GLOBAL EQUITY MARKETS – June 26, 2021

REVIEW

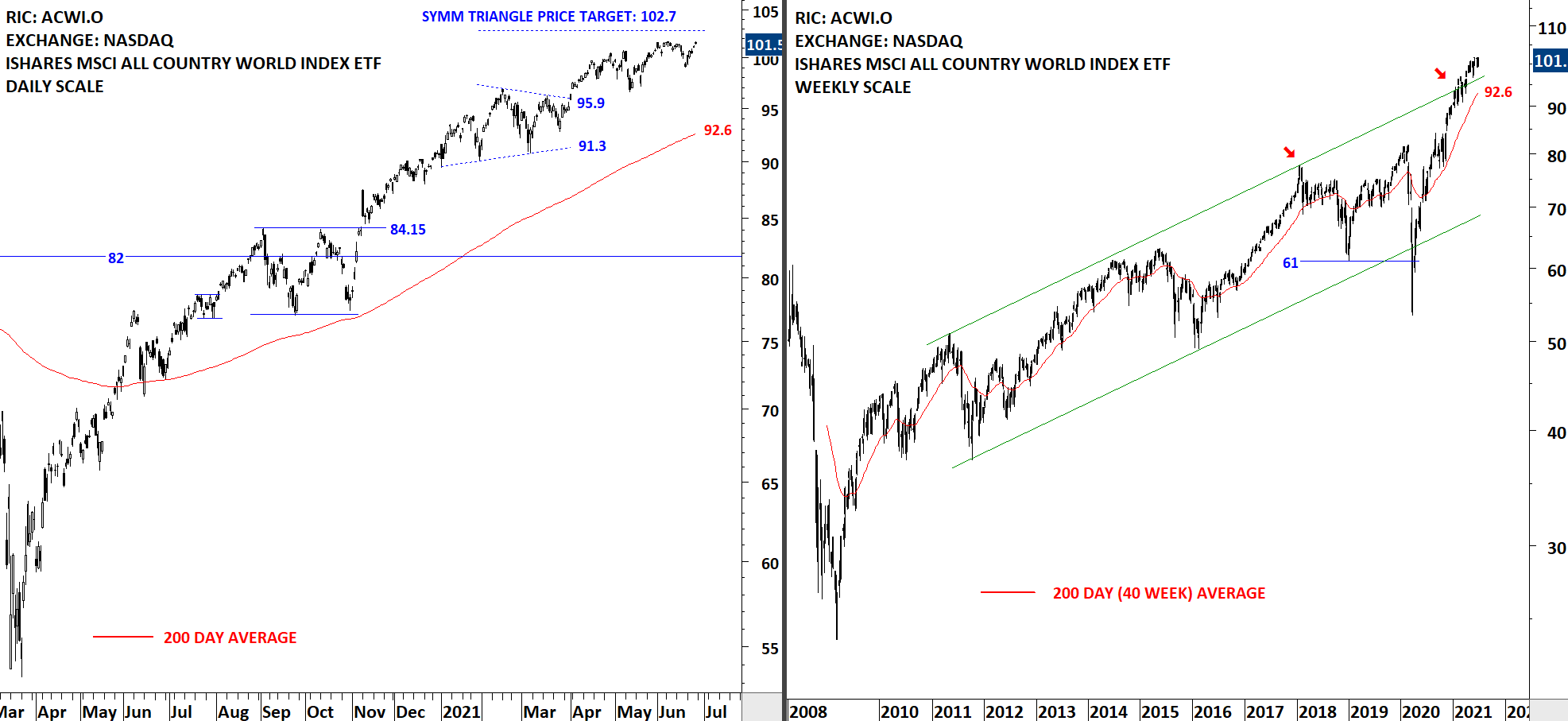

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) resumed its uptrend with higher highs and higher lows and this can be seen in steady uptrends. Symmetrical triangle price target stands at 102.7 levels. Price remains above the long-term average, confirming the uptrend. During any sharp pullback, the 200-day average at 92.6 and the previous minor low at 96.5 can form an area of support.

Read More

Read MoreINTERIM UPDATE (AMERICAS) – June 25, 2021

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop during the week and is worth bringing to your attention before the week finalizes. Below is the latest addition to Tech Charts watchlist from AMERICAS equities. One of them is an ETF that has a larger influence on a theme, possible strength in small cap growth stocks. The other is a stand alone breakout opportunity that might be too late to report in the weekly update if a breakout materializes. These charts will also be included in the weekly update.

