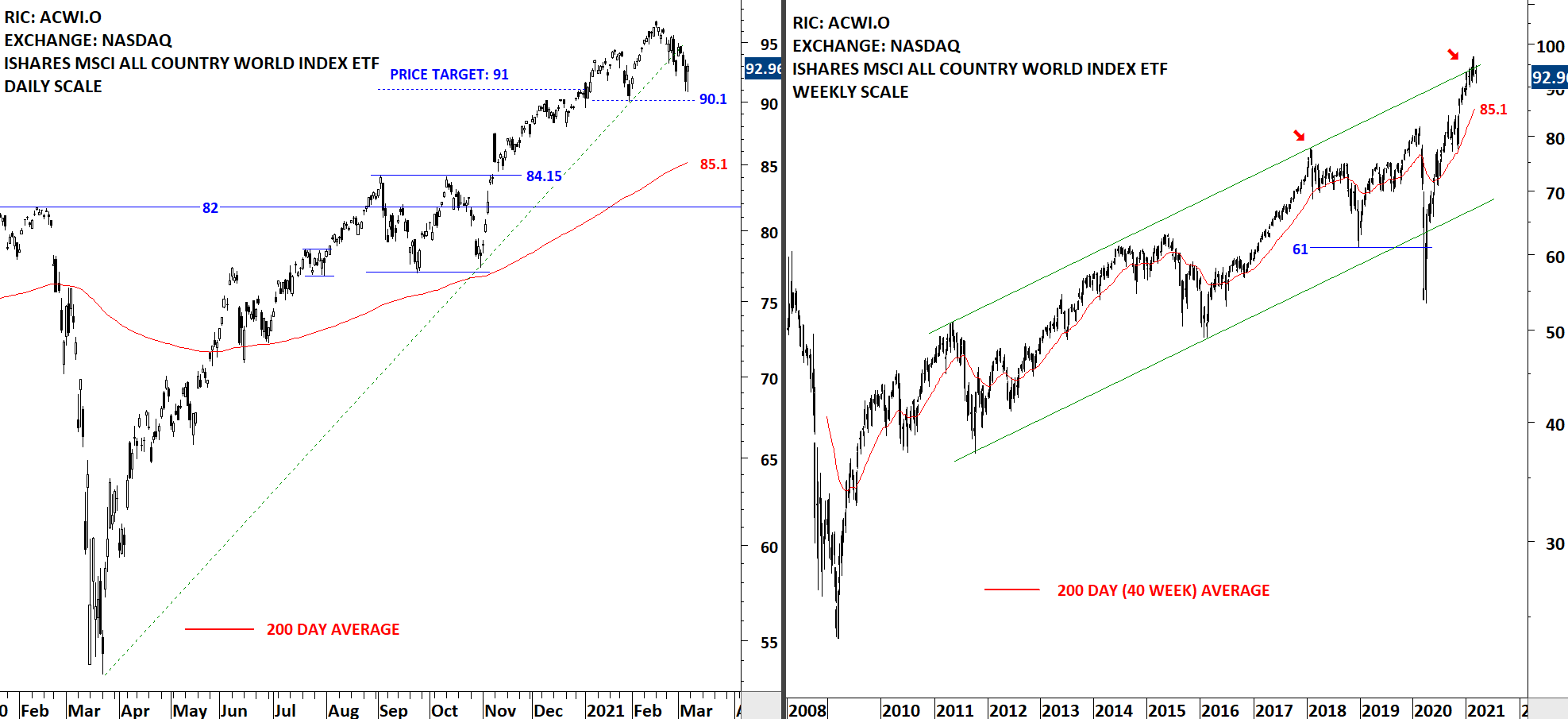

GLOBAL EQUITY MARKETS – March 6, 2021

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) failed to hold above the existing uptrend line. The last time the ETF tried to reverse the ongoing trend was in January. The recent pullback came close to January minor low at 90.1. We are possibly in a reversion to the mean stage where the ETF can pullback towards the 200-day average similar to Sep-Oct period. For the time being we can say that the ETF found support at the minor low for a possible rebound. It could be still early to bring this possibility to your attention but I will monitor the ACWI ETF for a possible H&S top. The ETF might rebound to form the right shoulder of a possible H&S top.

