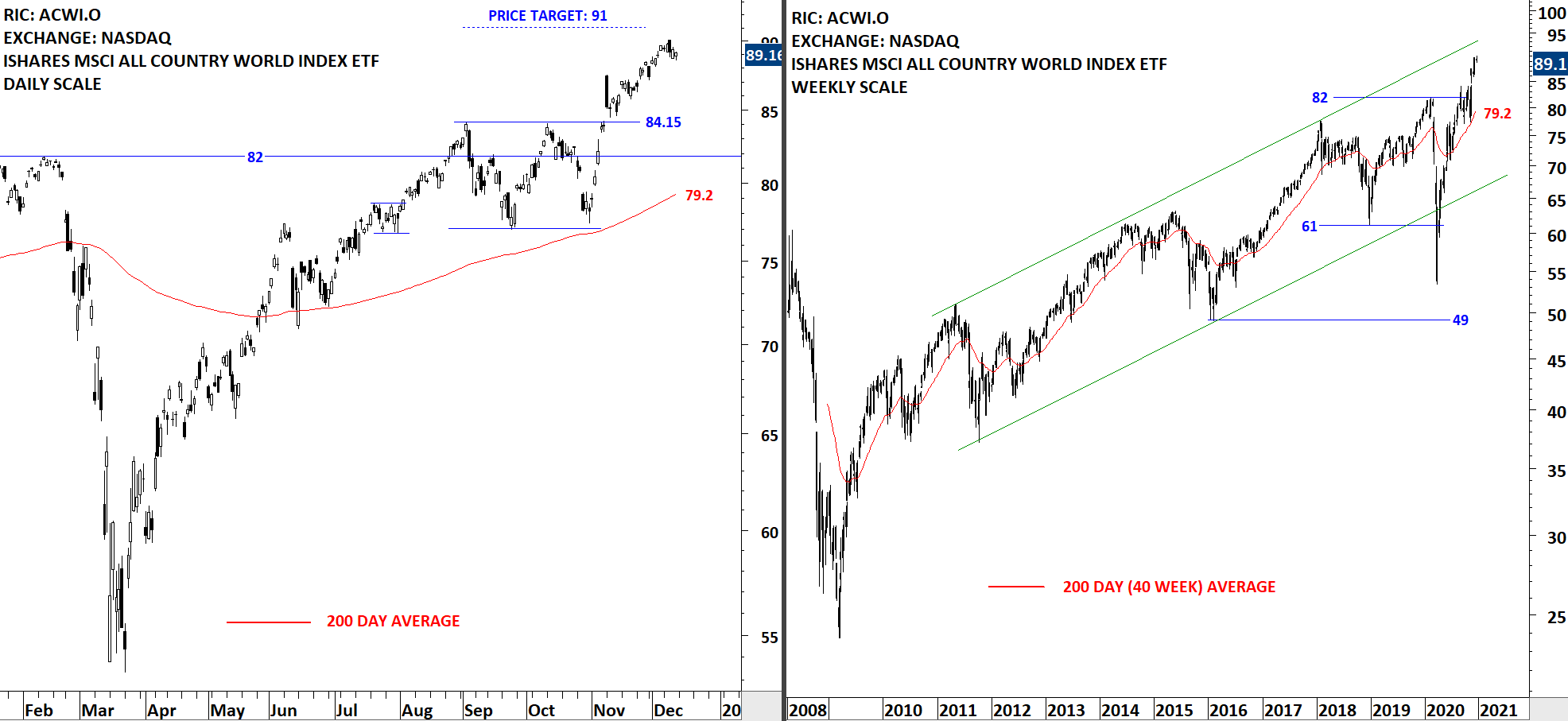

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) resumed its uptrend after completing a rectangle chart pattern. Breakout took place above 84.15, the upper boundary of the rectangle which is now a short-term support. Possible chart pattern price target stands at 91 levels. During any pullback 84.15 will act as support. The 200-day moving average, which I utilize as a trend filter, is rising as well, now at 79.2 levels. There is no reversal chart pattern on the daily price chart.

