4 Types of Breakouts and How To Trade Them – March 2021 Tech Charts Webinar

- Review of chart pattern statistics and discussion on chart pattern reliability

- 4 types of breakouts and examples on each breakout situation

- How to manage open trades with each type of breakout

- 4 types of breakouts (hard re-test, re-test, failed breakouts, breakouts without any pullback)

- Review of latest chart pattern setups

- Member Q&A

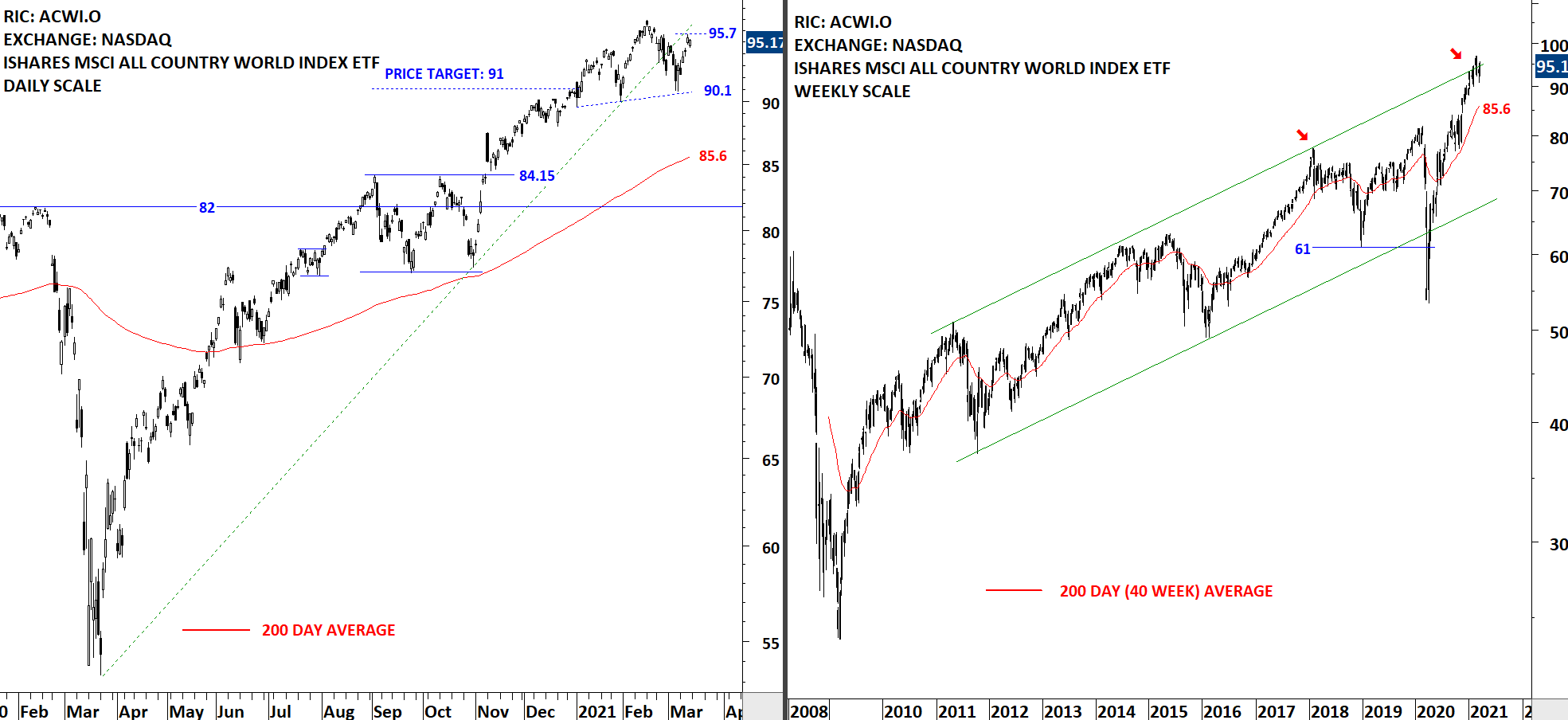

GLOBAL EQUITY MARKETS – March 13, 2021

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) failed to hold above the existing uptrend line. The last time the ETF tried to reverse the ongoing trend was in January. The recent pullback came close to January minor low at 90.1. For the time being we can say that the ETF found support at the minor low and rebounded. There is a possibility of a H&S top forming at current levels that can be utilized in both directions. The possible right shoulder hasn't formed yet so it is early to call this a H&S top. Right now we can conclude that the uptrend is intact. If price stalls at current levels and rolls over in the following week, then we will consider the possibility of a H&S top.

Read More

Read MoreINTERIM UPDATE (EUROPE & US) – March 10, 2021

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop during the week and is worth bringing to your attention before the week finalizes. Below is the latest addition to Tech Charts watchlist from EUROPE & AMERICAS equities. These charts will also be included in the weekly update.

Read More