CRYPTOCURRENCIES – September 26, 2021

Several crypto currency pairs have completed short-term consolidations during July-September period. Most of them met their short-term price target. However following the rebounds, several pairs have run out of steam and charts have rolled over. In this update I'm taking a long-term look to many cryptocurrency charts to understand where we stand after the recent rebound and loss of momentum. All charts are on weekly scale and the moving average is the 52 week (year-long) average. Read More

GLOBAL EQUITY MARKETS – September 25, 2021

REVIEW

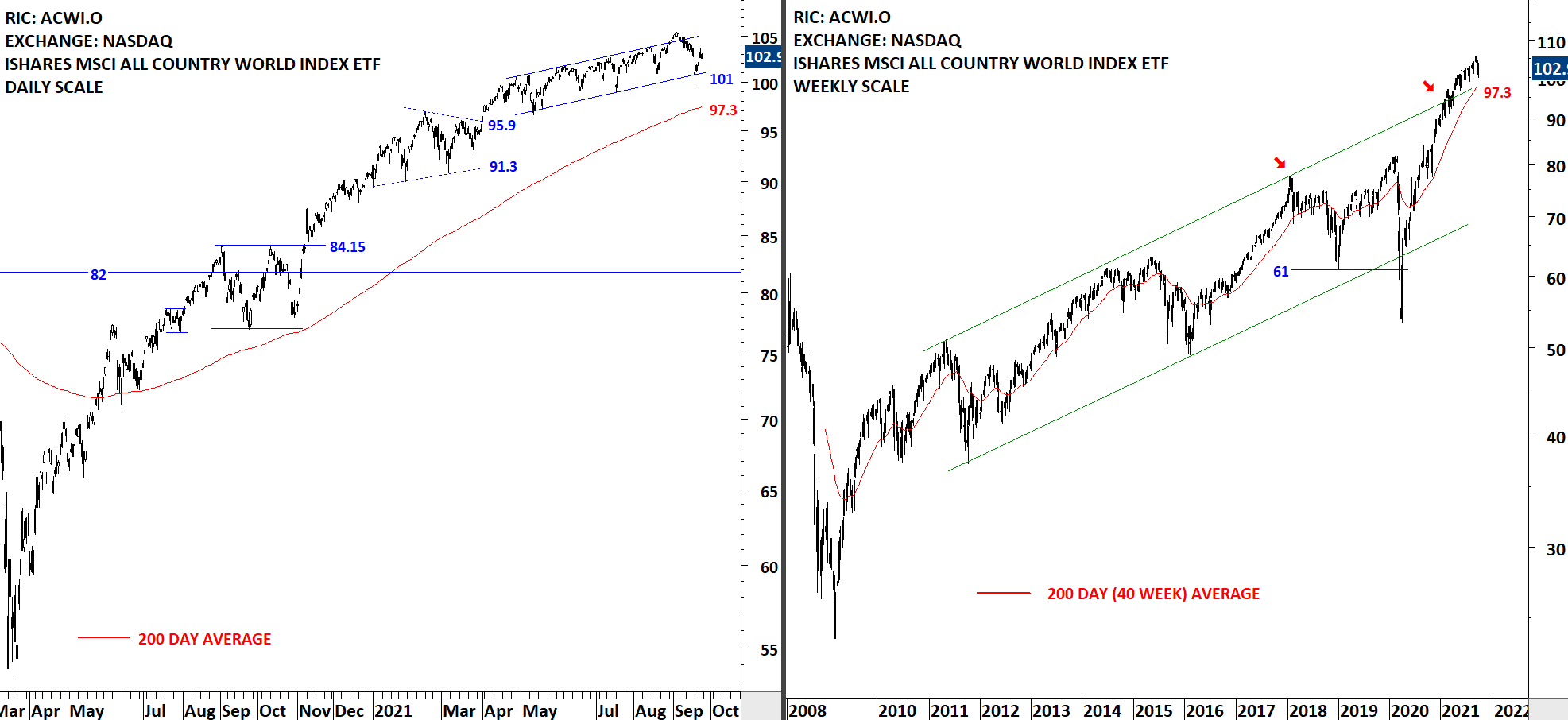

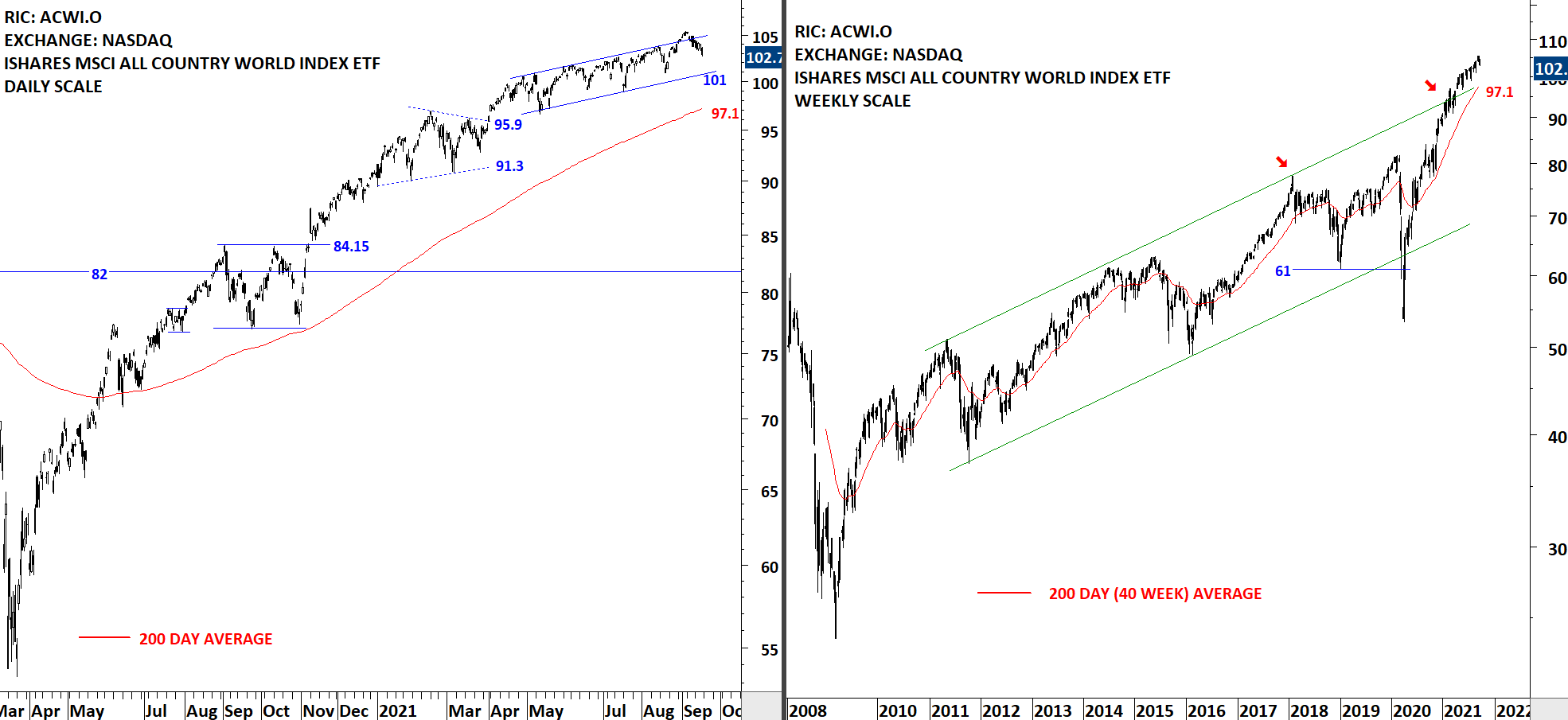

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above the upper boundary resulted in a failed breakout and is now followed by a correction towards the lower boundary of the trend channel at 101 levels. The ETF tested the lower boundary of the trend channel and rebounded. The lower boundary is now a valid support given several tests. In case of a larger scale correction, strong support area will remain between 97.1 and 101 levels. 97.1 is also the upper boundary of the long-term trend channel that can be seen on weekly scale price chart.

Read More

Read MoreGLOBAL EQUITY MARKETS – September 18, 2021

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above the upper boundary resulted in a failed breakout and is now followed by a correction towards the lower boundary of the trend channel at 101 levels. In case of a larger scale correction, strong support area will remain between 97.1 and 101 levels. 97.1 is also the upper boundary of the long-term trend channel that can be seen on weekly scale price chart.

Read More

Read More