Read More

Read MoreChart Pattern Statistics, H&S continuation and H&S failures – December 2020 Tech Charts Webinar

Chart Pattern Statistics, H&S continuation and H&S failures - December 2020 Tech Charts Webinar

We are continuing our Member webinar series with several important and frequently asked topics. Given that the topics are different concepts in technical analysis/classical charting and trading, each section will have a +/- 10 min presentation followed by Q&A on that section.

Webinar Outline- Review of chart pattern statistics and discussion on chart pattern reliability / Q&A

- Current market conditions and review of major benchmarks/important chart pattern developments / Q&A

- A frequently asked chart pattern, H&S continuation and review of H&S failures and how to trade them / Q&A

- A typical day for me, the daily routine, selection of markets, review and research tips / Q&A

- Additional Q&A

- No Questions

- I wanted to know more about log scale and how to set targets using it. For instance, I have seen some chartist giving two targets for H&S, one for each scale. 28:44

- Where do you usually set your "stop loss" in the H&S bottom/continuation? Is it the negation level, or do you use other criteria? 30:35

- Do you use the 200 SMA or Exponential & why? Any other moving average you use? 32:11

- Could you provide another example or two for setting the H&S target? Do we measure from the neckline to the bottom of the lowest candle body in the head, or to a wick? 33:31

- Do you always get out of 100% of your trade when it gets to its objective? Or do you switch to a trailing stop? 33:47

- On the last chart, it didn't look the H&S pattern had been completed by breaching the neckline, so why is it a H&S failure? (Possibly page 17 or 18.) 49:09

- How did you calculate the H&S failure price target on page 19? 50:21

- In the H&S bottom with NON-Horizontal neckline (neckline with slope), how do you measure the price target? 51:03

- If you wait for the closing price for the breakout signal, how do you decide the trigger price? 51:38

- Are you discounting the validity of vertical necklines against the horizontal ones? 52:35

- How do you handle spindles? By using Stop Close Only orders? 53:28

- If a stocks breaks down and then reverses and goes above the right shoulder, is that a H&S failure? 54:26

- In this BTC Monthly chart, in the log scale, do you see "Cup & Handle" with a neckline at $13,880? 1:05:00

- How do you look at Netflix now? 1:06:16

- How did you set the target about the sym triangle in slide 30? from the first point? 1:06:53

- Do you ever take any help from any indicator while identifying the chart patterns? 1:07:32

- Please check GH & KO in you have time 1:08:35

- With weekly patterns the chart validation points usually have much wider risk; what % of NAV risk for each position do you use for weekly and what for daily patterns breakouts? 1:08:44

- In the US Marker review, for example, I am assuming you are not going chart by chart and have a certain criteria "as starting point" to pick your charts. Do you mind sharing your criteria (if any)? 1:16:24

- Vacation? 1:17:49

- Can you explain a bit more about how you use volatility to identify possible patterns? I'm not sure how you review so many stocks! 1:18:05

- Do you scan charts by industry? 1:20:14

- Do you enter orders during 1 hour before the close? 1:20:41

- Would you elaborate a bit further about cases that you can open a position intraday, and do you keep stops during weekends? 1:21:20

- The filter I find useful is the MA 18 weekly rather EMA 200 . What do you think about it? 1:23:45

- Could you suggest about position size strategy? 1:24:27

- I know you previously mentioned about sending a report on Chinese stocks. Are you still planning to do so - thanks for all you do. 1:25:17

- Aren't Keltner channels more useful than Bollinger bands? After all, Keltner is based on ATRs -- actual price ranges, not just the moving average close which Bollinger uses? 1:25:42

- Do you think the volume of stocks is relevant for the pattern success ratio? 1:26:31

- Van Tharp’s Definitive Guide to Position Sizing – Van Tharp