GLOBAL EQUITY MARKETS – October 9, 2021

REVIEW

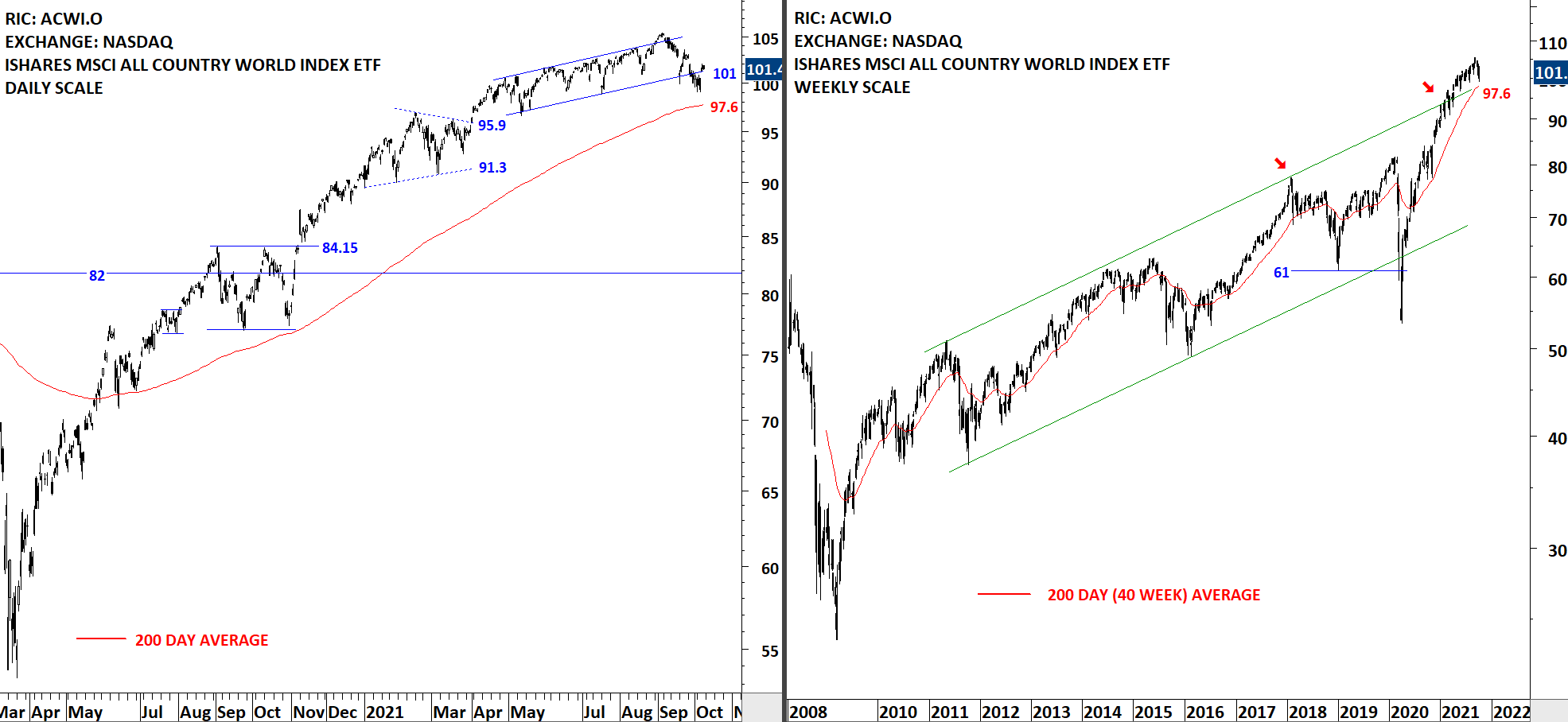

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above the upper boundary resulted in a failed breakout and is now followed by a correction towards the lower boundary of the trend channel at 101 levels. This week the price recovered back inside the trend channel. So far the price action seems like a reversion back to the mean. Strong support area remains between 97.6 and 101 levels.

Read More

Read MoreINTERIM UPDATE (AMERICAS) – October 8, 2021

I start my research on Mondays and finalize by end of day Thursday. Friday is dedicated to putting all ideas to the report format. During the week I come across good setups and those are featured in the weekly report. However, there are those that pop during the week and is worth bringing to your attention before the week finalizes. Below is the latest addition to Tech Charts watchlist from AMERICAS equities. This charts will also be included in the weekly update.