Read MoreGLOBAL EQUITY MARKETS – June 19, 2021

REVIEW

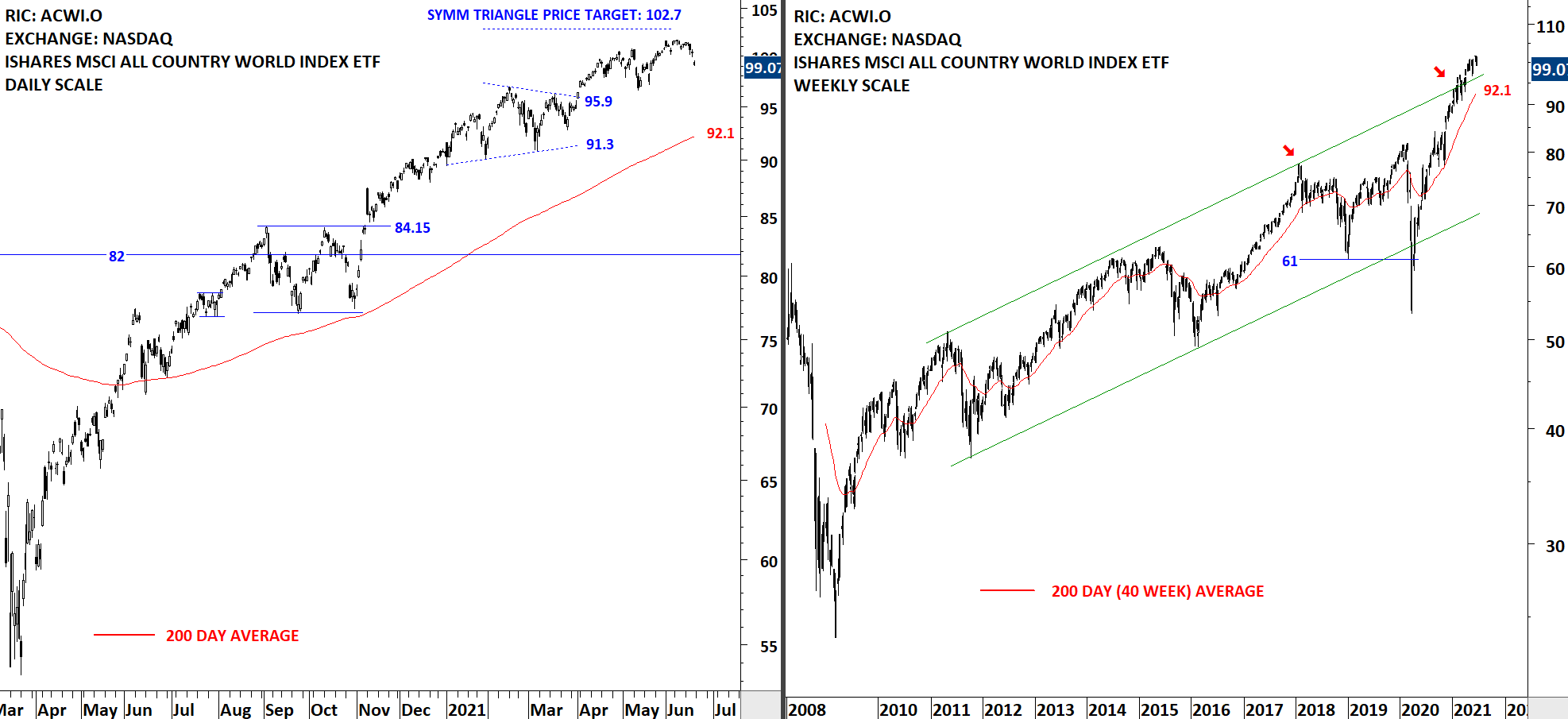

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) experienced a setback without reaching the symmetrical triangle price target. The ETF continued to form higher highs and higher lows and this can be seen in steady uptrends. Symmetrical triangle price target stands at 102.7 levels. Price remains above the long-term average, confirming the uptrend. During any sharp pullback, the 200-day average at 92.1 and the previous minor low at 96.5 can form an area of support.

Read More

Read More