Live Webinar and Q&A with Aksel – Sunday, September 5th, 8:30 am mountain

Dear Tech Charts Members,

We are continuing our Member webinar series with chart pattern reliability and how the latest market conditions have impacted success rates on different chart patterns. What are the patterns that are robust in different types of market cycles?

Scheduled for: Sunday, September 5th, 8:30 am mountain (register below)

Read MoreCRYPTOCURRENCIES – August 31, 2021

Several crypto currency pairs have completed short-term consolidations on the upside. Volatility was low. These short-term consolidations acted as bottom reversals. Previous resistance levels acted as support and they remain as critical levels to manage risk. In this update I'm reviewing several pairs that formed short-term consolidations after their breakouts. Those short-term consolidations can act as bullish continuation chart patterns; flag or pennant chart patterns. Read More

GLOBAL EQUITY MARKETS – August 28, 2021

REVIEW

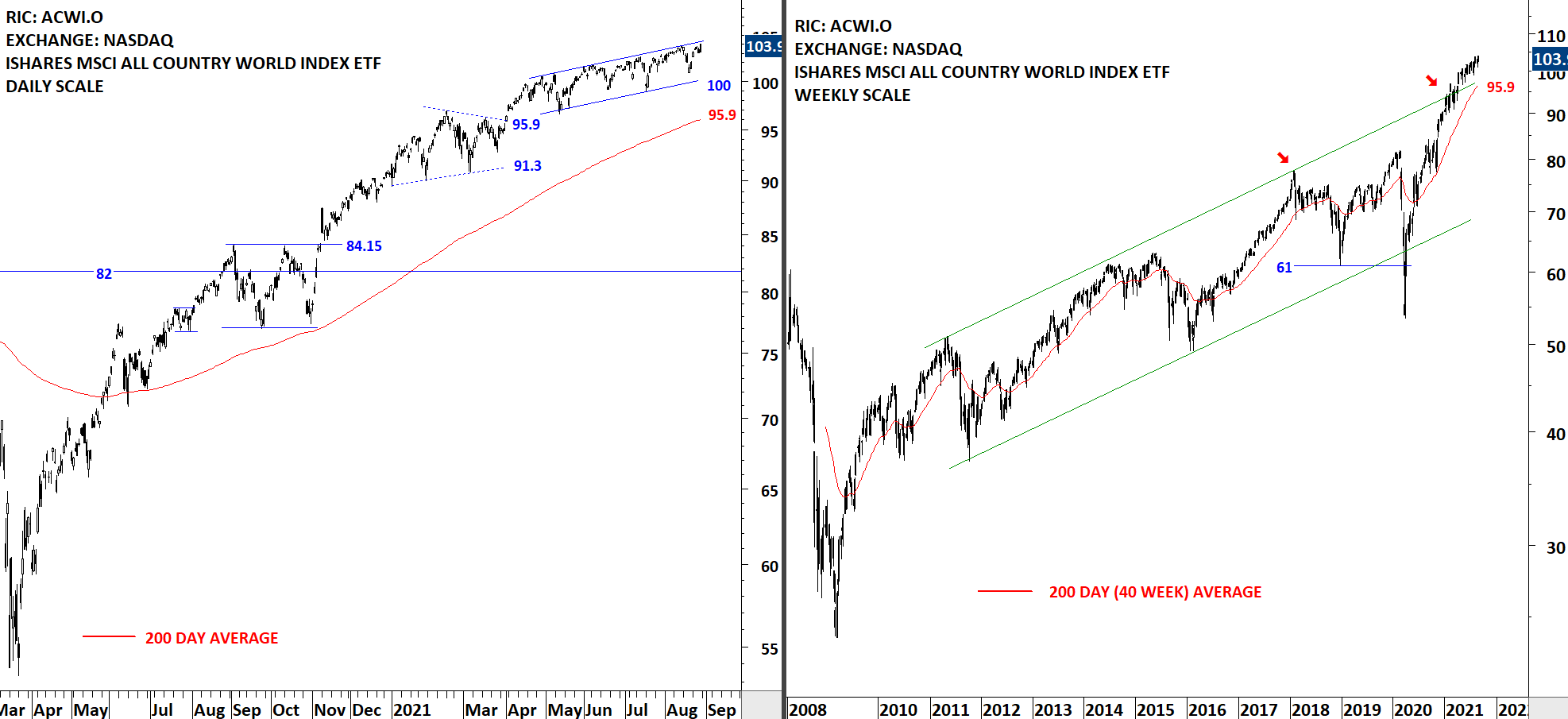

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an upward sloping channel. The lower boundary of the channel is forming support at 100 levels. Support area remains between 95.9 and 100 levels. There is no clear top reversal chart pattern on daily and weekly scale price charts. This week the ETF tested the upper boundary of the trend channel on daily scale price chart. Volatility is low on daily scale and a breakout above the upper boundary can result in acceleration of the uptrend.

Read More

Read More