Read More

Read MoreLive Webinar and Q&A with Aksel – Thursday, March 11th, 8:30 am mountain

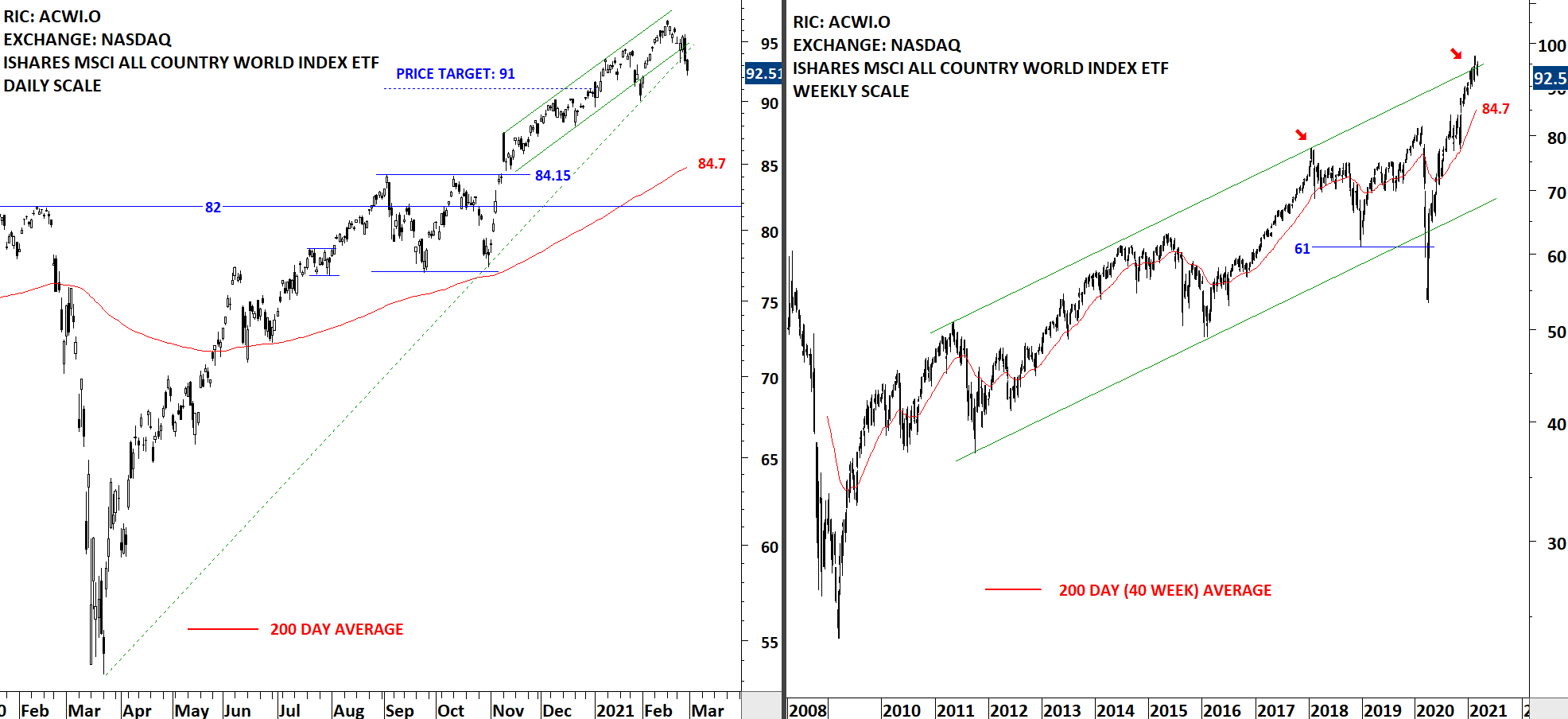

GLOBAL EQUITY MARKETS – February 27, 2021

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) failed to hold above the existing uptrend line. The last time the ETF tried to reverse the ongoing trend was in January. That pullback rebounded from the trend line support and resulted in a another attempt to reach new all-time highs. Friday's close was weak and it was below the arguable (because I think trend lines, diagonal boundaries are more prone to failure) trend line support. The ETF is also at the upper boundary of a long-term trend channel. We are possibly entering into a reversion to the mean stage where the ETF can pullback towards the 200-day average similar to Sep-Oct period.

Read More

Read More