Read MoreGLOBAL EQUITY MARKETS – October 2, 2021

REVIEW

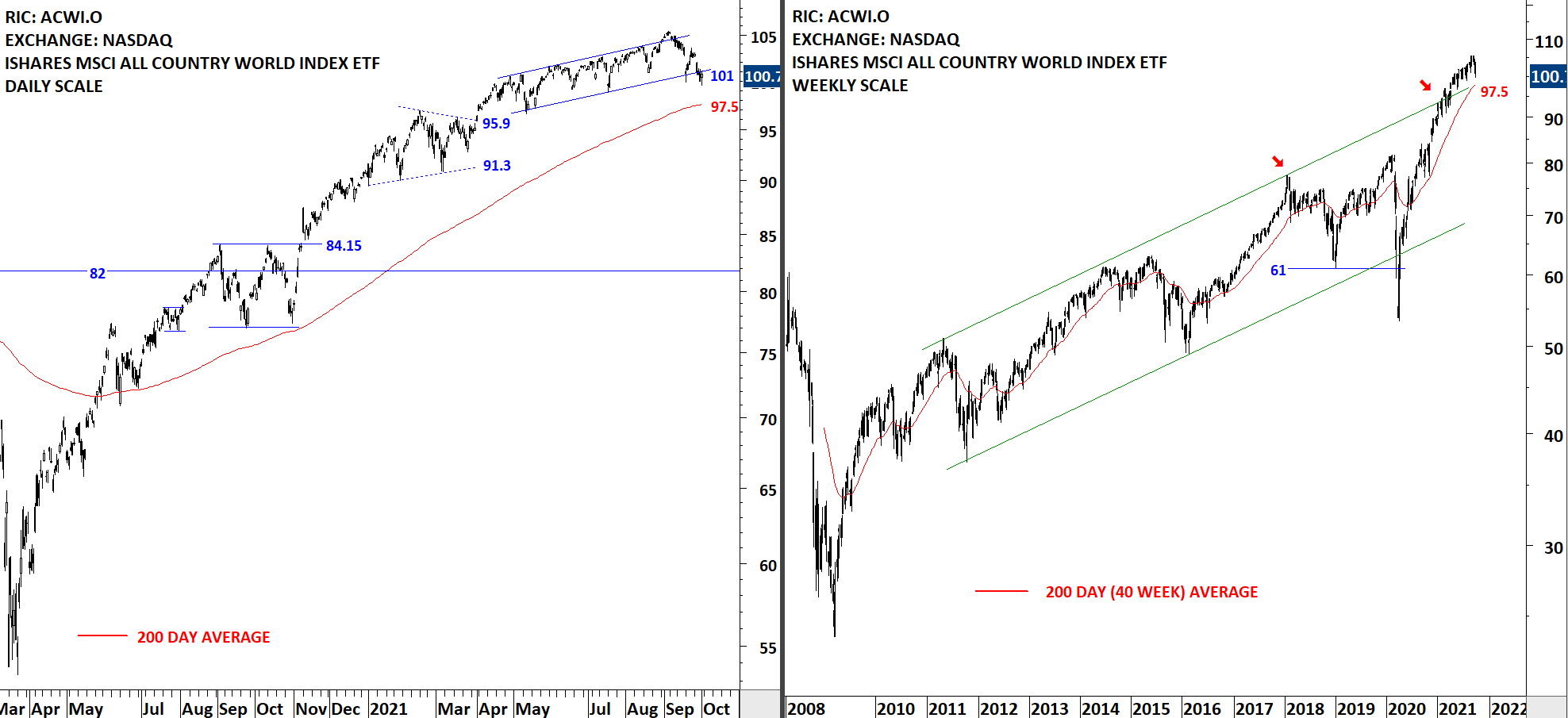

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above the upper boundary resulted in a failed breakout and is now followed by a correction towards the lower boundary of the trend channel at 101 levels. The ETF after the rebound from the lower boundary of the channel, once again challenged the support. Unless we see a quick recovery back inside the channel, price can test the 200-day average at 97.5 levels. 97.5 is also the upper boundary of the long-term trend channel that can be seen on weekly scale price chart. For now the outlook is more like a reversion to the mean, rather than a major top reversal.

Read More

Read More